Borealis-Borouge Merger: The Next Big Chemicals Giant?

The talks between OMV and Abu Dhabi National Oil Company (ADNOC) regarding a potential merger of Borealis and Borouge have sparked interest and generated positive market sentiment for OMV. However, despite this news-driven upside pressure, the company is still facing significant fundamental risks that could result in a downside. When ADNOC announced the acquisition of Mubadala’s 24.9% stake in OMV in December 2022, we wrote at the time that both companies have an overlapping chemicals strategy. Since expansion would require more organic and inorganic investment, a strong partner like ADNOC would easily enable investment to be derisked and it would be a good strategy for OMV to enter into acquisitions with its long-standing partner.

Analysis

OMV’s energy transition strategy is largely underpinned by becoming an integrated sustainable fuels, chemicals and materials company with a strong focus on a circular economy. As this strategy translates into the integration, expansion, and diversification of the chemicals business, the Austrian company needs an overhaul of its business while the capex requirements increase.

Valuation

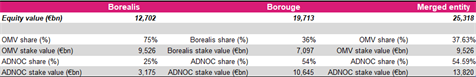

A merger of Borealis and Borouge could potentially create an entity worth €25.3bn. While Borouge has a market cap of around €19.7bn, we estimate the value of Borealis at €12.7bn. Our valuation for Borealis is higher than the media-reported figure of $10bn and includes:

i) Borealis’ 36% stake in Borouge – valued at €7.1bn at the current market price.

ii) Borealis’ value excluding Borouge at €5.6bn with an EV/EBIT multiple of 9.5x.

iii) Our EBIT estimate for Borealis, excluding the JVs, does not account for the nitrogen business as it has been divested and will be deconsolidated, but it does reflect the challenging market environment until the end of FY24.

Source: AlphaValue

The last column of the above table shows the total estimated value of the merged entity and how much the stakes of OMV and ADNOC would be worth without any further assumptions.

The merger and the options

OMV’s stake in the merged entity would fall slightly short of 38% while ADNOC would enjoy a controlling majority above 54%. This could raise significant questions for OMV and its shareholders, including the Austrian State. The remaining 7.8% will come from the listed shares in the Abu Dhabi exchange, but these floated shares will likely be delisted.

The very limited information on this highly hypothetical and potentially difficult merger leaves the Austrian company with few options:

1) OMV, in which the Austrian government holds a 31.5% stake, could take the controlling stake in the merged entity and raise its equity to 51%. This would require a cash outflow of €3.4bn for OMV, making this an expensive venture.

a. With 2% gearing and a hefty cash pile of $9.5bn, OMV has the financial muscle to increase its stake in the merged entity. However, the company is also facing an increased capex requirement (€3.8bn in FY23 vs c.€3bn in FY22) and is maintaining a steady increase in regular dividends.

b. Another way to finance the stake increase could be the issuance of new shares, yet OMV has rarely resorted to capital increases via share issuance. The last capital increase program was in 2011 and the share count has remained stable ever since. Any dilution would therefore provoke the ire of shareholders.

c. While asset disposals could be an option, this would be more challenging since OMV had already divested several assets to finance previous acquisitions. Moreover, debt issuance would be very expensive in the current market given the

high interest rates.

2) Apart from a potentially strenuous process of merging Borouge and Borealis, OMV and ADNOC could continue their current strategy and jointly go into a takeover to expand their market and product offer.

When ADNOC was reported to be bidding for Covestro in late June, we highlighted at the time that a joint bid by OMV and ADNOC offers higher potential to integrate Covestro into the chemical operations.

A joint takeover of a European chemicals company would allow OMV to de-risk the acquisition, reduce funding requirements and strengthen chemicals integration (Covestro is a customer of Borealis). The companies could follow a similar ownership structure in Borouge with a majority stake by ADNOC (~65-70%) and OMV (~30-35%) leveraging its expertise in the sector. A joint acquisition at a price tag of €11-12bn would still require a cash outflow of €3.3-3.8bn for OMV.

In terms of cash outflow, options 1 and 2 seem to lead to a similar amount of cash outflow for OMV. The 2nd option seems a bit pricier for a stake of around 35% and an €11bn acquisition. However, there is always the option of the lesser interest of around 25% and this could prove more practical than the first one.

Final thoughts

We believe that, if OMV and ADNOC were to succeed, the merger of Borealis and Borouge would create a chemical giant reinforcing the integration of operations – a catalyst for OMV’s chemical business growth and product diversification.

Note that ADNOC recently became a shareholder in Borealis when it acquired Mubadala’s 25% interest in the company in April 2022. Mubadala owns a Canadian chemicals company called Nova Chemicals, manufacturing polymers (ethylene) and several other chemicals at its facilities across Canada and the US. Therefore, another asset swap between Mubadala and ADNOC seems likely and would bode well for OMV.

Some serious challenges to the merger however remain:

• OMV’s lack of a controlling stake and the cost of increasing the stake to shareholders

• The Austrian Investment Law of 2020 stipulates that, if a foreign entity owns more than 25% of an Austrian company in strategic sectors including chemicals, the regulatory authority must investigate the transaction, and this could take years and risk a regulatory overrule.

