IAG unbeatable were it not for Brexit

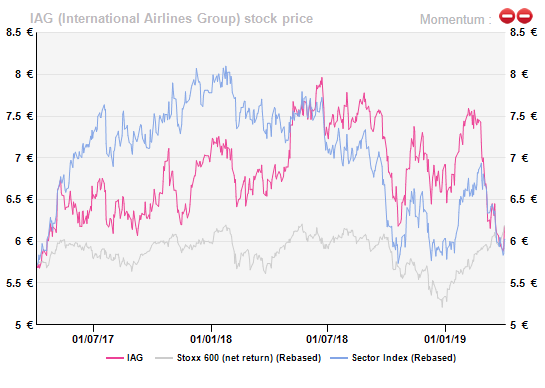

Although the best-in-class airline group has beaten cost inflation (both fuel and non-fuel costs) and the stiffer competition that resulted in lower fares, the lingering unsolved Brexit threat has kept a firm lid on the stock.

IAG has been extremely confident that a reasonable agreement on air traffic is bound to follow Brexit, whatever its final shape as this is “in every one’s best interest”. We are not so sure as the tone of the EC regulator suggests that the wait & see choice may be harmful eventually.

Above market expectation results in 2018

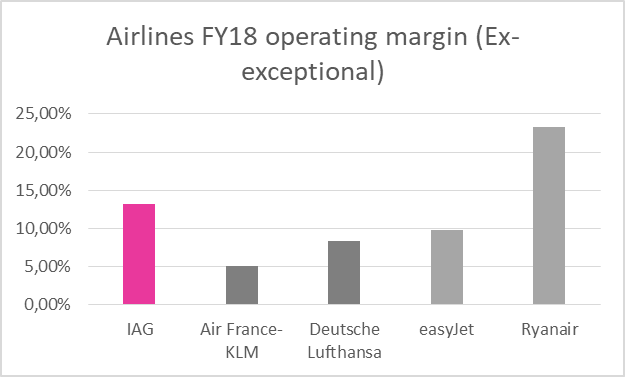

Despites the lower fares/higher cost market scenario in 2018, IAG has continued to outperform its peers (see the graph below). The FY18 operating result was up by 9.5% yoy to €3.2bn on the back of a 6.7% yoy increase in the top-line. IAG was the only major legacy airline group to report a higher operating margin than in 2017, mainly thanks to effective cost management (although the fuel cost per ASK was up 8%, the non-fuel cost per ASK has decreased by 2.2%, which resulted in a total cost per ASK rise of only 0.2%). It continued to benefit from the synergies of the combined Airlines.

Above market expectation results in 2018

Despites the lower fares/higher cost market scenario in 2018, IAG has continued to outperform its peers (see the graph below). The FY18 operating result was up by 9.5% yoy to €3.2bn on the back of a 6.7% yoy increase in the top-line. IAG was the only major legacy airline group to report a higher operating margin than in 2017, mainly thanks to effective cost management (although the fuel cost per ASK was up 8%, the non-fuel cost per ASK has decreased by 2.2%, which resulted in a total cost per ASK rise of only 0.2%). It continued to benefit from the synergies of the combined Airlines.

