Enel rather than Iberdrola

We like Iberdrola but currently prefer Enel as the drivers behind the latter’s recent underperformance should progressively peter out.

Stormy Italian politics combined with Eletropaulo’s pricey acquisition kept Enel’s share price under water while Iberdrola benefited from rising power prices and closed the spread previously widened by sterling’s slide and an equally-tough political situation in Spain.

While the two offer a compelling, future-proof business model, able to cope with the shifting EU Energy framework, Enel is likely to see several headwinds either vanish or turn to positives in the near future, which should help it close the 20-30% valuation gap.

Shearing political winds

Consistent positioning

The Fukushima incident in 2011, the Paris agreement, the European carbon trading system as well as many national policies are pushing for lower global carbon intensity and increased levels of investments towards renewables to diversify away from polluting (coal) and risky (nuclear) energy sources.

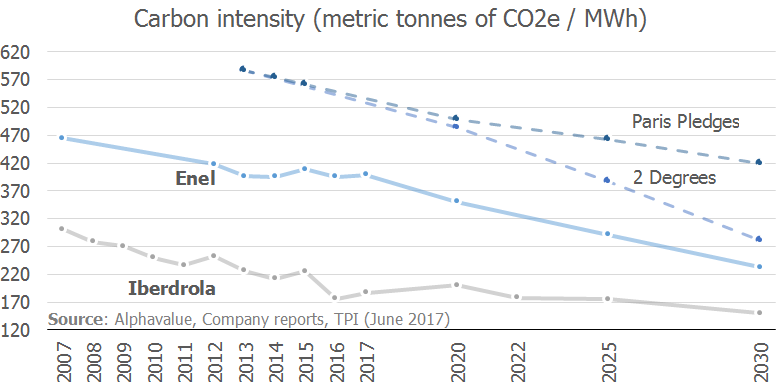

To cope better with increased injections of renewables production, more money has to be put in Networks, to increase their size and efficiency. Enel and Iberdrola have both reoriented their business mix towards these two growth areas. Their current carbon intensity (the amount of CO2 emitted per MWh produced) have been steadily decreasing over recent years.

While Iberdrola stays a step ahead, Enel's positioning is consistent with the targets set during the COP21 in Paris and the two could benefit from this evolving EU energy framework.

Consistent positioning

The Fukushima incident in 2011, the Paris agreement, the European carbon trading system as well as many national policies are pushing for lower global carbon intensity and increased levels of investments towards renewables to diversify away from polluting (coal) and risky (nuclear) energy sources.

To cope better with increased injections of renewables production, more money has to be put in Networks, to increase their size and efficiency. Enel and Iberdrola have both reoriented their business mix towards these two growth areas. Their current carbon intensity (the amount of CO2 emitted per MWh produced) have been steadily decreasing over recent years.

While Iberdrola stays a step ahead, Enel's positioning is consistent with the targets set during the COP21 in Paris and the two could benefit from this evolving EU energy framework.

Monozygotic twins?

Despite Iberdrola’s head start in terms of carbon intensity, the two groups share a broad range of similarities, including their business breakdowns and investment strategies.

Both companies spent the last years focusing on de-risking their portfolio by stepping up investments in both networks and renewables. Transmission or distribution networks offer higher earnings’ visibility and do not bear volume risk as remuneration is linked to capex, depreciations, inflation and efficiencies (through various KPIs). Renewables prices are often fixed over 15-20 year periods thanks to PPAs/CfDs and are therefore considered as semi-regulated.

Enel expects to invest 46% of its 2017-20 capex in Networks and 38% in renewables compared to 50% and 37% for Iberdrola, respectively (2018-22). The share of regulated or semi-regulated EBITDA should reach around 80% this year at both Enel and Iberdrola.

The two groups also share some political risks in Italy (Enel), Spain and the UK (Iberdrola), as well as a significant exposure to depreciating currencies, notably Sterling (Iberdrola: 26% of Q1 18 EBIT), the Brazilian real (Enel: 5.4%, Iberdrola: 11.7%), the US dollar (Iberdrola: 15%) or the Argentine peso (Enel: 4%).

