EDF is more than a commodity call option

EDF is a complex story one could resume as a commodity call option in a sea of regulatory, technical and political uncertainties. The share price spent last year outperforming the market, driven by surging European power prices and speculation over a potential change in capital structure. While we do recognise a sizeable fundamental upside, we pass our turn and favour other stocks with a lower risk profile.

EDF, a baseload ETF?

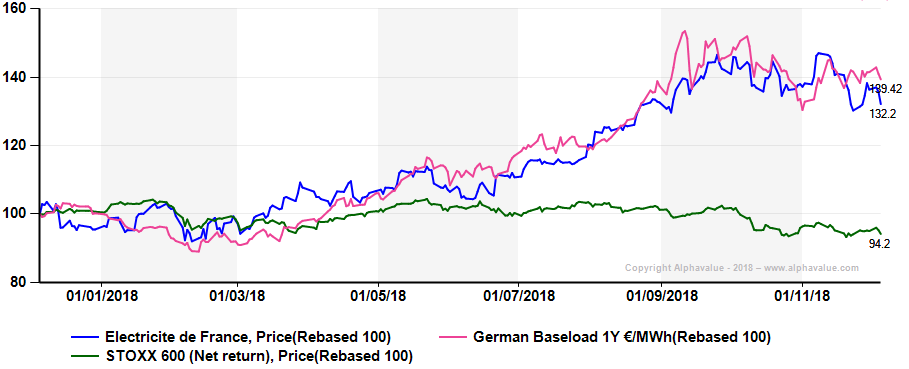

The above chart makes it quite clear: investors are not fretting about the future of the French nuclear industry nor asking themselves if nuclear provisions are rightly valued. They are simply replicating power prices’ swings … rightly so?

Commodity call option

Higher CO2 prices, capacity constraints and increased gas demand have pushed power prices higher over the past three years or so. Considering that most of EDF generation assets’ costs are fixed (nuclear and hydro), the stock can be seen as a commodity call option.

The amplification factor is further heightened by a high leverage at the company level, close to 3x EBITDA - hybrids included.

Calculating the group’s earnings sensitivity to changes in wholesale prices can prove a real ordeal as it relies on a plethora of different drivers. Considering that the surge in power prices was mostly gas-driven and that the company isn’t exposed to coal (1% of 9M18 output), benefits will mostly be felt at the nuclear (FR+UK) and hydro levels.

After stripping out ARENH sales (sold at a fixed €42/MWh), we find that a €1 increase per MWh results in a c.€280-300m boost to EBITDA and a 6-7% boost to EPS, gradually delivered over three years given the group’s hedging policy.

During the first nine months of the year, average French spot prices were on average €5 higher than last year, meaning that – if the group had had no hedging policy - this would have added almost a billion euros to EDF’s FY18 bottom line. A 35% push. However, looking only at power prices would be too simplistic given the current political blur.

What future for the French nuclear industry?

On 27 November, Mr Macron presented France’s 10-year energy guidelines. He announced the closure of 14 nuclear reactors by 2035 and his government decided not to order any new EPRs before at least 2019, when EDF will have to provide an updated estimated cost for the new nuclear.

The cost of nuclear has steadily increased over the past decade, from €42/MWh pre Fukushima to £93/MWh (€104/MWh, Hinkley Point C). Even if economies of scale and more mature technical know-how will obviously drag costs down, EDF might find it hard to market at an estimated cost price below €100/MWh for a first batch of new EPRs.

It is hard to know if Mr Macron will be willing to sign such a cheque. The current “Gilets Jaunes” (Yellow Vests) movement makes it even more politically touchy as affordability became the sacred word. The choice is even harder to make when keeping in mind that renewables + storage could have become the new baseload by the time old reactors retire. A complex equation conditioning EDF’s future.

Towards a new capital structure

In order to secure a complete control over the nuclear industry’s future, the government is reportedly considering a revision of EDF’s capital structure to move all nuclear activities, pensions, provisions and hybrid debts under a state-owned parent company whose partly-listed subsidiary would gather the remaining activities including networks and renewables.

In essence, this separation could strongly benefit EDF’s current minority shareholders by freeing the balance sheet from uncertain nuclear provisions while increasing the Newco’s financial flexibility (lower earnings volatility allowing for a higher leverage).

However, major question marks remain regarding asset allocation as the government will want to make sure the Oldco is able to secure a full coverage of provisions.

The government would also have to reform the nuclear power market to reduce the commodity risk. One of the solutions would be to opt for a CfD model, similar to the one used in the UK for the Hinkley Point C reactor where EDF sells its electrons at a fixed, agreed price.

Too many rocks to dare a plunge

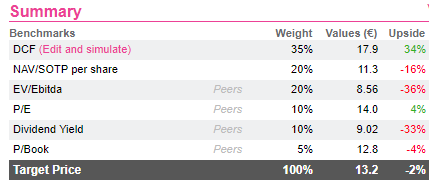

We perfectly understand investors’ willingness to take on the above-mentioned uncertainties to grasp the commodity upside. However, the lack of clarity around Macron’s government long-term strategy combined with doubts on EDF’s ability to finance its decommissioning obligation under its current capital structure leads us to stick to our cautious recommendation with a 2% downside.

The above chart makes it quite clear: investors are not fretting about the future of the French nuclear industry nor asking themselves if nuclear provisions are rightly valued. They are simply replicating power prices’ swings … rightly so?

