Dear(er) Vifor Pharma

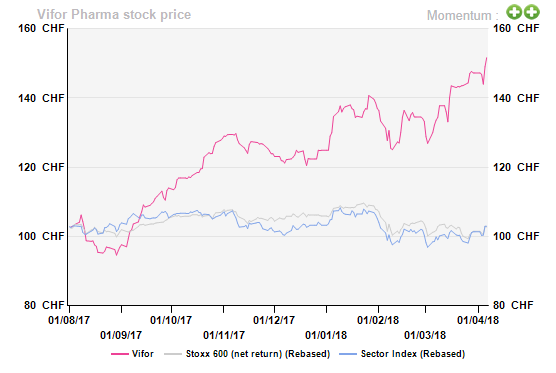

[dropcap]O[/dropcap]ur endorsement in August 2017 proved to be an ideal entry point for Vifor Pharma – the small-cap play has been the ace performer in the essentially lifeless Smaller Pharma sector since then (+c.57% vs. sector average: +0.1%).

While a guidance uplift in H1 17 (driven by strong performance by third-generation intravenous/IV iron drug ‘Ferinject’) infused new life into the otherwise beaten-down stock, a significant beat on the already raised bar in FY17 (driven by Ferinject and Veltassa) triggered another bull run (revenue and adjusted EBITDA ex-Veltassa launch cost up 15% and 17.7%, respectively vs. target of >10%).

However, the protracted rally has guzzled all of our upside, making Vifor the most expensive stock in the AV Smaller Pharma universe. Despite strong fundamentals and with few competitive threats lurking around, we would rather wait for a correction before dipping a toe one more time.

Ferinject still ruling the roost

As the investments by the US partner started to bear fruit (quadrupled sales force in Q1 17; 24.6% sales uptick in FY17), Ferinject’s market share in the global IV iron space jumped to c.45% (+c.5ppt yoy; c.32% of sales). While continued cannibalisation of second-gen IV drug ‘Venofer’ (c.30% market share) and entry into new geographies (launch in Japan and China in FY19 and FY20, respectively) would primarily bolster growth, extension into new therapeutic areas (cardiology, gynaecology/obstetrics, etc.) should accomplish Ferinject’s objective of turning blockbuster by FY20 (in-market sales of CHF696m in FY17).

Just to reiterate, there remains significant untapped potential for iron usage outside the nephrology setting (globally only 30% usage is ex-nephrology vs. c.91% in Switzerland).

Nonetheless, the broadened label for rival drug ‘Feraheme’ (from US Amag, a $700m smaller pharma) might act as a headwind (FDA approved for all adults with iron deficiency anaemia in February 2018).

Elephant enters the hyperkalaemia space

After two failed attempts, AstraZeneca has finally landed a gig in the hyperkalaemia marketplace (Lokelma/ZS-9 approved in Europe in March 2018; US FDA decision in Q2 18) abruptly ending the monopoly enjoyed by Veltassa since its launch in FY16. However, a cushy c.$6bn market potential means that despite AstraZeneca’s superior sales/marketing reach, there should be room enough to accommodate both players.

Given that Veltassa remains the preferred choice in the chronic setting (vs. acute setting usage for Lokelma), the blockbuster potential of the drug stays intact. Assuming a steady ramp-up in the US (continuous increase in Medicare coverage) and a successful launch in Europe (approved in H2 17) and other key geographies (Australia, Canada and Japan), we forecast peak sales of c.CHF1.5bn by FY30.

Adding to the nephrology herd

Besides continuing with the global roll-out of the phosphate binder ‘Velphoro’ (FY17: +48.6%; used for dialysis patients), Vifor (with JV partner Fresenius Medical Center/FMC) is bulking up on strategic partnerships to tighten further its nephrology foothold.

Things have been a mixed bag up to now. On the positive side, the expanded collaboration agreement with Roche (for Mircera; initiated sales outside FMC in Q4 17) is likely to bring in additional volumes, while partnership with ChemoCentryx should mark Vifor’s entry into the autoimmune rare disease universe (European approval for Avacopan by Q4 18). However, the delayed US entry of Epogen biosimilar ‘Retacrit’ (in-licensed from Pfizer; second CRL in June 2017; re-inspection in 2018) is a major missed opportunity (c.$1.3bn sales for Epogen).

Profitability at an inflection point

With planned investments to support the launch/ramp-up of Veltassa (CHF231.5m vs. guidance: CHF260m), the reported EBITDA slumped to CHF280.4m in FY17 (vs. FY16: CHF322.2).

However, with an increasing proportion of high margin Ferinject in the total sales mix and the strong possibility of a lower than CHF220m expense guided for Veltassa for FY18 (transformation towards API-based manufacturing), we expect the margin to improve from hereon.

Moreover, ongoing investments into Ferinject and other drugs should significantly enhance the earnings profile of the company in the long run. It is worth highlighting that, as Veltassa turns into the black by FY20 and generates an EBIT margin of 40-50% in the out-years, the long–term profitability growth potential remains robust (EBITDA growth of 7% on sales growth of 6% in the out-years under our DCF valuation).

