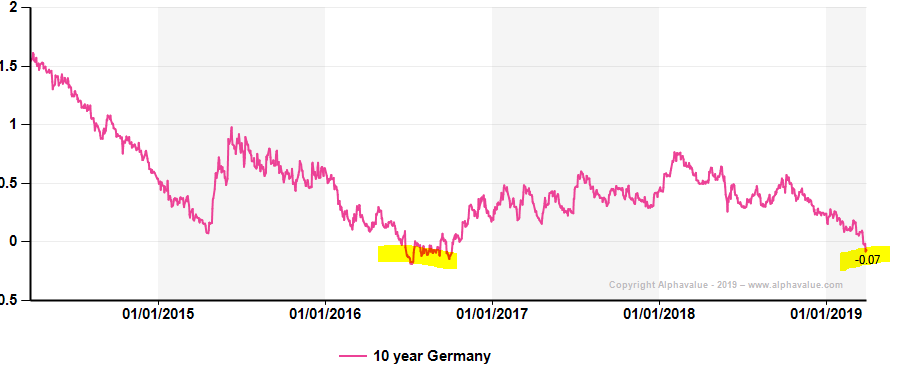

High gearing in negative rate context

More than two years ago when the 10y Bund had plunged below zero signalling deflation fears, we looked at the behaviour of highly geared corporates to conclude that extra cheap money for sovereign borrowers did not provide oxygen to corporates, all the reverse. The underlying prospect of deflation means that lenders incur higher risks of not seeing their money back and shareholders are mechanically in an even worse position.

Ergo, Wacc goes up through higher spreads and required equity risk premium, in effect nullifying the gains on the risk-free component of the equation.

10y Bund says: fear

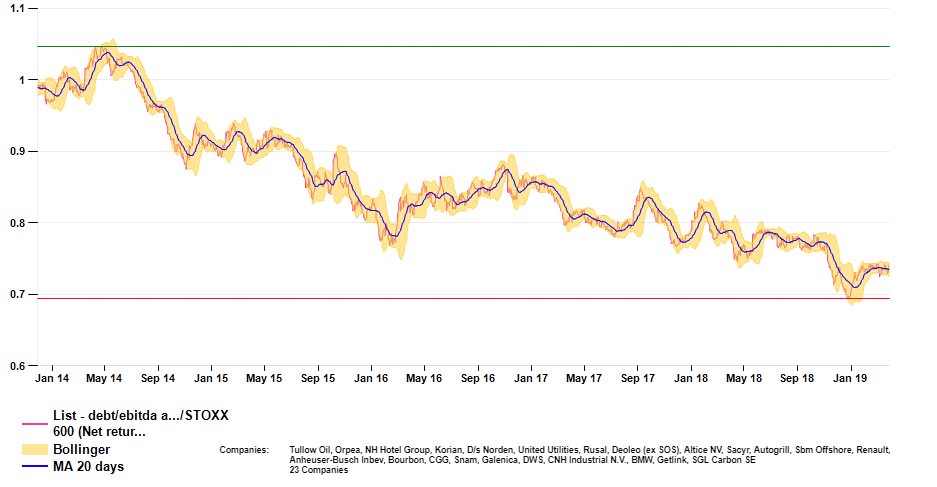

We looked at stocks that suffered back in 2016 from a weak balance sheet as measured by an adjusted net debt/EBITDA of 5x or more. Their combined equal weighted performance has been a steady relative decline (see following chart) whether rates pick up or not (above). So the message is clear: shareholders see little benefit from easier financial conditions when companies are stretched and presumably in slow-going businesses. The rebound of ABI cannot hide worries elsewhere.

Relative performance of 23 companies with a net debt/EBITDA above 5x in 2016

We looked at stocks that suffered back in 2016 from a weak balance sheet as measured by an adjusted net debt/EBITDA of 5x or more. Their combined equal weighted performance has been a steady relative decline (see following chart) whether rates pick up or not (above). So the message is clear: shareholders see little benefit from easier financial conditions when companies are stretched and presumably in slow-going businesses. The rebound of ABI cannot hide worries elsewhere.

Relative performance of 23 companies with a net debt/EBITDA above 5x in 2016

In other words, a highly-geared company is better off with higher rates and a degree of inflation as a way to maximise the odds of paying back its lenders.

It is interesting as well to mention that the average net debt/EBITDA ratio which stood at 6.04x back in 2016 now stands at 5x. 2017 and 2018 top line growth (7% and 4% median, respectively) could not hurt. Lower gearing is good to have but this highlights a slow progress with EBITDA up only 10% over the period (note that net debt and EBITDA are adjusted for pension under-provisioning and leases). Dividends would have progressed had it not been for ABI slashing its own.

In short, it takes a great leap of faith to expose one’s wealth to the highly geared stories without a strong signal of accommodating GDP growth. By 2019, AlphaValue had 38 stocks with a net debt/EBITDA above 3x (excluding Property and Holding companies). List on request.

Subscribe to our blog

Alphavalue Morning Market Tip

Likely to be massively impacted by Lidl's decision to stop ads on French TV.

As contrarian born market participants, what would we buy into this quality universe with closed eye?