Global warming is rentokil's best friend

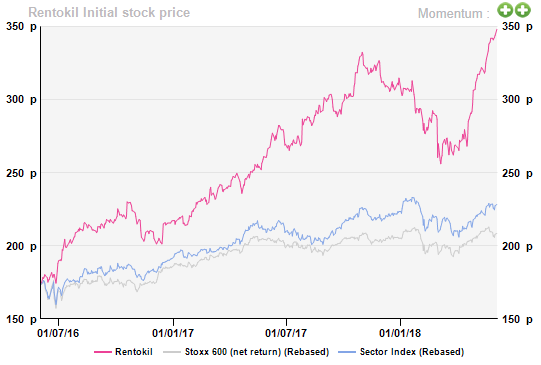

Rentokil's 2017 strong momentum – led by its strong pest control business (contributes c.68% of the group's profit), disposal of the ailing workwear business, increased focus on attractive Asian markets, and the spurt in M&A activity – fizzled out eventually when its core businesses started to lose steam.

The rat killer zoomed backed to life-time highs (up c.36% in the past two months) on the back of strong Q1 18 results and a reassuring analysts day.

No doubt Rentokil is a growth stock with an attractive long-term opportunity; we recommend buying the dips as valuation looks dear for short-term investment.

As we are hard pressed to back the share with traditional valuation metrics, the conclusion is that buying into dips requires keeping an eye and good nerves.

North America still the key

North America (contributes 34% of the group’s operating profit vs 21% in 2015) should continue to propel Rentokil’s growth engine in the near/mid-term.

The company (ranked third with a c.9% market share behind Terminix: 17% and Rollins: 17%) has gained significant ground by tapping the underpenetrated pest control business through aggressive bolt-on acquisitions.

The resultant improvement in route density should nudge profitability in the region, which has been a drag for the entity. The company looks well positioned to make quick inroads in the world’s largest pest control market (represents 50% of the global $18bn bazaar, with expected 5% CAGR through to 2023).

No wonder management has gone out with all guns blazing to exploit the fragmented market opportunity (acquired nine companies in 2017, which is almost twice the pace vs market leaders Terminix and Rollins). We estimate North America’s contribution to the group's profit will increase further to c.45-50% by 2020.

Other businesses are second fiddle

While the other core segment, hygiene (c.21% of the group's profit), should continue to play a supportive/complementary role, the French workwear business would serve investors better through a disposal.

As market leader Elis continues to dominate the country through superior scale and profitability, management needs to act fast to plug the erosion.

Even the current 18% stake in Haniel JV (to which Rentokil sold the majority of its European workwear business in late 2016) is likely to be sold with proceeds redeployed in greener pastures (probably for pest control expansion in emerging countries). We unequivocally agree with company’s strategy to focus on rodents and pests in the long term.

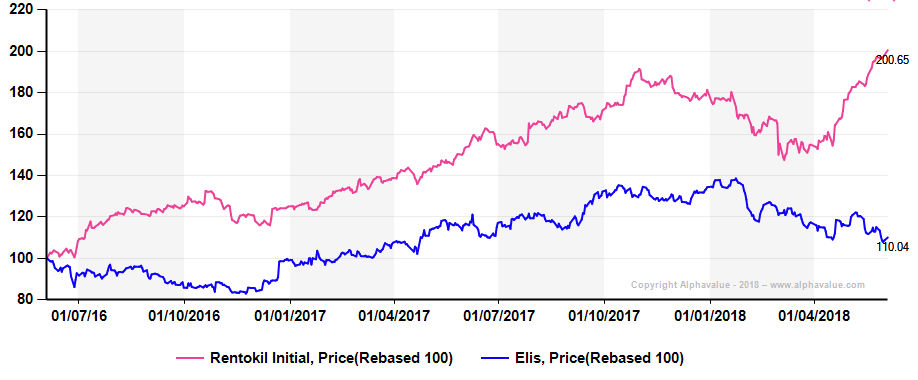

Interestingly, the Elis-type business is less attractive to market eyes from earlier this year as shown by the divergence between Elis (€4bn market cap) and Rentokil (£6.4bn mkt cap).

Rentokil diverges

North America still the key

North America (contributes 34% of the group’s operating profit vs 21% in 2015) should continue to propel Rentokil’s growth engine in the near/mid-term.

The company (ranked third with a c.9% market share behind Terminix: 17% and Rollins: 17%) has gained significant ground by tapping the underpenetrated pest control business through aggressive bolt-on acquisitions.

The resultant improvement in route density should nudge profitability in the region, which has been a drag for the entity. The company looks well positioned to make quick inroads in the world’s largest pest control market (represents 50% of the global $18bn bazaar, with expected 5% CAGR through to 2023).

No wonder management has gone out with all guns blazing to exploit the fragmented market opportunity (acquired nine companies in 2017, which is almost twice the pace vs market leaders Terminix and Rollins). We estimate North America’s contribution to the group's profit will increase further to c.45-50% by 2020.

