CASA would do well to emulate Natixis

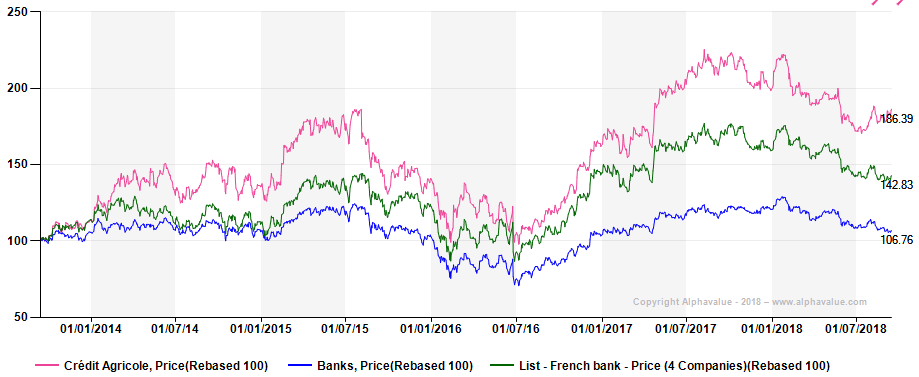

[dropcap]S[/dropcap]ince the great financial crisis, Crédit Agricole SA (CASA)’s share price has had quite an atypical path with a performance in line with that of its peers followed by an outperformance in the last five years (as evidenced by the graph below).

While it is still far from its record high level in 2006, its share price is yet 55% above its ten-year anniversary price in the middle of the financial crisis. Since then, it has been fully reshaping its model towards something much plainer if it were to survive ill-fated acquisitions.

Not mentioning changes in names (Calyon becoming CACIB for instance…), CASA has been through both a forced restructuring and an active restructuring plan.

Forced restructuring led to impairments of goodwill for its international activities (Greece and Italy) whereas restructuring is about optimal allocation of the scarce capital. This, in our opinion, really started in July 2016 with the Eureka plan.

That plan consisted in the simplification of a business model, which was incomprehensible for foreign investors (if not French investors…), with the sales of CASA’s shareholding in the “Caisses Regionales du Credit Agricole” which are its parent companies. Unwinding this circular control loop was a prerequisite.

Since then the stock has experienced quite a sharp rerating in terms of both P/B and P/E. While still in the low range of European banks, its P/E at 8.6x and its P/B at 0.6x are still above that of Societe Generale and, more surprisingly, that of BNP Paribas despite a lower profitability with a ROE at 6.73% versus 7.57%.

At that time, this rerating was explained by: a dividend now paid in cash, the simplification making it easier for foreign investors to understand the business model and an overall balanced business (between retail banking, asset gathering and CIB). Our guess is that all these factors make part of the story but the lowest common denominator is about balance sheet contraction.

…that has taken time to take shape

To be bad-mouthing, CASA has just been following Natixis’s business model towards simplification and an originate-to-distribute model where balance-sheet might is no more the centre of the company’s expertise.

CASA’s second fundamental move in recent years was the late 2015 listing of Amundi followed by the 2017 acquisition of Pioneer showing the bank’s appetence for capital-light businesses. That Amundi does not have Natixis investment management’s expertise and is at risk in the new AM paradigm (ETF swamping the industry, risks of being considered systemic) is another issue…

There is in any case a high probability CASA will push for more consolidation of the AM industry given its relative firepower. That makes even more sense given the weight of its insurance arms which mechanically open extra synergy potentials. The insurance sector is reshaping itself anyhow, while CA Assurance could also be a major player given its size (about €12bn valuation) and as the risk weighting allowance of insurance by a bank remains (abnormally) favourable.

No need to wait: accelerate balance sheet’s contraction

With much humbleness, we would recommend to walk the path cleared in Natixis’ strategy: transfer much of boring retail banking activities to their parent, CA Group.

Natixis announced last week the sale of its specialised financial services division to its parent, BPCE, leaving the listed entity with asset gathering, CIB and payments.

CASA’s business model is somewhat more complex thereby making moves more complicated ones. Its specialised financial services division still represents the second biggest capital consumer (after the CIB).

