Bleak Medtech Future

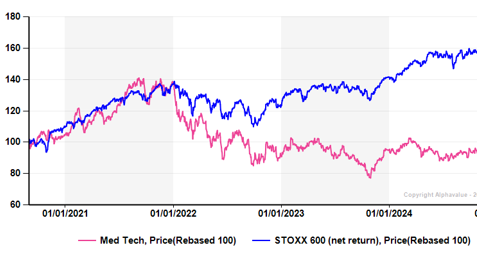

Medtechs are going nowhere. The post Covid darlings are no longer much in demand. This is made obvious in the following performance chart.

Trumpian ambitions to slash health costs while slapping high tariffs on providers and above all the Chinese dire political and competitive situation for non Chinese suppliers, explain the slow going for most of this year. MedTechs are not at the frontier of technology (too much risk for health regulators) so that they are fairly replicable by ambitious Chinese competitors. Bluntly the Chinese market may be open to western MedTechs, but home grown competitors are likely to deliver better value. And this observation does not allow for diverging Chinese technical norms (their own ‘TÜVs’). Over a short period, Chinese competitors will be mighty competitors in Asian markets too.

As for the US market, it tends to be served out of European manufacturing capacity and some of that manufacturing will include Chinese parts. So that US ASPs for European kit should be up at least 15% post tariffs deployment. The short of it is that MedTechs will find it hard to keep their market share in the US beyond the near term protection offered by the FDA umbrella, which will not open immediately to new comers.

From an investors' standpoint, the next question is: which company might start to buckle under the fresh competition pressure and when is a price low enough to attract bidders, including Chinese ones, who may possibly view an opportunity to seize a bridgehead in Europe?

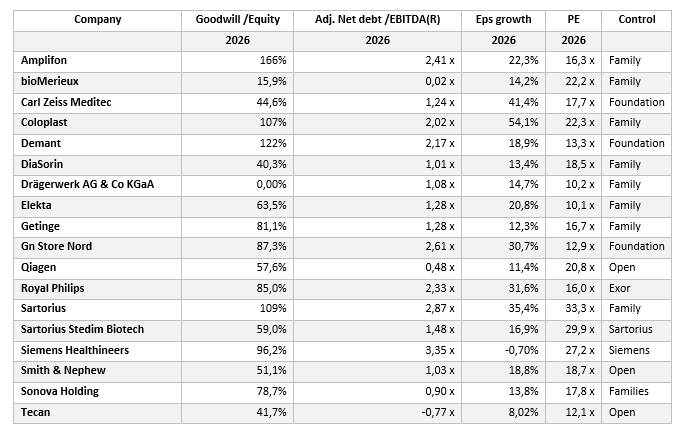

This perspective is unlikely to come to fruition though, as most of the businesses (next table)

- are family controlled, sometimes over generations (with no urge to sell)

- are not too geared (except for Healthineers backed by Siemens, Sartorius, GN Store and Amplifon), so that they can digest a slowdown

- and are still expensive at 21x 2026 earnings on average

It would take a serious event to burst the value of their goodwill, (76% of equity on average, post too many years of pricey acquisitions), that would trigger a debt event.

MedTech’s family locks

In all, the sector may well be facing worsening business conditions and there is little hope of fresh corporate action. One may walk away.

Trumpian ambitions to slash health costs while slapping high tariffs on providers and above all the Chinese dire political and competitive situation for non Chinese suppliers, explain the slow going for most of this year. MedTechs are not at the frontier of technology (too much risk for health regulators) so that they are fairly replicable by ambitious Chinese competitors. Bluntly the Chinese market may be open to western MedTechs, but home grown competitors are likely to deliver better value. And this observation does not allow for diverging Chinese technical norms (their own ‘TÜVs’). Over a short period, Chinese competitors will be mighty competitors in Asian markets too.

As for the US market, it tends to be served out of European manufacturing capacity and some of that manufacturing will include Chinese parts. So that US ASPs for European kit should be up at least 15% post tariffs deployment. The short of it is that MedTechs will find it hard to keep their market share in the US beyond the near term protection offered by the FDA umbrella, which will not open immediately to new comers.

From an investors' standpoint, the next question is: which company might start to buckle under the fresh competition pressure and when is a price low enough to attract bidders, including Chinese ones, who may possibly view an opportunity to seize a bridgehead in Europe?

This perspective is unlikely to come to fruition though, as most of the businesses (next table)

- are family controlled, sometimes over generations (with no urge to sell)

- are not too geared (except for Healthineers backed by Siemens, Sartorius, GN Store and Amplifon), so that they can digest a slowdown

- and are still expensive at 21x 2026 earnings on average

It would take a serious event to burst the value of their goodwill, (76% of equity on average, post too many years of pricey acquisitions), that would trigger a debt event.

MedTech’s family locks

In all, the sector may well be facing worsening business conditions and there is little hope of fresh corporate action. One may walk away.

Subscribe to our blog

Obviously such speculative question marks are not Stellantis specific.