Other businesses are second fiddle

While the other core segment, hygiene (c.21% of the group's profit), should continue to play a supportive/complementary role, the French workwear business would serve investors better through a disposal.

As market leader Elis continues to dominate the country through superior scale and profitability, management needs to act fast to plug the erosion.

Even the current 18% stake in Haniel JV (to which Rentokil sold the majority of its European workwear business in late 2016) is likely to be sold with proceeds redeployed in greener pastures (probably for pest control expansion in emerging countries). We unequivocally agree with company’s strategy to focus on rodents and pests in the long term.

Interestingly, the Elis-type business is less attractive to market eyes from earlier this year as shown by the divergence between Elis (€4bn market cap) and Rentokil (£6.4bn mkt cap).

Rentokil diverges

Betting big on Emerging countries

Although the Asian opportunity is here to stay, Rentokil’s strategy to capitalise on early-mover advantage (especially India and China) should propel the growth in out-years. This pest control market is worth c.$2.5bn and is estimated to clock an 8% CAGR over the next five years.

Management’s plan to build a $300m pest business in Asia by 2022 (equivalent to a c.10% CAGR) looks reasonable given Rentokil’s leading market position and robust growth potential in India and China – on the back of untapped market, high population/rising middle class, warm/humid weather conditions and growing hygiene awareness. Therefore, Rentokil’s recent acquisition of PCI in India is one of the key steps to consolidate footprint in the region.

Even Brazil might be a lucrative proposition to underpin mid/long-term growth. The national government is contemplating to outsource its pest control activities, which is worth a $1bn according to Rentokil.

Notably, the Brazilian government employs a huge task force (c.97k full-time employees; which is straining its already weak fiscal position) but is still unable to curtail the spread of diseases like dengue (c.1.5m cases reported each year). Although management expects the initial cash inflow around 18 months from now, we take a more conservative view considering the ongoing economic turmoil / upcoming elections in the country.

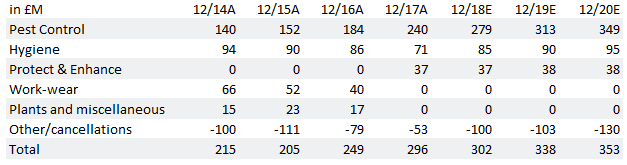

Divisional EBITs include widening “others”

Betting big on Emerging countries

Although the Asian opportunity is here to stay, Rentokil’s strategy to capitalise on early-mover advantage (especially India and China) should propel the growth in out-years. This pest control market is worth c.$2.5bn and is estimated to clock an 8% CAGR over the next five years.

Management’s plan to build a $300m pest business in Asia by 2022 (equivalent to a c.10% CAGR) looks reasonable given Rentokil’s leading market position and robust growth potential in India and China – on the back of untapped market, high population/rising middle class, warm/humid weather conditions and growing hygiene awareness. Therefore, Rentokil’s recent acquisition of PCI in India is one of the key steps to consolidate footprint in the region.

Even Brazil might be a lucrative proposition to underpin mid/long-term growth. The national government is contemplating to outsource its pest control activities, which is worth a $1bn according to Rentokil.

Notably, the Brazilian government employs a huge task force (c.97k full-time employees; which is straining its already weak fiscal position) but is still unable to curtail the spread of diseases like dengue (c.1.5m cases reported each year). Although management expects the initial cash inflow around 18 months from now, we take a more conservative view considering the ongoing economic turmoil / upcoming elections in the country.

Divisional EBITs include widening “others”

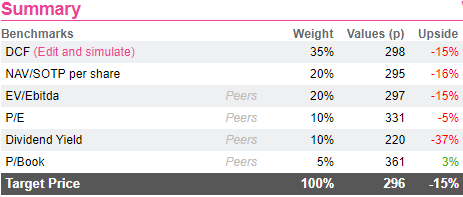

Unique business at luxury multiples

The underlying business is as unique as it is promising. But at what price! The stock looks overvalued on all valuation metrics except P/B. Our DCF factors in 4% and 4.5% revenue and EBITDA growth in the out-years, complemented with a better control on capital expenditure.

Our NAV makes a sell case despite margin recovery in forecast years. On a relative basis, the stock trades at a forward P/E and EV/EBITDA of 26.5x and 13x (vs historical average: 16.3x and 7.8x, respectively), a clear indication to wait for the right entry point.

Unique business at luxury multiples

The underlying business is as unique as it is promising. But at what price! The stock looks overvalued on all valuation metrics except P/B. Our DCF factors in 4% and 4.5% revenue and EBITDA growth in the out-years, complemented with a better control on capital expenditure.

Our NAV makes a sell case despite margin recovery in forecast years. On a relative basis, the stock trades at a forward P/E and EV/EBITDA of 26.5x and 13x (vs historical average: 16.3x and 7.8x, respectively), a clear indication to wait for the right entry point.

Full study available on our research platform : www.alphavalue.com

Full study available on our research platform : www.alphavalue.com

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...