Could a merger between Shell and bp be the next mega oil deal?

Sizeable all-stock acquisitions by Exxon and Chevron have revived expectations of more M&A in the industry to deliver the overdue consolidation and the market may now reasonably expect the trend to continue for a while. While the probability of a takeover of bp by a US major has fallen, could the company still be up for grabs? We have taken a closer look at a potential Shell-bp merger and the results look quite exciting…especially for shareholders.

Fact

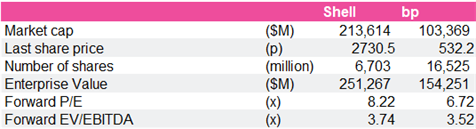

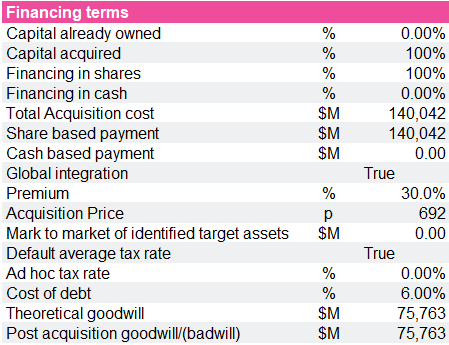

The inputs for the simulation in the AlphaValue M&A tool:

Source: AlphaValue

Source: AlphaValue M&A Tool

AlphaValue’s in-house M&A tool allows investors and analysts to simulate an M&A transaction of all companies in our coverage. With potential synergies, the tool empirically demonstrates whether a transaction is dilutive or accretive. To the best of our knowledge, AlphaValue is the only research provider with a tool like this built-in and already part of the offer.

Analysis

Consolidation in Europe – dare we imagine a Shell-bp merger?

After more than two quiet decades in the oil industry, the re-emergence of mega deals from Exxon and Chevron has sent a tremor of excitement across the oil market and amongst analysts.

In early October, Exxon ($433bn Mcap) announced the long-expected acquisition of Pioneer Natural Resources ($58bn Mcap) for $59.5bn and at an 18% premium to the latter’s price on Oct. 5. A big bet on shale as Exxon has devoured Pioneer’s high-quality Permian acreage and taken possession of innovative technology to increase efficiency.

Not long after, Chevron ($307bn Mcap) surprised the markets by acquiring Hess Corporation ($50bn Mcap), an independent exploration and production company with an offshore-weighted portfolio. Hess is an excellent addition to Chevron’s portfolio as the company gains access to Guyana – a booming oil nation with an ambition to reach 1.2 mbpd by 2027 from the current levels of 500 kbpd – to catch up with its biggest competitor Exxon. Chevron’s 30% stake in the Guyana portfolio puts it in a good competitive position with Exxon’s 45% interest.

The market now expects more M&A activity in the US and, while names like Occidental have lost a couple of potential buyers, they could still be merger targets. Companies including Devon Energy are frequently rumoured to be on the path to a merger.

We however prefer to focus on Europe, where investors could expect some news. bp has long been rumoured to be a takeover target for the US majors. With the recent acquisitions, this is not a strong possibility in the near future. For European Big Oil, an oil acquisition on this scale is less likely given the increasing political hurdles and growing ESG pressures. However, we have run our slide rule over a potential

Shell-BP merger as we believe the market could begin pricing in this deal after the recent events in the US – and what’s to come.

1) bp has been on the street rumour cycle for a takeover. For regulatory and political reasons, a takeover by a US major would be very difficult.

2) bp’s long-standing governance issues have again been in the news with the resignation of its former CEO Bernard Looney. Irrespective of the reasons, this raises big questions about the company’s strategy, or an organic synergy between the management and the board. Since it has no CEO currently, could it be a good moment for bp’s long-overdue takeover?

3) A Shell-bp merger would create a British giant with a more than $300bn market cap. Finally, a European big oil that can square up to its American rivals.

4) AlphaValue’s M&A tool shows a dilutive impact for Shell of 2.43% in the first year of the merger (were it to happen this year).

5) After accounting for synergies in terms of a revenue increase and cost reductions, the results could be impressive with more than 10% EPS growth in one year. The following years could see a rise in synergy-driven profits as the companies will better adjust the workforce and optimize revenue generation.

6) The impact of the merger on Shell’s operating cash flow would be the focal point for investors as Shell’s shareholder remuneration is based on cash flow from operations. After accounting synergies, our tool shows that the CFFO of the merged entity could be around 8% higher than the aggregate figure the companies can report on a standalone basis in FY24.