• The headquarters for the merged entity

• The issue of listing the new entity if OMV and ADNOC decide to float some shares. If ADNOC agrees to list 20% of the merged entity, the merger offers a great opportunity for OMV at a minimal cost. The only (big) problem will be where to list the entity.

Analysis

OMV’s energy transition strategy is largely underpinned by becoming an integrated sustainable fuels, chemicals and materials company with a strong focus on a circular economy. As this strategy translates into the integration, expansion, and diversification of the chemicals business, the Austrian company needs an overhaul of its business while the capex requirements increase.

Valuation

A merger of Borealis and Borouge could potentially create an entity worth €25.3bn. While Borouge has a market cap of around €19.7bn, we estimate the value of Borealis at €12.7bn. Our valuation for Borealis is higher than the media-reported figure of $10bn and includes:

i) Borealis’ 36% stake in Borouge – valued at €7.1bn at the current market price.

ii) Borealis’ value excluding Borouge at €5.6bn with an EV/EBIT multiple of 9.5x.

iii) Our EBIT estimate for Borealis, excluding the JVs, does not account for the nitrogen business as it has been divested and will be deconsolidated, but it does reflect the challenging market environment until the end of FY24.

Source: AlphaValue

The last column of the above table shows the total estimated value of the merged entity and how much the stakes of OMV and ADNOC would be worth without any further assumptions.

The merger and the options

OMV’s stake in the merged entity would fall slightly short of 38% while ADNOC would enjoy a controlling majority above 54%. This could raise significant questions for OMV and its shareholders, including the Austrian State. The remaining 7.8% will come from the listed shares in the Abu Dhabi exchange, but these floated shares will likely be delisted.

The very limited information on this highly hypothetical and potentially difficult merger leaves the Austrian company with few options:

1) OMV, in which the Austrian government holds a 31.5% stake, could take the controlling stake in the merged entity and raise its equity to 51%. This would require a cash outflow of €3.4bn for OMV, making this an expensive venture.

a. With 2% gearing and a hefty cash pile of $9.5bn, OMV has the financial muscle to increase its stake in the merged entity. However, the company is also facing an increased capex requirement (€3.8bn in FY23 vs c.€3bn in FY22) and is maintaining a steady increase in regular dividends.

b. Another way to finance the stake increase could be the issuance of new shares, yet OMV has rarely resorted to capital increases via share issuance. The last capital increase program was in 2011 and the share count has remained stable ever since. Any dilution would therefore provoke the ire of shareholders.

c. While asset disposals could be an option, this would be more challenging since OMV had already divested several assets to finance previous acquisitions. Moreover, debt issuance would be very expensive in the current market given the

high interest rates.

2) Apart from a potentially strenuous process of merging Borouge and Borealis, OMV and ADNOC could continue their current strategy and jointly go into a takeover to expand their market and product offer.

When ADNOC was reported to be bidding for Covestro in late June, we highlighted at the time that a joint bid by OMV and ADNOC offers higher potential to integrate Covestro into the chemical operations.

A joint takeover of a European chemicals company would allow OMV to de-risk the acquisition, reduce funding requirements and strengthen chemicals integration (Covestro is a customer of Borealis). The companies could follow a similar ownership structure in Borouge with a majority stake by ADNOC (~65-70%) and OMV (~30-35%) leveraging its expertise in the sector. A joint acquisition at a price tag of €11-12bn would still require a cash outflow of €3.3-3.8bn for OMV.

In terms of cash outflow, options 1 and 2 seem to lead to a similar amount of cash outflow for OMV. The 2nd option seems a bit pricier for a stake of around 35% and an €11bn acquisition. However, there is always the option of the lesser interest of around 25% and this could prove more practical than the first one.

Final thoughts

We believe that, if OMV and ADNOC were to succeed, the merger of Borealis and Borouge would create a chemical giant reinforcing the integration of operations – a catalyst for OMV’s chemical business growth and product diversification.

Note that ADNOC recently became a shareholder in Borealis when it acquired Mubadala’s 25% interest in the company in April 2022. Mubadala owns a Canadian chemicals company called Nova Chemicals, manufacturing polymers (ethylene) and several other chemicals at its facilities across Canada and the US. Therefore, another asset swap between Mubadala and ADNOC seems likely and would bode well for OMV.

Some serious challenges to the merger however remain:

• OMV’s lack of a controlling stake and the cost of increasing the stake to shareholders

• The Austrian Investment Law of 2020 stipulates that, if a foreign entity owns more than 25% of an Austrian company in strategic sectors including chemicals, the regulatory authority must investigate the transaction, and this could take years and risk a regulatory overrule.

• The headquarters for the merged entity

• The issue of listing the new entity if OMV and ADNOC decide to float some shares. If ADNOC agrees to list 20% of the merged entity, the merger offers a great opportunity for OMV at a minimal cost. The only (big) problem will be where to list the entity.

Subscribe to our blog

AlphaValue has certainly not been alone over the last 4 months in wondering when too much was to...

A week ago, Reckitt posted splendid Q3 sales lifted by emerging markets demand, while L’Oré...