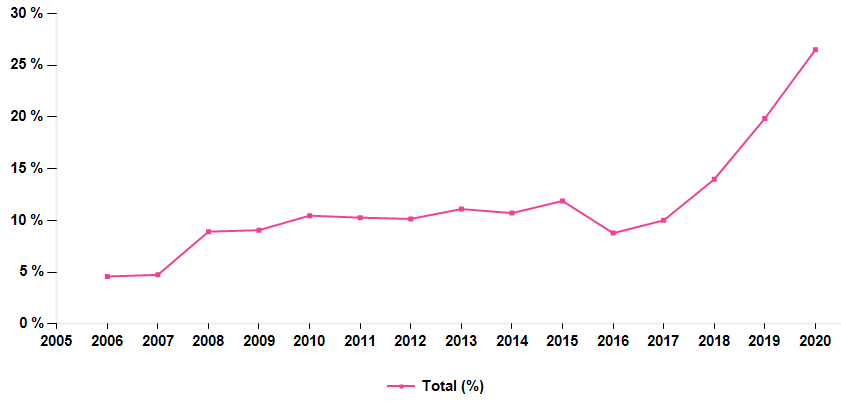

The sudden change of regime in the EBIT margin is reflected by the following chart (remember that pre-2017 figures are those of the pre-split Galenica).

Vifor Pharma EBIT margin

Ferinject still ruling the roost

As the investments by the US partner started to bear fruit (quadrupled sales force in Q1 17; 24.6% sales uptick in FY17), Ferinject’s market share in the global IV iron space jumped to c.45% (+c.5ppt yoy; c.32% of sales). While continued cannibalisation of second-gen IV drug ‘Venofer’ (c.30% market share) and entry into new geographies (launch in Japan and China in FY19 and FY20, respectively) would primarily bolster growth, extension into new therapeutic areas (cardiology, gynaecology/obstetrics, etc.) should accomplish Ferinject’s objective of turning blockbuster by FY20 (in-market sales of CHF696m in FY17).

Just to reiterate, there remains significant untapped potential for iron usage outside the nephrology setting (globally only 30% usage is ex-nephrology vs. c.91% in Switzerland).

Nonetheless, the broadened label for rival drug ‘Feraheme’ (from US Amag, a $700m smaller pharma) might act as a headwind (FDA approved for all adults with iron deficiency anaemia in February 2018).

Elephant enters the hyperkalaemia space

After two failed attempts, AstraZeneca has finally landed a gig in the hyperkalaemia marketplace (Lokelma/ZS-9 approved in Europe in March 2018; US FDA decision in Q2 18) abruptly ending the monopoly enjoyed by Veltassa since its launch in FY16. However, a cushy c.$6bn market potential means that despite AstraZeneca’s superior sales/marketing reach, there should be room enough to accommodate both players.

Given that Veltassa remains the preferred choice in the chronic setting (vs. acute setting usage for Lokelma), the blockbuster potential of the drug stays intact. Assuming a steady ramp-up in the US (continuous increase in Medicare coverage) and a successful launch in Europe (approved in H2 17) and other key geographies (Australia, Canada and Japan), we forecast peak sales of c.CHF1.5bn by FY30.

Adding to the nephrology herd

Besides continuing with the global roll-out of the phosphate binder ‘Velphoro’ (FY17: +48.6%; used for dialysis patients), Vifor (with JV partner Fresenius Medical Center/FMC) is bulking up on strategic partnerships to tighten further its nephrology foothold.

Things have been a mixed bag up to now. On the positive side, the expanded collaboration agreement with Roche (for Mircera; initiated sales outside FMC in Q4 17) is likely to bring in additional volumes, while partnership with ChemoCentryx should mark Vifor’s entry into the autoimmune rare disease universe (European approval for Avacopan by Q4 18). However, the delayed US entry of Epogen biosimilar ‘Retacrit’ (in-licensed from Pfizer; second CRL in June 2017; re-inspection in 2018) is a major missed opportunity (c.$1.3bn sales for Epogen).

Profitability at an inflection point

With planned investments to support the launch/ramp-up of Veltassa (CHF231.5m vs. guidance: CHF260m), the reported EBITDA slumped to CHF280.4m in FY17 (vs. FY16: CHF322.2).

However, with an increasing proportion of high margin Ferinject in the total sales mix and the strong possibility of a lower than CHF220m expense guided for Veltassa for FY18 (transformation towards API-based manufacturing), we expect the margin to improve from hereon.

Moreover, ongoing investments into Ferinject and other drugs should significantly enhance the earnings profile of the company in the long run. It is worth highlighting that, as Veltassa turns into the black by FY20 and generates an EBIT margin of 40-50% in the out-years, the long–term profitability growth potential remains robust (EBITDA growth of 7% on sales growth of 6% in the out-years under our DCF valuation).

The sudden change of regime in the EBIT margin is reflected by the following chart (remember that pre-2017 figures are those of the pre-split Galenica).

Vifor Pharma EBIT margin

Unappealing today

While it’s still early to consider Vifor as a mature pharma company, it has become pretty hard to justify a FY20 P/E of 26.8x vs. a sector average of 19.8x. An EV/EBITDA multiple of 13.9x for FY20 (vs. sector: 11.7x) is another clear indication that the stock is hovering in an overbought zone.

We have injected a 50% premium to all peer metrics and that is not enough. Beyond speculation (that we do not entertain) that the c.20% shareholding by Swiss billionaire Martin Ebner may have new designs for Vifor, it is out of reach.

Unappealing today

While it’s still early to consider Vifor as a mature pharma company, it has become pretty hard to justify a FY20 P/E of 26.8x vs. a sector average of 19.8x. An EV/EBITDA multiple of 13.9x for FY20 (vs. sector: 11.7x) is another clear indication that the stock is hovering in an overbought zone.

We have injected a 50% premium to all peer metrics and that is not enough. Beyond speculation (that we do not entertain) that the c.20% shareholding by Swiss billionaire Martin Ebner may have new designs for Vifor, it is out of reach.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...