French KHOL

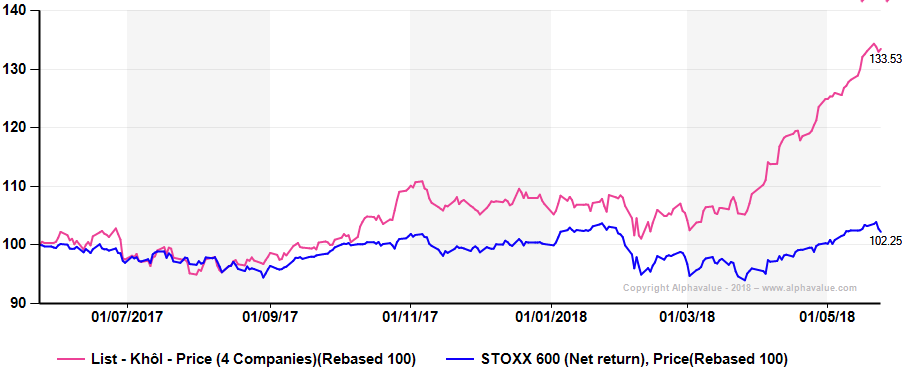

[dropcap]T[/dropcap]hink of Kering, Hermes, l'Oreal and LVMH (khôl) as the French version of GAFAs. This is when one sector tips the market balance. Their 33% combined jump from late March to now is substantially skewing the balance of the CAC40.

Luxury splash

Our Khôl universe has gained €107bn in market cap between now and the average of 2017. For the CAC40 index +Hermes, the gain has been €207bn over the same period. Thus Khôl explains 50% of the gains.

The 4 stock universe accounts for 24% of the CAC40 market cap (including Hermes for consistency).

LVMH alone weighs nearly 10% of the index which means that funds benchmarked to the CAC40 cannot hope to outperform lest they run into diversification risks.

There is another parallel and a difference from GAFAs. The parallel is the hope factor.

An ever-brighter technology future drives the confidence in GAFAs. For Khôl stocks, it is about this Chinese lady that will never flinch when looking at the price tag of that Hermès bag.

The fact that Hermes trades at 10x sales (on a 2018 EV basis) is a reflection of the fact that Chinese demand was a positive surprise in Q1. With apparently more in Q2-2018. But surprises go both ways.

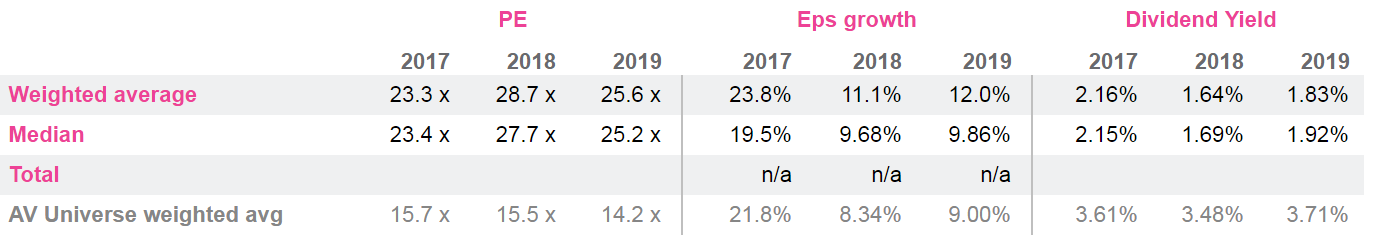

The difference is valuation. The French Khôl trades at a rather remarkable 28x 2018 earnings. Those are admittedly likely to be upgraded. Ex Amazon at 130x, GAFAs trade at 21x

Khôl valuations

Our Khôl universe has gained €107bn in market cap between now and the average of 2017. For the CAC40 index +Hermes, the gain has been €207bn over the same period. Thus Khôl explains 50% of the gains.

The 4 stock universe accounts for 24% of the CAC40 market cap (including Hermes for consistency).

LVMH alone weighs nearly 10% of the index which means that funds benchmarked to the CAC40 cannot hope to outperform lest they run into diversification risks.

There is another parallel and a difference from GAFAs. The parallel is the hope factor.

An ever-brighter technology future drives the confidence in GAFAs. For Khôl stocks, it is about this Chinese lady that will never flinch when looking at the price tag of that Hermès bag.

The fact that Hermes trades at 10x sales (on a 2018 EV basis) is a reflection of the fact that Chinese demand was a positive surprise in Q1. With apparently more in Q2-2018. But surprises go both ways.

The difference is valuation. The French Khôl trades at a rather remarkable 28x 2018 earnings. Those are admittedly likely to be upgraded. Ex Amazon at 130x, GAFAs trade at 21x

Khôl valuations

The taste for French luxury will last while trying to apply traditional valuation metrics to Hermès has proved futile over the last 10 years. Meaning that the craze for Luxury may last.

The only issue is when a crowded trade becomes a stampede for the exit.

The taste for French luxury will last while trying to apply traditional valuation metrics to Hermès has proved futile over the last 10 years. Meaning that the craze for Luxury may last.

The only issue is when a crowded trade becomes a stampede for the exit.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...