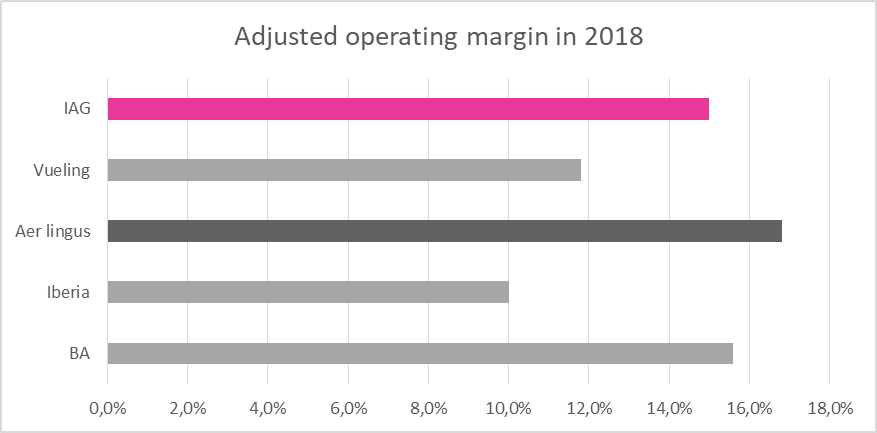

While BA and Vueling have been heavily affected by the worst European air traffic controllers disruption, Aer Lingus (operating mainly from its Dublin hub to and from the Americas) with its lower exposure to Europe has experienced a year of record operating performance. Aer Lingus’s lease adjusted operating margin reached 16.8%, becoming the most profitable airline within the group (see the graph below). In addition, LEVEL as the latest launch of IAG achieved satisfactory deployment for its first full year of operation. The brand is mainly focused on leisure customers and younger generations. It operates low-cost long-haul (from Barcelona and Paris to North and South America) and short-haul (launched in 2018, from Vienna). Development appears to have been demand driven. Importantly, contrary to Norwegian Air and recently collapsed Wow Air (as fares would not cover the increase in cost), LEVEL could leverage the scale and capacity of IAG to deliver quality products (both long-haul and short-haul) at the lowest possible cost (especially, high non-fuel unit cost saving). Low-cost long-haul looks a non-starter if there is no strong parent in the background.

IAG’s adjusted margins by Airline

While BA and Vueling have been heavily affected by the worst European air traffic controllers disruption, Aer Lingus (operating mainly from its Dublin hub to and from the Americas) with its lower exposure to Europe has experienced a year of record operating performance. Aer Lingus’s lease adjusted operating margin reached 16.8%, becoming the most profitable airline within the group (see the graph below). In addition, LEVEL as the latest launch of IAG achieved satisfactory deployment for its first full year of operation. The brand is mainly focused on leisure customers and younger generations. It operates low-cost long-haul (from Barcelona and Paris to North and South America) and short-haul (launched in 2018, from Vienna). Development appears to have been demand driven. Importantly, contrary to Norwegian Air and recently collapsed Wow Air (as fares would not cover the increase in cost), LEVEL could leverage the scale and capacity of IAG to deliver quality products (both long-haul and short-haul) at the lowest possible cost (especially, high non-fuel unit cost saving). Low-cost long-haul looks a non-starter if there is no strong parent in the background.

IAG’s adjusted margins by Airline

Another Brexit curse: post-Brexit uncertainty conducive of “unfair” pay revision

The uncertain post-Brexit economic condition and the purchasing power of UK travellers have led airlines to adopt a very cautious stance on costs. BA, the biggest earnings contributor, has been proposing a 12-month salary increase by inflation to its pilots instead of a new three-year salary package. The 12-month offer has been regarded as “unacceptable” by BA’s pilot unions. The European pilot shortage has given pilots more leverage, especially as BA’s pilots did take a pay cut during the financial crisis to help the company navigate a difficult economic downturn. The risk of industrial action is high. The recent Air France version of a similar issue cost it more than €355m, which is worth pondering.

Brexit curse - flying rights at risk

As already mentioned, the current European sky is regulated by two agreements: the ECAA and the EU-USA open skies agreement, which allow European companies to fly freely within the EU and to/from the USA. The UK signed new air services agreements with the USA and Canada in November 2018 to ensure that the trans-Atlantic flights will continue as normal after Brexit, but the EU/UK transport agreement is still hanging in doubt. Under the current Brexit discussions, the EU regulation requires that airlines show they are more than 50% owned and controlled by EU shareholders to keep their flying rights in the bloc.

On that account, there seems to be a “hope” factor in the analysis provided by IAG to the market, as it is clearly no longer European once its UK shareholders are no longer counted toward that definition. The trick would be for IAG, a Spanish company, to bring the percentage of post-Brexit EU shareholders above the required 50% by stripping UK owners and the Qatari ones from their voting rights. There are ways to do that but at what cost to the shareholding structure? A genuine loss of a voting rights needs to be compensated, but who will pay ? The EU-based shareholders for instance collecting extra voting rights? Would UK owners be compensated by a preferred dividend? What about the Qatari stake at 21% which adds to the issue.

IAG is expecting the withdrawal agreement to be ratified, which may give a temporary exemption from the ownership requirement until spring 2020. However, the proposal also clarified that the airline must present a credible plan to explain how they would conform to the EU ownership rule in a short period. Of note, the EU regulation will only give a two-week grace period after a no-deal Brexit to airlines to submit their plans, otherwise, their flying rights will be revoked.

One twist to the ownership story is to try and believe that IAG, the Spanish entity, is in some sort of a thought experiment, a transparent legal entity with the actual operations being at the Iberia and BA levels. It is fair to confirm that Iberia is “truly” Spanish when it comes to owning the flying regulated rights as the majority ownership of Iberia is Spanish via El Corte Ingles acting as a trust for 50% of the voting rights. A symmetrical set-up at the BA level settles the UK flying rights issue as well by means of a trust. If IAG is transparent for the purpose of controlling flying rights, then there is no issue with Brexit creating a new context. Whether this or other designs, the EC air transport authorities seem to be choking.