Implementing a 40% shareholder remuneration rate (based on CFFO), the longevity of a dividend + share buyback combination is extended compared to what the companies can deliver individually. Integrated oil companies are almost obliged to maintain a double-digit yield with dividends and buybacks. In FY23, this was easy to achieve on strong FY22 results and FY24 will also see high yields thanks to high oil prices. Beyond FY25, (AV Brent estimates $70/bbl), this will be more challenging and a Shell-bp merger would help to overcome this.

To get access to our complete research on this hypothetical giant, the M&A tool and much more, please contact sales@alphavalue.eu.

To stay up to date with out latest research, please subscribe to our blog.

The inputs for the simulation in the AlphaValue M&A tool:

Source: AlphaValue

Source: AlphaValue M&A Tool

AlphaValue’s in-house M&A tool allows investors and analysts to simulate an M&A transaction of all companies in our coverage. With potential synergies, the tool empirically demonstrates whether a transaction is dilutive or accretive. To the best of our knowledge, AlphaValue is the only research provider with a tool like this built-in and already part of the offer.

Analysis

Consolidation in Europe – dare we imagine a Shell-bp merger?

After more than two quiet decades in the oil industry, the re-emergence of mega deals from Exxon and Chevron has sent a tremor of excitement across the oil market and amongst analysts.

In early October, Exxon ($433bn Mcap) announced the long-expected acquisition of Pioneer Natural Resources ($58bn Mcap) for $59.5bn and at an 18% premium to the latter’s price on Oct. 5. A big bet on shale as Exxon has devoured Pioneer’s high-quality Permian acreage and taken possession of innovative technology to increase efficiency.

Not long after, Chevron ($307bn Mcap) surprised the markets by acquiring Hess Corporation ($50bn Mcap), an independent exploration and production company with an offshore-weighted portfolio. Hess is an excellent addition to Chevron’s portfolio as the company gains access to Guyana – a booming oil nation with an ambition to reach 1.2 mbpd by 2027 from the current levels of 500 kbpd – to catch up with its biggest competitor Exxon. Chevron’s 30% stake in the Guyana portfolio puts it in a good competitive position with Exxon’s 45% interest.

The market now expects more M&A activity in the US and, while names like Occidental have lost a couple of potential buyers, they could still be merger targets. Companies including Devon Energy are frequently rumoured to be on the path to a merger.

We however prefer to focus on Europe, where investors could expect some news. bp has long been rumoured to be a takeover target for the US majors. With the recent acquisitions, this is not a strong possibility in the near future. For European Big Oil, an oil acquisition on this scale is less likely given the increasing political hurdles and growing ESG pressures. However, we have run our slide rule over a potential

Shell-BP merger as we believe the market could begin pricing in this deal after the recent events in the US – and what’s to come.

1) bp has been on the street rumour cycle for a takeover. For regulatory and political reasons, a takeover by a US major would be very difficult.

2) bp’s long-standing governance issues have again been in the news with the resignation of its former CEO Bernard Looney. Irrespective of the reasons, this raises big questions about the company’s strategy, or an organic synergy between the management and the board. Since it has no CEO currently, could it be a good moment for bp’s long-overdue takeover?

3) A Shell-bp merger would create a British giant with a more than $300bn market cap. Finally, a European big oil that can square up to its American rivals.

4) AlphaValue’s M&A tool shows a dilutive impact for Shell of 2.43% in the first year of the merger (were it to happen this year).

5) After accounting for synergies in terms of a revenue increase and cost reductions, the results could be impressive with more than 10% EPS growth in one year. The following years could see a rise in synergy-driven profits as the companies will better adjust the workforce and optimize revenue generation.

6) The impact of the merger on Shell’s operating cash flow would be the focal point for investors as Shell’s shareholder remuneration is based on cash flow from operations. After accounting synergies, our tool shows that the CFFO of the merged entity could be around 8% higher than the aggregate figure the companies can report on a standalone basis in FY24.

Implementing a 40% shareholder remuneration rate (based on CFFO), the longevity of a dividend + share buyback combination is extended compared to what the companies can deliver individually. Integrated oil companies are almost obliged to maintain a double-digit yield with dividends and buybacks. In FY23, this was easy to achieve on strong FY22 results and FY24 will also see high yields thanks to high oil prices. Beyond FY25, (AV Brent estimates $70/bbl), this will be more challenging and a Shell-bp merger would help to overcome this.

To get access to our complete research on this hypothetical giant, the M&A tool and much more, please contact sales@alphavalue.eu.

To stay up to date with out latest research, please subscribe to our blog.

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.