Energy markets in panic mode before winter starts

Supply constraints along the intricate energy system have caused a surge in European electricity and gas prices. Several energy-intensive companies have started to respond to the high prices by halting their production but the upcoming winter season is going to be challenging. We therefore expect the markets to remain tight throughout the whole winter, with temperatures as the main unknown for demand.

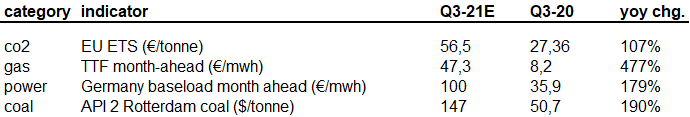

European energy prices trade at multiples from 2020 (depressed) levels:

Natural gas: many moving parts

European gas prices are on a record streak with Dutch TTF day-ahead close to €70/MWh, and up by 75% over a month. Spot prices jumped by 20% after the fire at a France-UK electricity interconnector last week, but the trend has been upwards for a year now (TTF day-ahead was below €10/MWh in Q3 20).

There are several explanations for this rally:

- Low storage levels: European storages are 70-71% full, which compares to 93% in 2020, 94% in 2019, 78% in 2018, 81% in 2017. At 80bcm (785TWh), this covers around two months of consumption, but bear in mind that gas consumption is seasonal (c. 60% from October to March).

- Russia (200 bcm p.a., 40% of the European supply) is not increasing deliveries despite the higher prices. Since Q2, Gazprom’s sales on its Electronic Sales Platform (ESP) were in small volumes and for delivery starting in winter at the earliest (starting in October), and nothing on prompt delivery (day ahead, week-end, balance of the month). Take for instance August, where volumes sold were for 1.05 bcm (-28% yoy) and with the earliest delivery in Q1 22 (compared to September 2020 in August 2020). Uncertainties around the start of Nord Stream 2 add volatility, the start of which will be key.

- Asia remains more attractive for LNG: Europe’s LNG imports are lower yoy (-17bcm) and higher in Asia (+29bcm). In August, Asia imported 23 m tonnes of LNG against 5 m tonnes in Europe (7bcm at the moment and North-East Asian LNG prices for delivery in November were trading at $23/mmbtu (€67/MWh) this week. The latest rally in European prices makes imports more likely, only if Asia does not bid higher.

- Declining indigenous production: As the Netherlands is running down production at Groningen (before halting it in 2022), indigenous production was down by 11% yoy in Q1 (13.8bcm).

- Demand is rather inelastic to prices: Gas consumption in Europe is around 480bcm per annum, with 25% for the Industrial sector (c. 120bcm), 25-30% for Power and Heat plants (c. 120bcm), 40% for Buildings (c. 190bcm), and the rest (c. 7%) for Transport and others. Power generation responds to the price signal, and explains why generation from coal power plants are higher yoy, while gas power plants production levels are lower.

The inelasticity of demand explains the high volatility. Note, however, that the recent announcement by the fertiliser maker CF Industries to halt production at two of its UK sites (followed by Yara two days later), due to high gas prices, shows that Industrials finally responded. For heat and buildings consumption, temperatures will be the key driver (especially from Q1 22). We expect prices to remain elevated until at least the end of the year, as injection into storage will support prices while Nord Stream 2 comes on stream.

Power: high CO2 prices paradoxically means high CO2 emissions

This is the current oddity: while CO2 prices have never been so high and stand close to €60/t (+78% ytd), the carbon intensity of the European energy mix keeps increasing. Indeed, the surge in gas prices makes plants run out-of-the-money, even if the electricity produced can be sold on the booming electricity spot market. On the other side, even c. 2x more carbon intensive than gas, coal plants are benefiting from high electricity prices that more than offset the rise in CO2 prices. At the end of the day, gas plants are stopped and coal ones are running at full power to compensate, increasing global CO2 emissions. This is above all the case in Germany where RWE already operates a switch from gas to coal plants.

Going into more detail: the current dark spread, i.e. the profitability of coal plants, is at around €52/MWh according to our estimates. This is well above the long-term average, obviously driven by the surge in electricity prices (Germany day-ahead baseload index above €150/MWh vs €40 on average) that more than offset the higher cost for coal (CIF ARA forward 1m +156% ytd) and for CO2. On the other side, the spark spread, i.e. the profitability of gas plants, is a negative €3/MWh on a baseload basis.