Valuation conundrum

Operationally, our fundamentals metrics still offer considerable upside potential, boosted by the resilient profitability and relatively low leverage level. As Brexit gets both closer and delayed, the invisible hand has in effect indicated that it was not as confident as IAG management when it comes to the Brexit negatives.

We certainly do not know how to discount a moving situation but do recognise that the legal set up of IAG raises questions while answers are dependent on the Brexit outcome. We dropped a €5bn negative impact in our DCF and NAV based valuations. It will be tweaked according to the Brexit winds.

To make the point, one other thought experiment is to envisage IAG as four independent operating companies as a result of Brexit/EU/flying regulations. What would then be the lost value of not collecting the much-vaunted synergies at the IAG parent company level. Good question.

Another Brexit curse: post-Brexit uncertainty conducive of “unfair” pay revision

The uncertain post-Brexit economic condition and the purchasing power of UK travellers have led airlines to adopt a very cautious stance on costs. BA, the biggest earnings contributor, has been proposing a 12-month salary increase by inflation to its pilots instead of a new three-year salary package. The 12-month offer has been regarded as “unacceptable” by BA’s pilot unions. The European pilot shortage has given pilots more leverage, especially as BA’s pilots did take a pay cut during the financial crisis to help the company navigate a difficult economic downturn. The risk of industrial action is high. The recent Air France version of a similar issue cost it more than €355m, which is worth pondering.

Brexit curse - flying rights at risk

As already mentioned, the current European sky is regulated by two agreements: the ECAA and the EU-USA open skies agreement, which allow European companies to fly freely within the EU and to/from the USA. The UK signed new air services agreements with the USA and Canada in November 2018 to ensure that the trans-Atlantic flights will continue as normal after Brexit, but the EU/UK transport agreement is still hanging in doubt. Under the current Brexit discussions, the EU regulation requires that airlines show they are more than 50% owned and controlled by EU shareholders to keep their flying rights in the bloc.

On that account, there seems to be a “hope” factor in the analysis provided by IAG to the market, as it is clearly no longer European once its UK shareholders are no longer counted toward that definition. The trick would be for IAG, a Spanish company, to bring the percentage of post-Brexit EU shareholders above the required 50% by stripping UK owners and the Qatari ones from their voting rights. There are ways to do that but at what cost to the shareholding structure? A genuine loss of a voting rights needs to be compensated, but who will pay ? The EU-based shareholders for instance collecting extra voting rights? Would UK owners be compensated by a preferred dividend? What about the Qatari stake at 21% which adds to the issue.

IAG is expecting the withdrawal agreement to be ratified, which may give a temporary exemption from the ownership requirement until spring 2020. However, the proposal also clarified that the airline must present a credible plan to explain how they would conform to the EU ownership rule in a short period. Of note, the EU regulation will only give a two-week grace period after a no-deal Brexit to airlines to submit their plans, otherwise, their flying rights will be revoked.

One twist to the ownership story is to try and believe that IAG, the Spanish entity, is in some sort of a thought experiment, a transparent legal entity with the actual operations being at the Iberia and BA levels. It is fair to confirm that Iberia is “truly” Spanish when it comes to owning the flying regulated rights as the majority ownership of Iberia is Spanish via El Corte Ingles acting as a trust for 50% of the voting rights. A symmetrical set-up at the BA level settles the UK flying rights issue as well by means of a trust. If IAG is transparent for the purpose of controlling flying rights, then there is no issue with Brexit creating a new context. Whether this or other designs, the EC air transport authorities seem to be choking.

Valuation conundrum

Operationally, our fundamentals metrics still offer considerable upside potential, boosted by the resilient profitability and relatively low leverage level. As Brexit gets both closer and delayed, the invisible hand has in effect indicated that it was not as confident as IAG management when it comes to the Brexit negatives.

We certainly do not know how to discount a moving situation but do recognise that the legal set up of IAG raises questions while answers are dependent on the Brexit outcome. We dropped a €5bn negative impact in our DCF and NAV based valuations. It will be tweaked according to the Brexit winds.

To make the point, one other thought experiment is to envisage IAG as four independent operating companies as a result of Brexit/EU/flying regulations. What would then be the lost value of not collecting the much-vaunted synergies at the IAG parent company level. Good question.

Subscribe to our blog

Alphavalue Morning Market Tip

Likely to be massively impacted by Lidl's decision to stop ads on French TV.

As contrarian born market participants, what would we buy into this quality universe with closed eye?