Commodity call option

Higher CO2 prices, capacity constraints and increased gas demand have pushed power prices higher over the past three years or so. Considering that most of EDF generation assets’ costs are fixed (nuclear and hydro), the stock can be seen as a commodity call option.

The amplification factor is further heightened by a high leverage at the company level, close to 3x EBITDA - hybrids included.

Calculating the group’s earnings sensitivity to changes in wholesale prices can prove a real ordeal as it relies on a plethora of different drivers. Considering that the surge in power prices was mostly gas-driven and that the company isn’t exposed to coal (1% of 9M18 output), benefits will mostly be felt at the nuclear (FR+UK) and hydro levels.

After stripping out ARENH sales (sold at a fixed €42/MWh), we find that a €1 increase per MWh results in a c.€280-300m boost to EBITDA and a 6-7% boost to EPS, gradually delivered over three years given the group’s hedging policy.

During the first nine months of the year, average French spot prices were on average €5 higher than last year, meaning that – if the group had had no hedging policy - this would have added almost a billion euros to EDF’s FY18 bottom line. A 35% push. However, looking only at power prices would be too simplistic given the current political blur.

What future for the French nuclear industry?

On 27 November, Mr Macron presented France’s 10-year energy guidelines. He announced the closure of 14 nuclear reactors by 2035 and his government decided not to order any new EPRs before at least 2019, when EDF will have to provide an updated estimated cost for the new nuclear.

The cost of nuclear has steadily increased over the past decade, from €42/MWh pre Fukushima to £93/MWh (€104/MWh, Hinkley Point C). Even if economies of scale and more mature technical know-how will obviously drag costs down, EDF might find it hard to market at an estimated cost price below €100/MWh for a first batch of new EPRs.

It is hard to know if Mr Macron will be willing to sign such a cheque. The current “Gilets Jaunes” (Yellow Vests) movement makes it even more politically touchy as affordability became the sacred word. The choice is even harder to make when keeping in mind that renewables + storage could have become the new baseload by the time old reactors retire. A complex equation conditioning EDF’s future.

Towards a new capital structure

In order to secure a complete control over the nuclear industry’s future, the government is reportedly considering a revision of EDF’s capital structure to move all nuclear activities, pensions, provisions and hybrid debts under a state-owned parent company whose partly-listed subsidiary would gather the remaining activities including networks and renewables.

In essence, this separation could strongly benefit EDF’s current minority shareholders by freeing the balance sheet from uncertain nuclear provisions while increasing the Newco’s financial flexibility (lower earnings volatility allowing for a higher leverage).

However, major question marks remain regarding asset allocation as the government will want to make sure the Oldco is able to secure a full coverage of provisions.

The government would also have to reform the nuclear power market to reduce the commodity risk. One of the solutions would be to opt for a CfD model, similar to the one used in the UK for the Hinkley Point C reactor where EDF sells its electrons at a fixed, agreed price.

Too many rocks to dare a plunge

We perfectly understand investors’ willingness to take on the above-mentioned uncertainties to grasp the commodity upside. However, the lack of clarity around Macron’s government long-term strategy combined with doubts on EDF’s ability to finance its decommissioning obligation under its current capital structure leads us to stick to our cautious recommendation with a 2% downside.

Only an official announcement of a separation of the nuke activities into a state-owned entity could make us reconsider our opinion. Unsurprisingly, EDF’s biggest union is strongly opposed to any change.

The support mechanism would also be complex to introduce while avoiding state aid allegations. Lastly, even if Mr Macron overcomes these obstacles, the endless talks around Engie’s privatisation tend to show that such complex decisions often linger on.

One should also keep in mind that 2019 doesn’t look good for the nuclear business, volume-wise. The number of planned inspections in the French fleet will reach a peak of 7 units, which should lead to a decline in output.

In the UK, the outlook isn’t any brighter as the group uncovered several hundred cracks in the Hunterston B nuclear reactor, which should remain offline until at least 21 February 2019.

In our coverage, we like Engie which offers a compelling mix of growth and cash flow predictability, although the company is also entangled in a complex net of technical issues in its Belgian nuclear division. However, 2019 should prove much more favourable as the group is completing its asset disposal programme and will benefit strongly from the rise in power prices.

Otherwise, if betting on power prices movements isn’t your thing, National Grid could be your pick. Its regulated profile means it does not bear any volume/price risk, while its (sustainable) dividend yield stands consistently above 5%.

Only an official announcement of a separation of the nuke activities into a state-owned entity could make us reconsider our opinion. Unsurprisingly, EDF’s biggest union is strongly opposed to any change.

The support mechanism would also be complex to introduce while avoiding state aid allegations. Lastly, even if Mr Macron overcomes these obstacles, the endless talks around Engie’s privatisation tend to show that such complex decisions often linger on.

One should also keep in mind that 2019 doesn’t look good for the nuclear business, volume-wise. The number of planned inspections in the French fleet will reach a peak of 7 units, which should lead to a decline in output.

In the UK, the outlook isn’t any brighter as the group uncovered several hundred cracks in the Hunterston B nuclear reactor, which should remain offline until at least 21 February 2019.

In our coverage, we like Engie which offers a compelling mix of growth and cash flow predictability, although the company is also entangled in a complex net of technical issues in its Belgian nuclear division. However, 2019 should prove much more favourable as the group is completing its asset disposal programme and will benefit strongly from the rise in power prices.

Otherwise, if betting on power prices movements isn’t your thing, National Grid could be your pick. Its regulated profile means it does not bear any volume/price risk, while its (sustainable) dividend yield stands consistently above 5%.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...