Coloplast: Valuations Finally 'Grounded'

Coloplast is, undoubtedly, a high quality business – validated by the sector-leading return metrics (average 5Y ROCE of 39.5% vs 10.5% for AV peers) as well as the only perfect ’10/10’ score, among our MedTech coverage, on the AV fundamental strength rating.

The last time we teased this name , there was little to fault with the business. Not much has changed on that front. Our caution was, and rightly in hindsight (-8.5% vs -22.6% for AV MedTech, +1.9% vs Stoxx 600), rooted in the steep valuations as the preference for value overgrowth names weighed on the stock performance through 2022.

Though the stock has rallied strongly since Q4 22 (in line with broader MedTech sector recovery), the valuations are far from the ‘super-premium levels the stock traded at pre-2020. The big, but important question is whether or not the stock is worth a buy?

Ticking the right strategic growth boxes…

First things first, Coloplast continues to remain a solid business, handily outperforming the 4-5% growth in the target markets. As a reminder, the market growth is underpinned by secular trends (ageing population, increasing health care spends, rising prevalence of chronic diseases, etc.). However, the company isn’t resting on its laurels, as is evidenced by its strategic ambition to gain share in markets outside its traditional strongholds - double-digit growth in US Ostomy underpinned by GPO wins in last two years - and aggressive investments in its Urology business (2Y average growth >15%+).

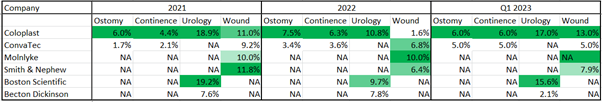

Growth rates of comparable MedTech players

The acquisition of Atos Medical in November 2021 added a faster-growing (high single-digit growth) segment to the addressable market, taking Coloplast’s chronic care exposure to ~80% (vs 75% previously). Lest we forget, this exposure offers very sticky revenues with high visibility (average patient treatment span is 10 years).

…complemented by a strong product pipeline

Also, with the new Catheter product (Luja) already live in key markets, the new digital Ostomy platform (Heylo) in its pilot launch in the UK and Germany, and wound care products to be launched in North America in 2024/25, the firm is on track with its product launch plan, as outlined in the Strive 25 strategy. As a reminder, these are all new generation products, which will be targeting higher reimbursement categories, effectively providing longer-term pricing tailwinds.

Though near-term risks do exist…

Though the longer-term opportunity is matched by Coloplast’s strong execution capabilities, the near term is not without uncertainties. The biggest being the pace of recovery in the broader Chinese market (~5% of group sales, largely an Ostomy and Wound care business) and the energy price situation in Hungary, which accounts for the lion’s share (>80%) of the firm’s production footprint. However, with the Chinese chronic care NPD (New Patient Discharge) numbers now back to pre-COVID levels and 80% of the near-term energy requirement already hedged at favourable terms (FY23/24 hedged at 50% of FY22/23 contracted levels), the uncertainties should be in the rear-view mirror sooner than later. Combine that with strong momentum in the US and Europe (both NPDs now well above pre-COVID levels), and Coloplast should be firing on all cylinders.

The Atos medical acquisition was strategically spot-on. However, the size of the deal (DKK16bn), is expected to weigh on the return metrics in the near term. Hence, execution on the integration and synergy delivery (DKK100m by year 3) will be key to a near-term recovery.

Pristine fundamentals could get even better

As a reminder, the combination of defensive products, high customer loyalty (in chronic care) and attractive margins has allowed Coloplast to deliver sector-leading return metrics for nearly a decade. In spite of the Atos acquisition weighing heavily on the return metrics (FY22 ROCE at 18% vs 44% in FY21) Coloplast is already on course to recover its best-in-class status (FY23 ROCE of 19.2% vs 8.9% for AV MedTech peers). Supported by an FCF conversion of more than 60%, this has allowed Coloplast to pay out rising annual dividends for more than a decade.

Though the leverage (2.4x net debt/EBITDA) has risen sharply to finance the Atos acquisition, we believe Coloplast should be able to pay down its obligations, thanks to the improving operating environment, good FCF conversion and encouraging longer-term dynamics.

