Coverage Initiation: Haleon

Haleon is a leader in the highly-fragmented >£160bn Consumer Healthcare market. Apart from the industry’s promising structural demand drivers, the firm’s above-market growth ambitions are backed by its enviable scale and leadership, the scope for improved market penetration, the potential to capitalise on the thriving e-commerce channel and a successful track-record of prescription (Rx) to OTC switches. Moreover, with steady cashflow expectations, the relatively higher leverage should moderate over time and make way for increased dividends. We initiate coverage of Haleon with an ‘ADD’ recommendation.

A formidable Consumer Healthcare giant

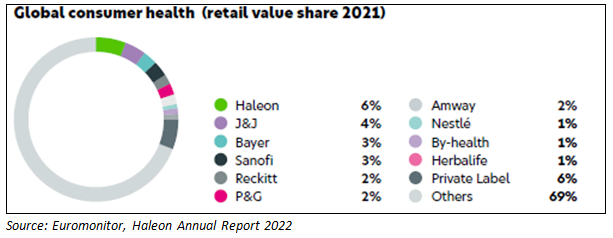

Haleon, formed over the years via the amalgamation of GSK, Novartis: and Pfizer’s Consumer Health arms, is the world’s largest Consumer Healthcare player, with a c.6% market share. The >£160bn market – comprising OTC (over-the-counter; incl. pain relief, digestives and respiratory offerings) products (£80bn size), Vitamins, Minerals and Supplements (VMS; £46bn) and Oral Health (£25bn) – is highly-fragmented and competitive (illustrated below) with certain product categories exhibiting low barriers to entry, especially in the VMS space. While OTC and VMS is a fragmented market, Oral Health is largely consolidated with the top-5 players holding >60% of the market. The group faces competition from the (demerged/divested) Consumer Healthcare segments/businesses of the large pharma companies, FMCG firms with overlapping target areas and private labels – particularly in the US, UK and Australia.

In terms of distribution, the products reach the end-consumers/patients primarily through pharmacies (68% of OTC; 42% of VMS; 22% of Oral Health), followed by various other retail channels (25% of OTC; 28% of VMS; 66% of Oral Health) and e-commerce (7% of OTC; 30% of VMS; 12% of Oral Health). In the US (Haleon’s largest market, accounting for c.34% of sales) distribution is largely concentrated, with the top-five largest retailers contributing over half of the firm’s top line. Geographically, c.38% of sales in 2022 emanated from North America (i.e. primarily the US), c.35% from EMEA, 23% from APAC and c.4% from LatAm. China accounted for c.8% of group sales.

Dominance in most categories

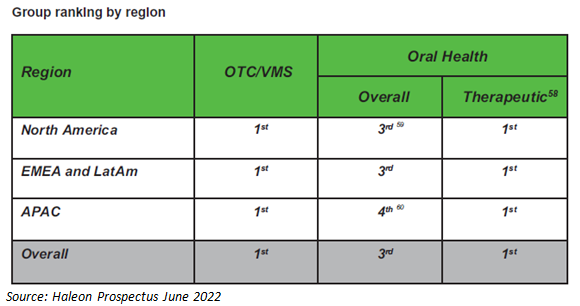

Oral Health is the key contributor (c.27% of sales), followed by Pain Relief (c.24%), Digestive Health & Others (c.19%), VMS (c.15%) and Respiratory Health (c.15%). The firm has strong market positions across its portfolio – #1 in Vitamins, Minerals and Supplements (VMS), Pain Relief, Respiratory Health and Digestive Health & other. In Oral Health, while the firm holds the #3 position, it is a leader in Therapeutic Oral Health (i.e. sensitivity).

Turning down the Unilever bid was a costly decision

In December 2021, GSK received a bid from Unilever to acquire the Consumer Health JV (now Haleon) between GSK (c.68%-owned) and Pfizer (c.32%) for an EV of £50bn. However, GSK rejected the offer citing that it undervalued the business and. as per some media reports, GSK sought £60bn from Unilever – which it never received. However, in July 2022, Haleon was listed with a market cap of c.£31bn and ‘reported’ net debt of £11bn, which meant that GSK missed a big value-creation opportunity for its own shareholders as well as those of Haleon.

Recommendation

We initiate coverage of Haleon with an ‘ADD’ recommendation and a target price of 402 pence per share. The firm has a market capitalisation of c.£31bn and a free float of >60%. As one of the top players in the highly-fragmented >£160bn global Consumer Healthcare market with a c.6% market share, the firm operates in five segments: Oral Health (c.27% of sales), Pain Relief (c.24%), Digestive Health & Others (c.19%), VMS (c.15%) and Respiratory Health (c.15%). Haleon’s above-market top-line growth ambitions are supported by its enviable market leading position, substantial scope to improve its products’ market penetration, an increasing contribution from the fast-growing e-commerce channel, a favourable history in terms of prescription (Rx)-to-OTC switches and the growing popularity of Naturals i.e. offerings containing naturally-occurring ingredients. Moreover, besides the noteworthy improvements in profitability over the years, going forward the firm is targeting some moderate margin expansion on the back of strong growth in its relatively high-margin ‘Power Brands’ (representing >60% of group sales). Balance sheet-wise, the firm is highly-leveraged (2023e net debt of £8.6bn, net debt-to-EBITDA ratio of 2.9x) compared with other Consumer Healthcare/FMCG firms (1x-2x). This is however a consequence of its owners extracting pre-separation dividends of c.£11bn. However, supported by the UK giant’s healthy cash-generating ability, the leverage should normalise over time.