LCL, according to our calculation is no more profitable with a return on CET1 at 7.20% (once the Basel IV impact is factored in). The impact of low/negatives rates has weighed on CASA’s shareholders while LCL is in competition with big mutual banks, amongst which BPCE, Crédit Mutuel and…the “Caisses Regionales” that own CASA and thus LCL.

The profitability of French retail banking activities has become a question mark for listed groups. As a utility-type business, retail banking would be better off lodged in a mutual bank owning huge piles of capital waiting for rates to increase (if it ever happens).

Digitalisation and the open banking revolution in progress make retail banking’s future model and profitability all the more uncertain. Selling its retail banking to the Caisses Régionales would mechanically create value for CASA and provide the former with extra synergies (which could be shared in the transaction price with CASA).

Retail banking can still be profitable if it proposes innovation to consumers or retail merchants such as Natixis’ breakthrough in the payments’ industry. Trying a similar move at CASA would mean concentrating on the distribution of retail banking products, not tying up more of its balance sheet, which would be left to the Caisses. This may not happen overnight due to the complex governance issues that would be involved.

As strange as it might be, the CIB division is almost profitable with a calculated 9.7% RoCET1. This division remains yet the biggest contributor to CASA’s RWA (35%). Whereas we believe trading/market making is no more profitable and should be got rid of, corporate financing should be split throughout CASA and the Caisses Régionales. In the same manner as with the retail banking division, distribution and commercial relationships are key to profitability while the production (loans origination) could be granted by the parent company.

Valuation: a lighter balance sheet to trigger a re-rating

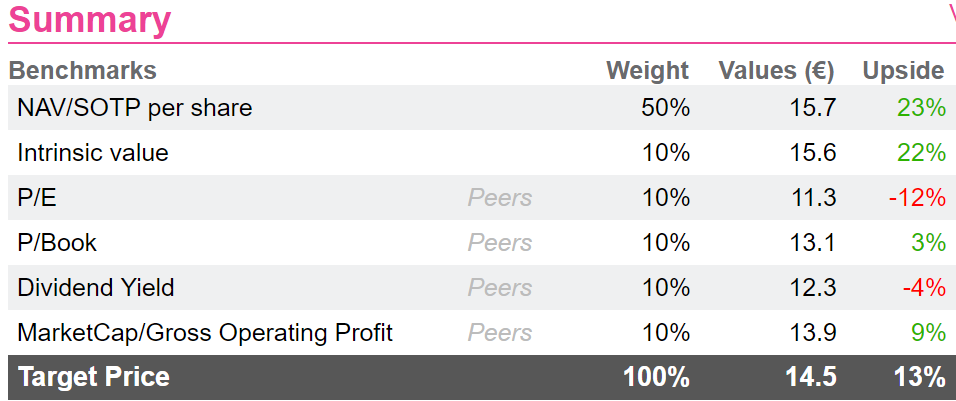

Valuation-wise, our peer-based metrics point towards a fair value of CASA’s share price. CASA’s path towards a lighter model would mechanically lead to a re-rating of these multiples. It started in 2016 and may be pushed further.

Both the intrinsic value and the NAV/SOTP valuation show a 22-23% potential upside. The SOTP valuation factors in a 15% inflation of the risk-weighted assets (from Basel IV) which is manageable given the payout ratio’s current level, which is at a low 50%. CASA does not generate yet any excess capital at that level. A higher than expected inflation in RWA could threaten CASA’s current payout ratio.

Given that banks tend to be considered today as utilities, we believe CASA would be better off with a higher payout ratio. As an investment proposition, it would definitely benefit from a trimmed down balance sheet focused on distribution activities while the Caisses Régionales’ balance sheet would be used for the manufacturing of low value-added and commoditised banking products.

That plan consisted in the simplification of a business model, which was incomprehensible for foreign investors (if not French investors…), with the sales of CASA’s shareholding in the “Caisses Regionales du Credit Agricole” which are its parent companies. Unwinding this circular control loop was a prerequisite.

Since then the stock has experienced quite a sharp rerating in terms of both P/B and P/E. While still in the low range of European banks, its P/E at 8.6x and its P/B at 0.6x are still above that of Societe Generale and, more surprisingly, that of BNP Paribas despite a lower profitability with a ROE at 6.73% versus 7.57%.