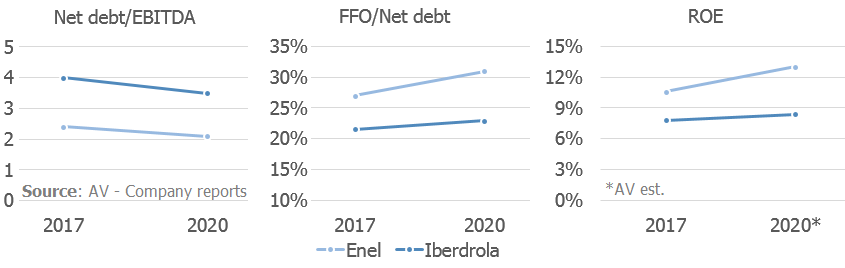

From a financial standpoint, Enel’s growth expectations seem superior. Capex, M&A and cost efficiencies should be able to drive a 6% EBITDA CAGR over 2017-20, leveraged into a 14% EPS CAGR thanks to lower financial expenses and some minority buyouts.

Iberdrola foresees the opposite trends between 2017 and 2022, with a c.10% EBITDA CAGR and a lower 5% EPS CAGR as larger investments in the US and in Brazil will drive the average cost of debt higher (from 3.8% to 4.2%) while the company won’t enjoy Enel’s 3% EPS accretion linked to the buyout of minorities.

As regards rates, the share of fixed-rate debt stands at 72% at Iberdrola vs 78% at Enel, which would give the latter a small advantage in a rising interest rates environment. Enel’s leverage is also lower, with a net debt c.1x EBITDA lower than it peer and faster deleveraging expectations, supported by an improving return on equity.

Monozygotic twins?

Despite Iberdrola’s head start in terms of carbon intensity, the two groups share a broad range of similarities, including their business breakdowns and investment strategies.

Both companies spent the last years focusing on de-risking their portfolio by stepping up investments in both networks and renewables. Transmission or distribution networks offer higher earnings’ visibility and do not bear volume risk as remuneration is linked to capex, depreciations, inflation and efficiencies (through various KPIs). Renewables prices are often fixed over 15-20 year periods thanks to PPAs/CfDs and are therefore considered as semi-regulated.

Enel expects to invest 46% of its 2017-20 capex in Networks and 38% in renewables compared to 50% and 37% for Iberdrola, respectively (2018-22). The share of regulated or semi-regulated EBITDA should reach around 80% this year at both Enel and Iberdrola.

The two groups also share some political risks in Italy (Enel), Spain and the UK (Iberdrola), as well as a significant exposure to depreciating currencies, notably Sterling (Iberdrola: 26% of Q1 18 EBIT), the Brazilian real (Enel: 5.4%, Iberdrola: 11.7%), the US dollar (Iberdrola: 15%) or the Argentine peso (Enel: 4%).

From a financial standpoint, Enel’s growth expectations seem superior. Capex, M&A and cost efficiencies should be able to drive a 6% EBITDA CAGR over 2017-20, leveraged into a 14% EPS CAGR thanks to lower financial expenses and some minority buyouts.

Iberdrola foresees the opposite trends between 2017 and 2022, with a c.10% EBITDA CAGR and a lower 5% EPS CAGR as larger investments in the US and in Brazil will drive the average cost of debt higher (from 3.8% to 4.2%) while the company won’t enjoy Enel’s 3% EPS accretion linked to the buyout of minorities.

As regards rates, the share of fixed-rate debt stands at 72% at Iberdrola vs 78% at Enel, which would give the latter a small advantage in a rising interest rates environment. Enel’s leverage is also lower, with a net debt c.1x EBITDA lower than it peer and faster deleveraging expectations, supported by an improving return on equity.

In fact, the main discrepancy could relate to governance as the two groups recently engaged in a heated contest to acquire Eletropaulo, Brazil’s largest power distribution company, for which Enel ended up overpaying by offering an unreasonable 160% premium.

Many, ourselves included, warned that such a pricey acquisition would be hard to monetise as it represents a forward EV/EBITDA multiple of close to 11x, well above the peers’ average. Further evidence came from the fact that Iberdrola gave up while the deal would have been more value accretive for the Spanish group given the two grids' geographical proximity.

