Decoding Anil Agarwal’s mission ‘Anglo American’

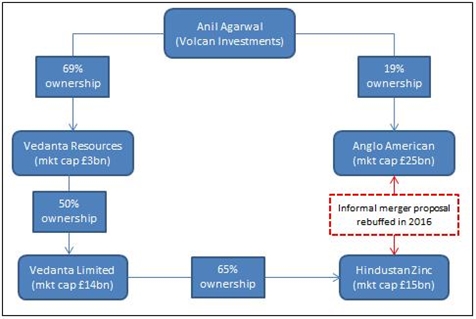

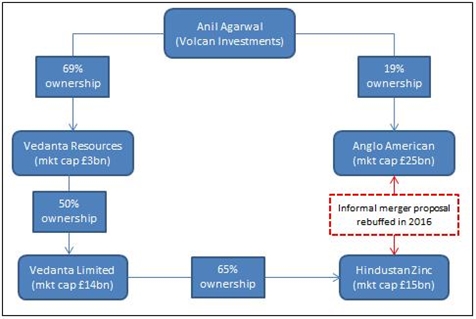

In 2017, Anil Agarwal (Vedanta Resources’ Chairman) via his family trust, Volcan Investments (Vedanta’s largest shareholder – c.69% stake), acquired a 19.4% stake in Anglo American.

The stake was amassed in two tranches during April 2017 and October 2017. The deal structure (details in our latests dated 17 March 2017 and 6 October 2017) was intriguing, with the funding requirements being fulfilled via issuance of mandatory exchangeable bonds.

Volcan did, however, securitise c.92m Vedanta Resources (hereafter Vedanta) shares, 34% of the share capital and c.50% of its holding in Vedanta, with JP Morgan – the sole book runner for exchangeable bond issuance.

While Volcan eventually emerged as Anglo’s largest shareholder, followed by the Public Investment Corporation (PIC) holding a 13.3% stake (as of 2016 end), Anil Agarwal has been reiterating that the stake purchase is a personal investment and there is no intent to initiate a takeover bid and/or to go for a Board seat. But is there a (bigger) hidden agenda behind his aggressive pursuit of the diversified miner?

Anglo American has been a clear outperformer for the past two years (+679% vs. +204% sector returns) due to a plethora of reasons – ranging from recovering commodity prices to successful asset divestments and (partial) curtailment of operational inefficiencies. However, the euphoric gains were also attributable to the stock falling to record lows at the bottom of the commodity cycle. While the Anglo-Volcan deal rationale has been noted in our earlier latests, we reiterate them in addition to highlighting a few more possibilities as we believe that the emergence of Anil Agarwal as the largest shareholder could be a game-changer, though not in the immediate term, for the diamond-platinum-metals-coal miner.

Current situation

Probable M&A angles

Vedanta’s Chairman could facilitate a (partial) sale of Anglo’s non-performing assets, given his illustrious M&A (and restructuring) experience. In fact, the appointment of Stuart Chambers as Anglo’s new Chairman (post Volcan buying a stake in Anglo in April 2017) could have a specific agenda, as Stuart had previously chaired companies, ARM Holdings and Rexam, which were eventually acquired by SoftBank and Ball Corporation, respectively. However, given a long history of fraught labour relations in South Africa (accounting for c.30% of Anglo’s non-current assets and 76% of the workforce), any big-bang asset sale/restructuring won’t be a cakewalk. But then Anil Agarwal is known for his astute negotiation skills and has the reputation of pulling-off next-to-impossible deals. While an informal merger proposal between Anglo American and Hindustan Zinc (HZL – Vedanta’s indirectly-owned cash-rich subsidiary) was rebuffed in 2016, another attempt seems unlikely, given no (commodity and geographic) synergies between the two groups. However, by emerging as the largest shareholder, Anil Agarwal could very well persuade Anglo to acquire Vedanta Limited – Vedanta’s key subsidiary, encompassing all the operations (e.g. Konkola Copper Mines). Besides the two companies’ overlap in copper and iron ore, India could be a very attractive end-market for Anglo – especially in the context of China’s waning economic growth momentum. Remember that India – 1/ happens to be the world’s largest importer of unprocessed diamonds; 2/ is still heavily reliant on thermal coal for energy generation; 3/ lacks a formidable (long-term) plan for large scale EV roll-out and, hence, PGMs could be in high demand; and 4/ has massive infrastructure investment needs (estimated to be $4.5tn by 2040), which should ensure a very strong commodity appetite for the next two-three decades (at least).Merit in buying time