Valuations finally easing

Trading at 33x FY23e earnings, Coloplast’s valuations are far from appealing, as validated by the meagre upside in our intrinsic valuations. However, these are the cheapest valuation levels seen in over five years. Given the high quality nature of the underlying business, we believe these levels are worth dipping a toe for the adventurous. Any further correction from here will only make this opportunity harder to resist.

The last time we teased this name , there was little to fault with the business. Not much has changed on that front. Our caution was, and rightly in hindsight (-8.5% vs -22.6% for AV MedTech, +1.9% vs Stoxx 600), rooted in the steep valuations as the preference for value overgrowth names weighed on the stock performance through 2022.

Though the stock has rallied strongly since Q4 22 (in line with broader MedTech sector recovery), the valuations are far from the ‘super-premium levels the stock traded at pre-2020. The big, but important question is whether or not the stock is worth a buy?

Coloplast Stock Price Momentum

Ticking the right strategic growth boxes…

First things first, Coloplast continues to remain a solid business, handily outperforming the 4-5% growth in the target markets. As a reminder, the market growth is underpinned by secular trends (ageing population, increasing health care spends, rising prevalence of chronic diseases, etc.). However, the company isn’t resting on its laurels, as is evidenced by its strategic ambition to gain share in markets outside its traditional strongholds - double-digit growth in US Ostomy underpinned by GPO wins in last two years - and aggressive investments in its Urology business (2Y average growth >15%+).

Growth rates of comparable MedTech players

The acquisition of Atos Medical in November 2021 added a faster-growing (high single-digit growth) segment to the addressable market, taking Coloplast’s chronic care exposure to ~80% (vs 75% previously). Lest we forget, this exposure offers very sticky revenues with high visibility (average patient treatment span is 10 years).

…complemented by a strong product pipeline

Also, with the new Catheter product (Luja) already live in key markets, the new digital Ostomy platform (Heylo) in its pilot launch in the UK and Germany, and wound care products to be launched in North America in 2024/25, the firm is on track with its product launch plan, as outlined in the Strive 25 strategy. As a reminder, these are all new generation products, which will be targeting higher reimbursement categories, effectively providing longer-term pricing tailwinds.

Though near-term risks do exist…

Though the longer-term opportunity is matched by Coloplast’s strong execution capabilities, the near term is not without uncertainties. The biggest being the pace of recovery in the broader Chinese market (~5% of group sales, largely an Ostomy and Wound care business) and the energy price situation in Hungary, which accounts for the lion’s share (>80%) of the firm’s production footprint. However, with the Chinese chronic care NPD (New Patient Discharge) numbers now back to pre-COVID levels and 80% of the near-term energy requirement already hedged at favourable terms (FY23/24 hedged at 50% of FY22/23 contracted levels), the uncertainties should be in the rear-view mirror sooner than later. Combine that with strong momentum in the US and Europe (both NPDs now well above pre-COVID levels), and Coloplast should be firing on all cylinders.

The Atos medical acquisition was strategically spot-on. However, the size of the deal (DKK16bn), is expected to weigh on the return metrics in the near term. Hence, execution on the integration and synergy delivery (DKK100m by year 3) will be key to a near-term recovery.

Pristine fundamentals could get even better

As a reminder, the combination of defensive products, high customer loyalty (in chronic care) and attractive margins has allowed Coloplast to deliver sector-leading return metrics for nearly a decade. In spite of the Atos acquisition weighing heavily on the return metrics (FY22 ROCE at 18% vs 44% in FY21) Coloplast is already on course to recover its best-in-class status (FY23 ROCE of 19.2% vs 8.9% for AV MedTech peers). Supported by an FCF conversion of more than 60%, this has allowed Coloplast to pay out rising annual dividends for more than a decade.

Though the leverage (2.4x net debt/EBITDA) has risen sharply to finance the Atos acquisition, we believe Coloplast should be able to pay down its obligations, thanks to the improving operating environment, good FCF conversion and encouraging longer-term dynamics.

Valuations finally easing

Trading at 33x FY23e earnings, Coloplast’s valuations are far from appealing, as validated by the meagre upside in our intrinsic valuations. However, these are the cheapest valuation levels seen in over five years. Given the high quality nature of the underlying business, we believe these levels are worth dipping a toe for the adventurous. Any further correction from here will only make this opportunity harder to resist.

Subscribe to our blog

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...