Casino: Debt pressure is surmounting

[dropcap]C[/dropcap]asino’s share price collapsed c.10% on Friday evening after the US short seller Muddy Waters said on Twitter that one of Casino’s subsidiaries (the finance unit of the retailer) had not filed its 2017 accounts.

This news raised fresh concerns about the company’s financial health, which has already been struggling with pressing issues such as high leverage, increasing competition in France and weakening LatAm currencies (although the operations remain healthy).

The company’s spokesperson, however, said the delay was attributable to technical reasons and this subsidiary’s accounts were already integrated into Casino 2017 consolidated results.

He also added that the concerned accounts will be filed on Saturday (31 August 2018) and shall be available on Infogreffe next week.

New details released by management

Casino (CGP) has also released some details (regarding its credit rating, French cash and working capital position) in a press release.

1. S&P has downgraded Casino’s financial rating by one notch to BB, negative perspective. However, management remains confident about its ability to deleverage the French business on the back of the €1.5bn asset disposal plan (announced in June 2018) and good sales momentum in France (and LatAm) since the beginning of the year, and particularly in July and August.

2. The Casino board, which met on 31 August 2018, believes that the Casino stock price is subject to speculative repeated attacks.

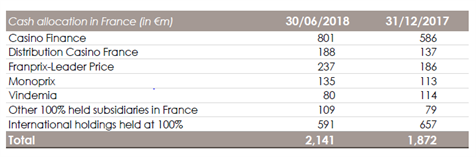

3. The French entity (includes CGP, French businesses and wholly-owned holding companies) held cash & cash equivalents worth €2.1bn at 30 June 2018 and €1.9bn at 31 December 2017. And this cash is fully available to CGP, regardless of the subsidiaries holding the cash.

4. The subsidiary under question, Casino Finance, is a fully-owned subsidiary of CGP and a cash-pooling entity for the French businesses.

The following table includes the cash of Casino Finance, the balance of cash held by of the French businesses (held 100%) that has not yet been centralised at the closing date, and the cash of international holding companies.

5. Cash deposits in foreign currencies are made through 100% financial entities owned by CGP, the cash of which is fully available and transferrable at any moment without tax leakage.

6. Working capital improvement in H1 18 was not aided by the transfer of some non-food categories (from Geant to Cdiscount) or the sale of non-recurring real estate assets.

What lies ahead

Note that the stock has already lost c.45% in value in 2018, despite clocking a healthy top line and profitability, and forging a series of strategic ties (with the likes of Amazon and Ocado) in France.

Management announced an ambitious deleveraging plan (entails €1.5bn non-core asset sales) to re-impose investors’ faith in June 2018.

However, there is a need to watch these developments closely – management recently resorted to financial engineering tools (e.g. a LAtam holding company controlled by Casino raised the loan and passed it over to the French business, resulting in a net debt reduction of the French subsidiary).

Any repetition of similar measures or a reduction of debt through a heavy reliance on sale-and-leaseback transactions might not be perceived well by the jittery investors.

All in all, although the valuation is very attractive today, the implied condition is that promises are fulfilled in a timely manner by management and that no hidden skeletons are found in the cupboard.

We believe the stock price is likely to remain under pressure / range bound for the next 3-4 months (given the bearish investor sentiment) until the first green shoots of the asset disposal plan are visible on the ground.

We maintain our earnings estimates for the firm but have increased the debt spread to capture the overhang of the surmounting credit risk perceived by the market.

The full research study on Casino is available on www.alphavalue.com

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...