Admittedly, the analysis must be qualified. While the dark spread is relatively flat across countries, spark spreads can vary highly depending on the energy mix. In the UK for example, which has few coal plants, gas plants are running at baseload and thus sell their electricity at daily average prices. But, in Germany, which has lots of coal and thus higher flexibility, gas plants are running peak-load and are benefiting from higher prices at peak times (currently: spot baseload at €150/MWh while spot peak-load is at €170/MWh). But, even on a peak-load basis, the spark spread is close to €10/MWh, or half that of the dark spread.

In conclusion, no matter where one looks or what prices one takes, coal is more profitable than gas, despite the current historic price of coal and despite the current historic price of CO2. Rising energy prices are damaging for customers but, above all, damaging for the environment. And while governments are trying to protect retail customers from soaring energy bills, like in Spain, France or Greece, nobody is protecting scope 1 & 2 emissions from skyrocketing prices compared to 2020 levels. We expect a strong deterioration on this topic in the 2021 annual reports from various companies, almost in parallel to their rising profits. A green paradox in an ESG-driven economy.

Natural gas

Apart from Gazprom, Equinor is the company that benefits the most from the surge in European gas hub prices. For Equinor, around 75% of the gas production is produced in Norway and therefore directed to Europe, on which realised prices track the ‘sTF closely.

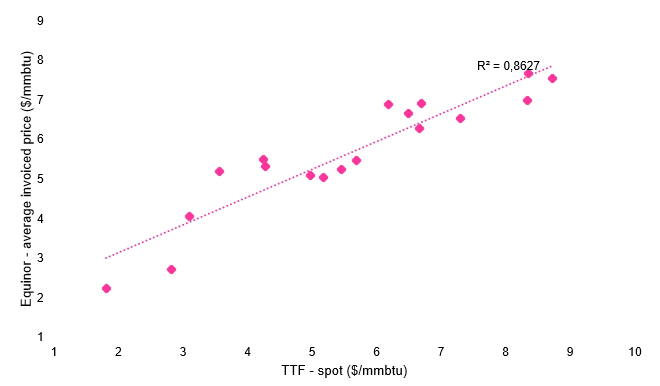

Equinor, average invoiced gas prices (quarterly) vs TTF spot since 2017:

Furthermore, the company has also drastically changed its exposure since 2019, and now sells 70% of its production on the spot market, and 30% in the front month. With Norwegian gas production of around 680kboed, we expect the price increase seen in H2 (and lasting until the end of the year) to bring c. $1.5bn in additional earnings.

The direct exposure to hub prices is lower for the other companies, where pricing is also fixed or indexed to oil. Around 10-20% of the gas production (for the other integrated companies) is sold in Europe on a spot basis.

Positive surprises could come from Shell, Total and BP’s trading arms, thanks to the volatility, but that is hard to estimate and more of a one-off.

Power

The more exposed to generation activities one is, the more one will benefit from surging prices. But with two variables: the aggressiveness of one’s hedging policy, and one’s exposure to carbon prices. We identify Fortum, EDF, and RWE as potential winners. In our view, the upside is already priced in for Verbund and, by extension, for EVN.

Hydro and nuclear operators are the most valuable technology in these times, making EDF and Fortum the real winners. For the French utility, we see FY21 EBITDA close to €19bn (vs above €17.7bn in group’s guidance and €18.05bn in Bloomberg consensus). A high double-digit EPS growth is expected for FY22 and FY23. However, this upside is conditional on the French government’s decision to increase – or not – the ARENH cap from 100 to 150TWh. Effective as of February 2022, this could have an €1.5bn negative impact on FY22 EBITDA.

Roughly, a 20-25% EPS increase compared to current forecasts seems realistic in FY21 for Fortum. Uniper, highly exposed to gas and now fully consolidated, will be key.

For RWE, we expect no material impact in FY21 as we estimate the remaining unhedged production at close to 0%. We see potential for FY22 and, above all, FY23, but also limited as the group is particularly conservative in its hedging policy.

Access to full report : click here