Of course, Enel’s top executives aim to engineer enough top line and cost synergies to bring the EV/EBITDA down to 6.1x in FY21 yet investors’ fears regarding Enel’s lack of financial discipline could act as a small drag on the share price until a more reasonable deal is landed.

A stress-test of Enel's financial rigour could happen soon as the group is reportedly eyeing two of Eletrobras’ six distribution subsidiaries.

Enel’s edge

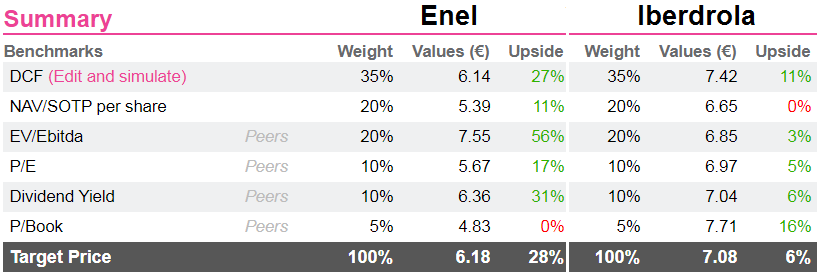

Valuation aside, we like the two profiles as they offer a compelling mix of resiliency and growth. However, Enel's multiples are currently well below Iberdrola’s, with a FY18 P/E 22% below, at 11.3x and a FY18 EV/EBITDA 33% below, at 6.5x. Dividend-wise, the gap is less obvious, with Enel’s yield only sitting 90bp higher, at 5.8%.

With calmer political winds in Italy, the only persisting negative we see is the group’s exposure to LatAm countries, notably to Brazil where the lack of investor-friendly candidates might weigh on the currency ahead of the October election.

However, with higher electricity prices finally reflecting into hedges (FY18 achieved prices up €2/MWh in Spain and €4/MWh in Italy), the risk/reward ratio seems skewed to the upside.

Moreover, the impact of higher CO2 prices (+200% 1Y increase) is expected to be a mildly positive as the negative impact on Enel’s thermal assets in Italy should be offset by the benefits of higher wholesale prices for nuclear and renewable assets in Iberia.

In fact, the main discrepancy could relate to governance as the two groups recently engaged in a heated contest to acquire Eletropaulo, Brazil’s largest power distribution company, for which Enel ended up overpaying by offering an unreasonable 160% premium.

Many, ourselves included, warned that such a pricey acquisition would be hard to monetise as it represents a forward EV/EBITDA multiple of close to 11x, well above the peers’ average. Further evidence came from the fact that Iberdrola gave up while the deal would have been more value accretive for the Spanish group given the two grids' geographical proximity.

Of course, Enel’s top executives aim to engineer enough top line and cost synergies to bring the EV/EBITDA down to 6.1x in FY21 yet investors’ fears regarding Enel’s lack of financial discipline could act as a small drag on the share price until a more reasonable deal is landed.

A stress-test of Enel's financial rigour could happen soon as the group is reportedly eyeing two of Eletrobras’ six distribution subsidiaries.

Enel’s edge

Valuation aside, we like the two profiles as they offer a compelling mix of resiliency and growth. However, Enel's multiples are currently well below Iberdrola’s, with a FY18 P/E 22% below, at 11.3x and a FY18 EV/EBITDA 33% below, at 6.5x. Dividend-wise, the gap is less obvious, with Enel’s yield only sitting 90bp higher, at 5.8%.

With calmer political winds in Italy, the only persisting negative we see is the group’s exposure to LatAm countries, notably to Brazil where the lack of investor-friendly candidates might weigh on the currency ahead of the October election.

However, with higher electricity prices finally reflecting into hedges (FY18 achieved prices up €2/MWh in Spain and €4/MWh in Italy), the risk/reward ratio seems skewed to the upside.

Moreover, the impact of higher CO2 prices (+200% 1Y increase) is expected to be a mildly positive as the negative impact on Enel’s thermal assets in Italy should be offset by the benefits of higher wholesale prices for nuclear and renewable assets in Iberia.

Subscribe to our blog

Alphavalue Morning Market Tip

French Wine and Champagne potentially hit with a 200% tariffs.

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...