Forever green

[dropcap]R[/dropcap]upert Murdoch is still a fixture of financial markets at 87. He no longer shows up in AlphaValue's long list of chairmen of listed corporates having given the baton to James. The death of Serge Dassault, the family ruler of the Dassault dynasty (a €20bn empire), at a sprightly 93 is a reminder that some men never quit.

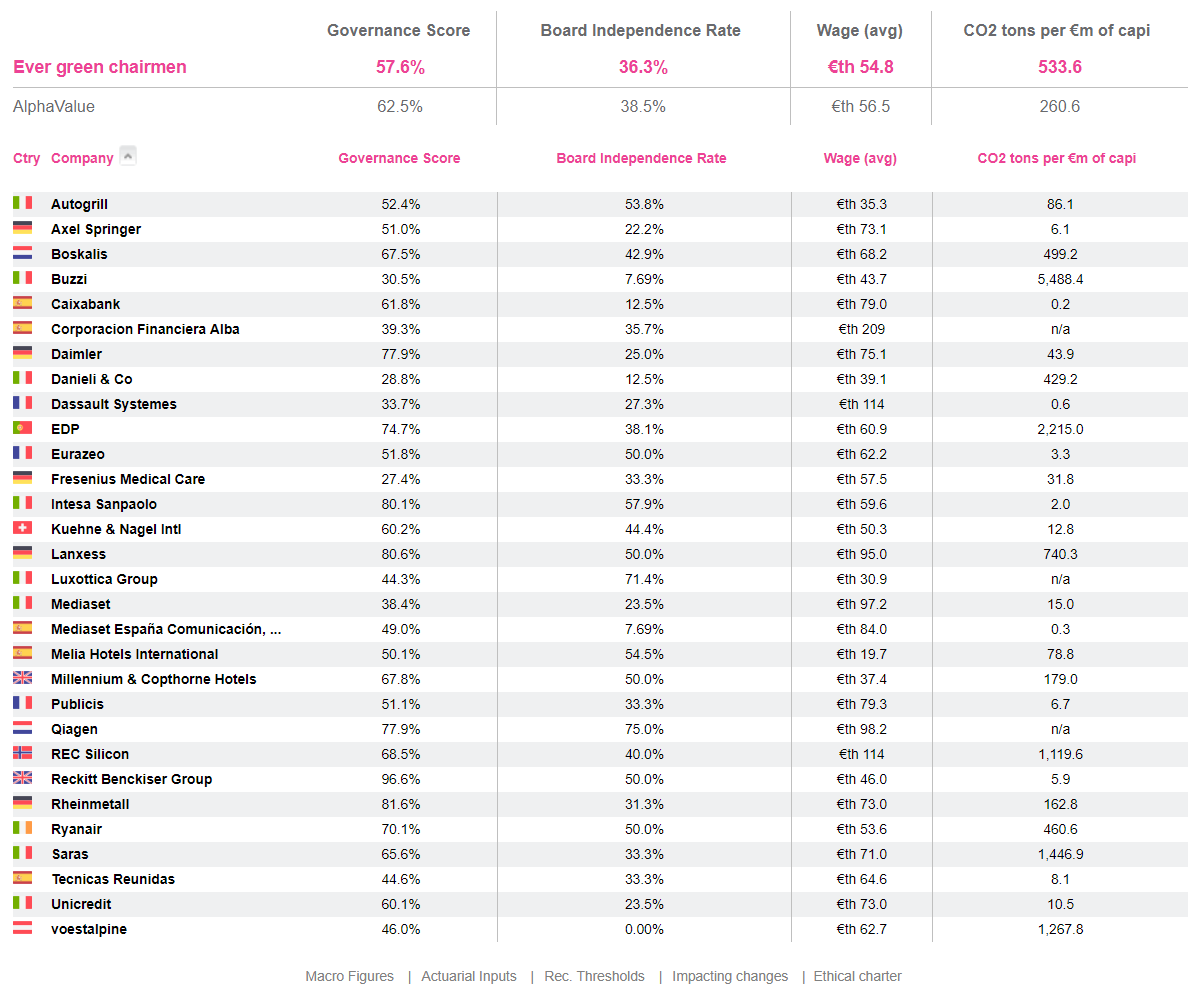

We can find 30 corporates in the AlphaValue universe with a chairman clocking 75 or more. All are men. The suspicion that this is not optimal even if the executive board can navigate without a competent board of directors is very hard to back.

Harbouring such a suspicion is natural as board chairs beyond a reasonable age may not be up to the job of challenging a generally much younger management. In addition, a chairman beyond 75 may exercise power in ways that reflect a more dynastic type of influence.

When the said chairman eventually meets his creator, things may then turn out to be messy, including in family-driven businesses when two generations hope to fill a void.

We investigated our 30 strong universe (€422bn market cap) as a theoretical equal-weighted portfolio to conclude that shareholders do not seem to care when we compare this sub group's essential metrics to average ones.

For instance, the governance scores of this universe do not significantly diverge from market averages. The proportion of independent directors, for example, is 36%, the same as for the whole universe. Directors fees do not diverge either.

P/Es are actually a bit higher and the dividend yield lower (2.8%) which may be construed by the fact that investors are fully relaxed about the issue. This may be partly due to the fact that they do know that many firms with aged chairmen are under family influence (13 are ranked as such in the 30 stock universe).

Obviously corporates have many more reasons to underperform than too-old-a-chairman. But one cannot help but feel that it is within the reach of shareholders to deal pre-emptively with the issue.

The following is a list of corporates with very senior chairs. Obviously this is not science and would require case by case comments.

Fighting on

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...