Debt above 5x EBITDA

[dropcap]T[/dropcap]he financial newspapers are making big titles about the private equity bubble. Bubble means that the average acquisition price is 10.2x EBITDA and gearing is 5.2x EBITDA.

These are indeed highish ratios that the listed world would be suspicious of. But the magicians of Private Equity will keep on explaining that they are talented at spotting quality assets that are hidden and can warrant high purchase prices.

No matter that the next move is to load the target with debt so as to extract the cash immediately. The story is well known but the illusion persists that the exercise can be repeated at will and that the exhausted assets can subsequently be sold into unsuspecting stock markets.

For the sake of this exercise, we look at these two metrics when applied to the AlphaValue universe of 470 stocks.

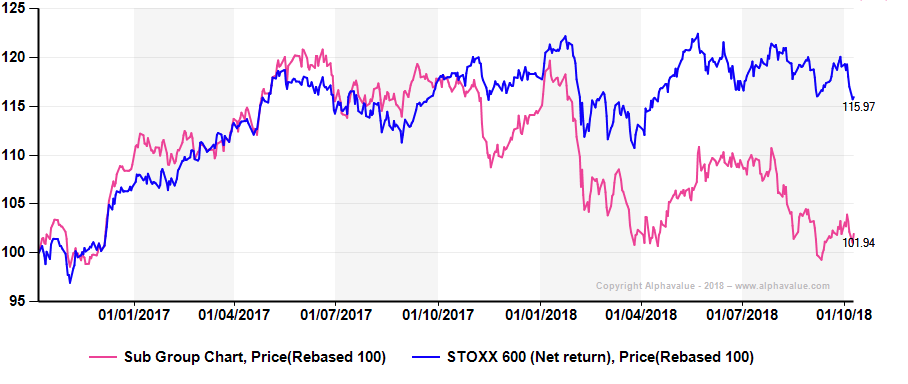

Let us start with stocks whose debt is higher than 5x EBITDA. Excluding Financials (and Property), we find only 20 names above this threshold amongst a universe of 365 issuers. Ergo, what is listed is safer than what is non-listed. The performance of that universe of 20 stocks (unweighted) is telling.

The music stopped in early 2018 when it became clear that US rates rises would be inescapable. The unweighted rating of that universe is a single B and the weighted average adjusted net debt/EBITDA is 6.4x. Only SNAM in this universe is ranked as investment grade on AlphaValue’s independent credit risk gauge.

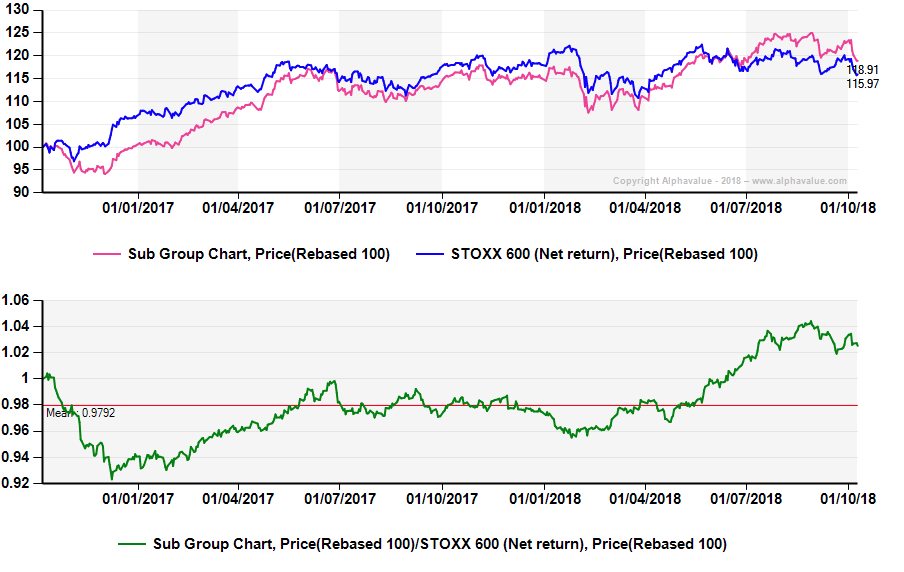

The picture is less gloomy on the other metrics. Stocks with an EV above 10x EBITDA are actually faring well. We count 166 of these in the 365 ex Financials universe. Below is their absolute and relative performances. It looks as if dear stocks are comparably doing better.

The picture is less gloomy on the other metrics. Stocks with an EV above 10x EBITDA are actually faring well. We count 166 of these in the 365 ex Financials universe. Below is their absolute and relative performances. It looks as if dear stocks are comparably doing better.

This is not inconsistent with the private equity valuations as the same wave of money is pushing up all assets. This 166 stock universe at 10x EBITDA is already trading at 22x its 2018 earnings against 2018 EPS growth at a modest 6%.

The upside potential is limited to 7% against 11% for the total AlphaValue coverage.

In short, for a private equity buyer to stump up 10x EBITDA means expectations about EPS growth/cash extraction potential that just does not exist in the real, transparent world of listed equities.

Those private equity buyers had better be talented or expect an exceptionally strong macro cycle over the next five years. The odds are low.

Which means that the odds are low that the last wave of buyers into PE funds will see their money back.

This is not inconsistent with the private equity valuations as the same wave of money is pushing up all assets. This 166 stock universe at 10x EBITDA is already trading at 22x its 2018 earnings against 2018 EPS growth at a modest 6%.

The upside potential is limited to 7% against 11% for the total AlphaValue coverage.

In short, for a private equity buyer to stump up 10x EBITDA means expectations about EPS growth/cash extraction potential that just does not exist in the real, transparent world of listed equities.

Those private equity buyers had better be talented or expect an exceptionally strong macro cycle over the next five years. The odds are low.

Which means that the odds are low that the last wave of buyers into PE funds will see their money back.

Higher leverage is less fashionable

Stocks with a debt/EBITDA above 5x (pink)

Stocks priced above 10x EBITDA accelerate (pink)

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...