At that time, this rerating was explained by: a dividend now paid in cash, the simplification making it easier for foreign investors to understand the business model and an overall balanced business (between retail banking, asset gathering and CIB). Our guess is that all these factors make part of the story but the lowest common denominator is about balance sheet contraction.

…that has taken time to take shape

To be bad-mouthing, CASA has just been following Natixis’s business model towards simplification and an originate-to-distribute model where balance-sheet might is no more the centre of the company’s expertise.

CASA’s second fundamental move in recent years was the late 2015 listing of Amundi followed by the 2017 acquisition of Pioneer showing the bank’s appetence for capital-light businesses. That Amundi does not have Natixis investment management’s expertise and is at risk in the new AM paradigm (ETF swamping the industry, risks of being considered systemic) is another issue…

There is in any case a high probability CASA will push for more consolidation of the AM industry given its relative firepower. That makes even more sense given the weight of its insurance arms which mechanically open extra synergy potentials. The insurance sector is reshaping itself anyhow, while CA Assurance could also be a major player given its size (about €12bn valuation) and as the risk weighting allowance of insurance by a bank remains (abnormally) favourable.

No need to wait: accelerate balance sheet’s contraction

With much humbleness, we would recommend to walk the path cleared in Natixis’ strategy: transfer much of boring retail banking activities to their parent, CA Group.

Natixis announced last week the sale of its specialised financial services division to its parent, BPCE, leaving the listed entity with asset gathering, CIB and payments.

CASA’s business model is somewhat more complex thereby making moves more complicated ones. Its specialised financial services division still represents the second biggest capital consumer (after the CIB).

LCL, according to our calculation is no more profitable with a return on CET1 at 7.20% (once the Basel IV impact is factored in). The impact of low/negatives rates has weighed on CASA’s shareholders while LCL is in competition with big mutual banks, amongst which BPCE, Crédit Mutuel and…the “Caisses Regionales” that own CASA and thus LCL.

The profitability of French retail banking activities has become a question mark for listed groups. As a utility-type business, retail banking would be better off lodged in a mutual bank owning huge piles of capital waiting for rates to increase (if it ever happens).

Digitalisation and the open banking revolution in progress make retail banking’s future model and profitability all the more uncertain. Selling its retail banking to the Caisses Régionales would mechanically create value for CASA and provide the former with extra synergies (which could be shared in the transaction price with CASA).

Retail banking can still be profitable if it proposes innovation to consumers or retail merchants such as Natixis’ breakthrough in the payments’ industry. Trying a similar move at CASA would mean concentrating on the distribution of retail banking products, not tying up more of its balance sheet, which would be left to the Caisses. This may not happen overnight due to the complex governance issues that would be involved.

As strange as it might be, the CIB division is almost profitable with a calculated 9.7% RoCET1. This division remains yet the biggest contributor to CASA’s RWA (35%). Whereas we believe trading/market making is no more profitable and should be got rid of, corporate financing should be split throughout CASA and the Caisses Régionales. In the same manner as with the retail banking division, distribution and commercial relationships are key to profitability while the production (loans origination) could be granted by the parent company.

Valuation: a lighter balance sheet to trigger a re-rating

Valuation-wise, our peer-based metrics point towards a fair value of CASA’s share price. CASA’s path towards a lighter model would mechanically lead to a re-rating of these multiples. It started in 2016 and may be pushed further.

Both the intrinsic value and the NAV/SOTP valuation show a 22-23% potential upside. The SOTP valuation factors in a 15% inflation of the risk-weighted assets (from Basel IV) which is manageable given the payout ratio’s current level, which is at a low 50%. CASA does not generate yet any excess capital at that level. A higher than expected inflation in RWA could threaten CASA’s current payout ratio.

Given that banks tend to be considered today as utilities, we believe CASA would be better off with a higher payout ratio. As an investment proposition, it would definitely benefit from a trimmed down balance sheet focused on distribution activities while the Caisses Régionales’ balance sheet would be used for the manufacturing of low value-added and commoditised banking products.

To read our full research on CASA and Natixis : click here

To read our full research on CASA and Natixis : click here

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...