Haleon was spun-off in July 2022 and, as of October 2023, Pfizer holds a c.32% stake and GSK holds 7.4%.

Investment case risks

Despite Haleon’s undoubted appeal, the following risks should not be overlooked:

1/ a potentially material liability from Zantac litigation by way of indemnification claims from GSK and Pfizer;

2/ concentration risk of distributors in the US, the with top five retailers accounting for >50% of the region’s sales;

3/ the fiercely competitive and fragmented market, where the scope for top-line growth and margin expansion remains limited (vis-à-vis other healthcare innovators);

4/ ongoing corruption crackdown on the healthcare sector in China (c.8% of sales) could remain an overhang on near-term business sentiment; and

5/ increasing volatility in material costs and/or availability, especially for active pharmaceutical ingredients, could have a significant impact on overall profitability; consequently, any delay in FCF generation could derail the firm’s deleveraging plan.

Haleon, formed over the years via the amalgamation of GSK, Novartis: and Pfizer’s Consumer Health arms, is the world’s largest Consumer Healthcare player, with a c.6% market share. The >£160bn market – comprising OTC (over-the-counter; incl. pain relief, digestives and respiratory offerings) products (£80bn size), Vitamins, Minerals and Supplements (VMS; £46bn) and Oral Health (£25bn) – is highly-fragmented and competitive (illustrated below) with certain product categories exhibiting low barriers to entry, especially in the VMS space. While OTC and VMS is a fragmented market, Oral Health is largely consolidated with the top-5 players holding >60% of the market. The group faces competition from the (demerged/divested) Consumer Healthcare segments/businesses of the large pharma companies, FMCG firms with overlapping target areas and private labels – particularly in the US, UK and Australia.

In terms of distribution, the products reach the end-consumers/patients primarily through pharmacies (68% of OTC; 42% of VMS; 22% of Oral Health), followed by various other retail channels (25% of OTC; 28% of VMS; 66% of Oral Health) and e-commerce (7% of OTC; 30% of VMS; 12% of Oral Health). In the US (Haleon’s largest market, accounting for c.34% of sales) distribution is largely concentrated, with the top-five largest retailers contributing over half of the firm’s top line. Geographically, c.38% of sales in 2022 emanated from North America (i.e. primarily the US), c.35% from EMEA, 23% from APAC and c.4% from LatAm. China accounted for c.8% of group sales.

Dominance in most categories

Oral Health is the key contributor (c.27% of sales), followed by Pain Relief (c.24%), Digestive Health & Others (c.19%), VMS (c.15%) and Respiratory Health (c.15%). The firm has strong market positions across its portfolio – #1 in Vitamins, Minerals and Supplements (VMS), Pain Relief, Respiratory Health and Digestive Health & other. In Oral Health, while the firm holds the #3 position, it is a leader in Therapeutic Oral Health (i.e. sensitivity).

Turning down the Unilever bid was a costly decision

In December 2021, GSK received a bid from Unilever to acquire the Consumer Health JV (now Haleon) between GSK (c.68%-owned) and Pfizer (c.32%) for an EV of £50bn. However, GSK rejected the offer citing that it undervalued the business and. as per some media reports, GSK sought £60bn from Unilever – which it never received. However, in July 2022, Haleon was listed with a market cap of c.£31bn and ‘reported’ net debt of £11bn, which meant that GSK missed a big value-creation opportunity for its own shareholders as well as those of Haleon.

Recommendation

We initiate coverage of Haleon with an ‘ADD’ recommendation and a target price of 402 pence per share. The firm has a market capitalisation of c.£31bn and a free float of >60%. As one of the top players in the highly-fragmented >£160bn global Consumer Healthcare market with a c.6% market share, the firm operates in five segments: Oral Health (c.27% of sales), Pain Relief (c.24%), Digestive Health & Others (c.19%), VMS (c.15%) and Respiratory Health (c.15%). Haleon’s above-market top-line growth ambitions are supported by its enviable market leading position, substantial scope to improve its products’ market penetration, an increasing contribution from the fast-growing e-commerce channel, a favourable history in terms of prescription (Rx)-to-OTC switches and the growing popularity of Naturals i.e. offerings containing naturally-occurring ingredients. Moreover, besides the noteworthy improvements in profitability over the years, going forward the firm is targeting some moderate margin expansion on the back of strong growth in its relatively high-margin ‘Power Brands’ (representing >60% of group sales). Balance sheet-wise, the firm is highly-leveraged (2023e net debt of £8.6bn, net debt-to-EBITDA ratio of 2.9x) compared with other Consumer Healthcare/FMCG firms (1x-2x). This is however a consequence of its owners extracting pre-separation dividends of c.£11bn. However, supported by the UK giant’s healthy cash-generating ability, the leverage should normalise over time.

Haleon was spun-off in July 2022 and, as of October 2023, Pfizer holds a c.32% stake and GSK holds 7.4%.

Investment case risks

Despite Haleon’s undoubted appeal, the following risks should not be overlooked:

1/ a potentially material liability from Zantac litigation by way of indemnification claims from GSK and Pfizer;

2/ concentration risk of distributors in the US, the with top five retailers accounting for >50% of the region’s sales;

3/ the fiercely competitive and fragmented market, where the scope for top-line growth and margin expansion remains limited (vis-à-vis other healthcare innovators);

4/ ongoing corruption crackdown on the healthcare sector in China (c.8% of sales) could remain an overhang on near-term business sentiment; and

5/ increasing volatility in material costs and/or availability, especially for active pharmaceutical ingredients, could have a significant impact on overall profitability; consequently, any delay in FCF generation could derail the firm’s deleveraging plan.

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.