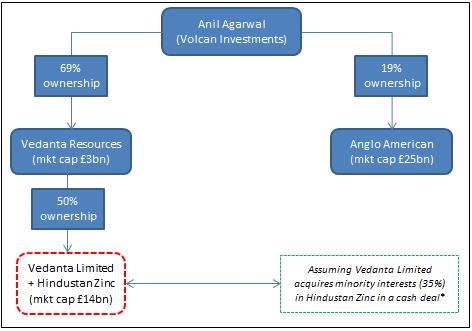

The Volcan-Anglo deal’s financing structure besides not warranting a sizeable cash outlay from Volcan and limiting the upside potential (along with the benefit of almost no downside potential) on Anglo’s shares gives Anil Agarwal a critical three-year window. This would allow him to assess the recovery in South Africa, given the country’s current dismal investment climate and decide whether there is any merit in riding Anglo’s ‘African Safari’. Interestingly, despite South Africa’s grave problems, Vedanta’s decision to go ahead with a $400m investment in the Gamsberg zinc project is (somewhat) indicative of their confidence in the country’s recovery prospects. Moreover, during this time Anil Agarwal can engage with the Government of India (GOI) to expedite their divestment of a c.30% stake in HZL, merge HZL with Vedanta Limited (similar to what was done to Cairn India) and, thereafter, gradually reduce the combined group’s excessive debt – from both HZL’s cash resources and healthy FCFs. While buying out HZL would require Vedanta Limited to raise additional debt, raising debt has seldom been a concern for Vedanta and its associate companies.Future possibility stage 1

*a share deal possibility looks unlikely as the GOI wants to monetise its stake in HZL and use the proceeds to reduce the budget deficit

Post stage 1, Vedanta Limited’s leverage could gradually be brought under control (which may take few years), thereby, making the group more attractive for a possible acquisition by Anglo – illustrated in stage 2 below.

*a share deal possibility looks unlikely as the GOI wants to monetise its stake in HZL and use the proceeds to reduce the budget deficit

Post stage 1, Vedanta Limited’s leverage could gradually be brought under control (which may take few years), thereby, making the group more attractive for a possible acquisition by Anglo – illustrated in stage 2 below.

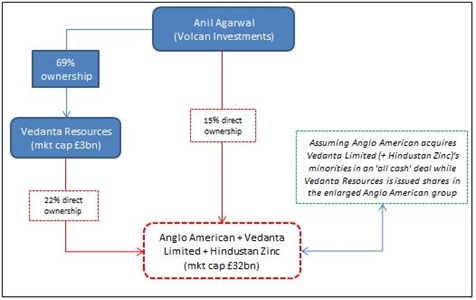

Future possibility stage 2

While Anglo would be required to raise debt to buy out Vedanta Limited’s minorities, Anil Agarwal’s house of cards financing prowess should certainly come in handy. Moreover, he could capitalise his experience in engaging with minority shareholders. Even for the Vedanta-Cairn merger, which seemed very difficult, he somehow managed to get Cairn’s minorities on-board. Given the latent potential of Vedanta Limited’s Indian assets, however, the minorities may demand a hefty premium. This way, by using a combination of debt and equity, Anglo can quickly address its problem of excessive asset exposure to South Africa and, eventually, capitalise on the benefits (discussed above) of being directly exposed to the Indian markets. Vedanta, on the other hand, could receive new shares in the enlarged Anglo American group and benefit via the diversification of dividend flows with the addition of diamonds, PGMs and coal to its (holding) portfolio.

Most importantly, post stage 2, Anil Agarwal could end-up with 37% control in Anglo American – comprising Volcan’s direct 15% stake and Vedanta Resources’ 22% stake. Remember, there is no dearth of examples (such as Vivendi and Glencore) wherein individuals with sizeable influence (and economic interest of (much) less than 50%) are still capable of single-handedly running a full-show.

While the above scenarios are just an illustration of how Anil Agarwal could create a global mining giant, there are very few like him who exhibit the capability of pulling-off something as ambitious as this. This would certainly entail huge risks, but there could be a reason why bankers continue to pour money into a series of Vedanta’s (and its promoter’s) aggressive bets.

While Anglo would be required to raise debt to buy out Vedanta Limited’s minorities, Anil Agarwal’s house of cards financing prowess should certainly come in handy. Moreover, he could capitalise his experience in engaging with minority shareholders. Even for the Vedanta-Cairn merger, which seemed very difficult, he somehow managed to get Cairn’s minorities on-board. Given the latent potential of Vedanta Limited’s Indian assets, however, the minorities may demand a hefty premium. This way, by using a combination of debt and equity, Anglo can quickly address its problem of excessive asset exposure to South Africa and, eventually, capitalise on the benefits (discussed above) of being directly exposed to the Indian markets. Vedanta, on the other hand, could receive new shares in the enlarged Anglo American group and benefit via the diversification of dividend flows with the addition of diamonds, PGMs and coal to its (holding) portfolio.

Most importantly, post stage 2, Anil Agarwal could end-up with 37% control in Anglo American – comprising Volcan’s direct 15% stake and Vedanta Resources’ 22% stake. Remember, there is no dearth of examples (such as Vivendi and Glencore) wherein individuals with sizeable influence (and economic interest of (much) less than 50%) are still capable of single-handedly running a full-show.

While the above scenarios are just an illustration of how Anil Agarwal could create a global mining giant, there are very few like him who exhibit the capability of pulling-off something as ambitious as this. This would certainly entail huge risks, but there could be a reason why bankers continue to pour money into a series of Vedanta’s (and its promoter’s) aggressive bets.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...