Gambling on utilities

[dropcap]S[/dropcap]o a bunch of early-moving hedge funds and a handful of traders rediscover the carbon rights market and turn European utilities into a casino-type wager on spot power prices?

This, in a nutshell, is what happened when the eyes of investors in the energy markets were mainly focused on oil markets. The following chart points to the strong correlation between carbon rights and the “German baseload” spot power price.

The vertical scale does not do justice to the correlation between the two curves but what happened is of epic proportions for such a dull sector as utilities.

German baseload (pink) and EU carbon rights (blue)

The German baseload rose by more than 50% since the beginning of the year and took 21% during the last month, due to two factors actually. First, the exit of coal capacity as most western European countries set out plans to exit coal-fired assets. Then, the stellar rise of carbon prices, which rose by 250% over the past twelve months, to €25 per ton.

Uneven impact on utilities

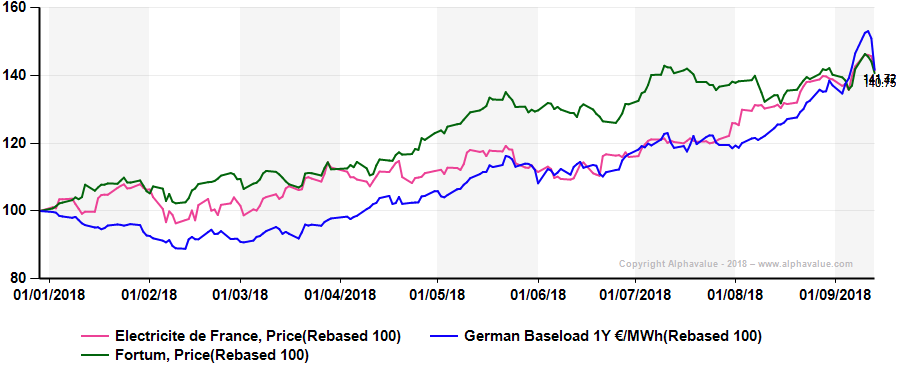

This strong increase in spot power prices is having a different impact on utilities depending on their business mix. It went unnoticed as indeed sector members do not all benefit so that the sector had not really moved (next chart)

Utilities have not reacted en masse

The German baseload rose by more than 50% since the beginning of the year and took 21% during the last month, due to two factors actually. First, the exit of coal capacity as most western European countries set out plans to exit coal-fired assets. Then, the stellar rise of carbon prices, which rose by 250% over the past twelve months, to €25 per ton.

Uneven impact on utilities

This strong increase in spot power prices is having a different impact on utilities depending on their business mix. It went unnoticed as indeed sector members do not all benefit so that the sector had not really moved (next chart)

Utilities have not reacted en masse

Higher electricity price means that players active in the Retail sector will see their margin erode as their procurement costs will increase. Similarly, Utilities with a strong exposure to coal and gas will see their generation margins decline. In our coverage, Centrica, “old SSE” and E.ON should be avoided.

Conversely, Utilities with an exposure to renewables and nuclear will benefit from this hike in prices as their costs will remain fixed and are independent of power prices, therefore the prices will boost their bottom lines. In our coverage, ERG, “new SSE” and Orsted, for example, have a high exposure to renewables.

All of this has to be taken with caution as winds in Q3 were exceptionally calm, meaning that the next set of results could disappoint the market. The “future RWE” will be focused on nuclear and renewables.

EDF is also well positioned given its nuclear activities. Moreover, the pressures in its Retail division will be partly offset by the fact that competitors will start to buy electricity from EDF now that wholesale prices are above the €42 level.

Fortum is certainly very well placed given that it has a 96% clean generation portfolio. The same is true for Verbund, which is exposed to the hydro and wind markets.

EDF and Fortum tango with spot power prices

Higher electricity price means that players active in the Retail sector will see their margin erode as their procurement costs will increase. Similarly, Utilities with a strong exposure to coal and gas will see their generation margins decline. In our coverage, Centrica, “old SSE” and E.ON should be avoided.

Conversely, Utilities with an exposure to renewables and nuclear will benefit from this hike in prices as their costs will remain fixed and are independent of power prices, therefore the prices will boost their bottom lines. In our coverage, ERG, “new SSE” and Orsted, for example, have a high exposure to renewables.

All of this has to be taken with caution as winds in Q3 were exceptionally calm, meaning that the next set of results could disappoint the market. The “future RWE” will be focused on nuclear and renewables.

EDF is also well positioned given its nuclear activities. Moreover, the pressures in its Retail division will be partly offset by the fact that competitors will start to buy electricity from EDF now that wholesale prices are above the €42 level.

Fortum is certainly very well placed given that it has a 96% clean generation portfolio. The same is true for Verbund, which is exposed to the hydro and wind markets.

EDF and Fortum tango with spot power prices

Finally, highly regulated players like National Grid or Snam shouldn’t be that much impacted in the short term as their remuneration is linked to investments, inflation and depreciation mainly.

Enel and Iberdrola won’t be too much impacted given that most of their activities are regulated or semi-regulated while the two operate renewable assets to help them cope with headwinds in their retail operations.

One has to keep in mind that, first, most utilities have in general a 2-3 years hedging policy, so the increase in prices will take time before being fully reflected in the results, while the risk of seeing a correction in carbon prices shouldn’t be disregarded as many doubt that carbon is currently in a bubble. Carbon rights prices indeed tumbled of late and so did spot power prices (first chart).

The last few hours’ news that a major electricity contract trader went belly-up in Norway, nearly taking down the market with it, is also a healthy reminder that sharp price rises may have thin foundations.

There is no doubt that cutting back on coal-based generation does help baseload prices but the carbon rights catalyst may be short-lived.

Learn more on Utilities sector research by AlphaValue : click here

Finally, highly regulated players like National Grid or Snam shouldn’t be that much impacted in the short term as their remuneration is linked to investments, inflation and depreciation mainly.

Enel and Iberdrola won’t be too much impacted given that most of their activities are regulated or semi-regulated while the two operate renewable assets to help them cope with headwinds in their retail operations.

One has to keep in mind that, first, most utilities have in general a 2-3 years hedging policy, so the increase in prices will take time before being fully reflected in the results, while the risk of seeing a correction in carbon prices shouldn’t be disregarded as many doubt that carbon is currently in a bubble. Carbon rights prices indeed tumbled of late and so did spot power prices (first chart).

The last few hours’ news that a major electricity contract trader went belly-up in Norway, nearly taking down the market with it, is also a healthy reminder that sharp price rises may have thin foundations.

There is no doubt that cutting back on coal-based generation does help baseload prices but the carbon rights catalyst may be short-lived.

Learn more on Utilities sector research by AlphaValue : click here

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...