Kering Loses the Luxury Plot

Kering, the luxury goods conglomerate, has struggled with the performance of its flagship brand Gucci due to pandemic-related issues and a lack of brand momentum. The company has announced a plan to reorganize and revitalize the brand with a new creative director and a focus on strengthening fundamentals and leadership in the fashion industry. While Kering's other brands, including Saint Laurent, Bottega Veneta, and Balenciaga, continue to perform well, the ongoing wholesale rationalization and transition period for Gucci may widen the sales performance gap between Kering and its industry rivals.

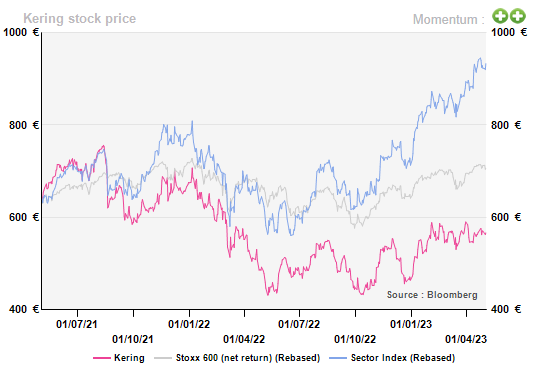

Strong top-line growth and record margins have turned the luxury sector into one of the most sought-after in the post-pandemic era. In particular, expectations of a rebound in the Chinese market after a year’s dearth of consumption have made Consumer Durables the best-performing sector in the European STOXX600. Hermès (36.7% YTD), followed by L’Oréal (30% YTD) and LVMH (29.8% YTD), which together led the CAC40 index to an all-time high.

However, as a member of the ‘Khol’ quatuor, Kering has lost the plot since Spring 2020. Key to Kering, Gucci (52% of total sales/67% of operating profit) was first affected by its larger exposure to tourism during the pandemic then suffered from the uncertainty associated with the need to have new collections and from its dependence on Chinese consumers. The brand has been struggling to return to its peak margin in 2019 and revitalize its brand heat.

Kering Stock Price Performance

Gucci is in transition

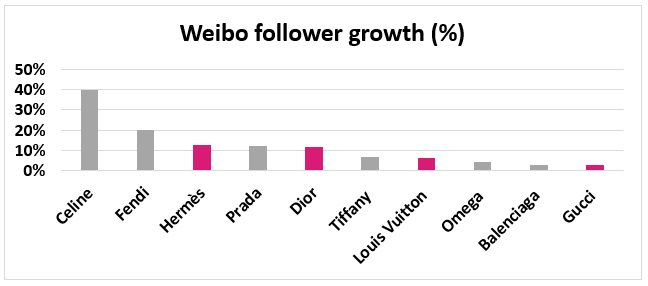

We didn’t expect the Aria collection to be the farewell show for Alessandro Michele (Gucci designer who left in Nov. 2022), but we did expect the lingering COVID-related restrictions in China last year to have significantly weighed on the brand’s performance. More importantly, we noticed that the brand had lost popularity on social media, especially in China, since last summer. As the chart below shows, from last summer to April 2023, the growth in the number of followers on Chinese Weibo for Gucci has lagged that of its industry rivals.

Gucci's greater exposure to younger customers and newness has resulted in greater earnings volatility. In recent years, Gucci has focused on the product rather than storytelling. High quality and craftsmanship are the basic expectations of luxury consumers rather than the decisive factors. The attitude of the brand, the culture and the community it represents are the main pulls of a luxury brand.

The rapid loss of brand momentum has prompted Kering's CEO to announce a plan to bring a "change of pace" at Gucci. The plan includes the appointment of a new creative director and the reorganization of the key management teams, which will strengthen the brand's fundamentals and leadership in fashion while ‘capitalizing on its rich heritage’.

In January the group announced that Italian designer Sabato De Sarno will take over as creative director of Gucci. He will present his first collection for Gucci at Milan Women's Fashion Week in September 2023, with the collection expected to arrive in shops by 2024. While we believe that the arrival of a new creative director and a series of strategic reorganizations for the brand, particularly in the Chinese market, will open a new chapter for Gucci, one cannot be but in wait-and-see mode as to whether the new collections/changes bear fruit and revive the brand's popularity.

This week, Gucci reported lower than expected results for Q1 23 confirming a transition period for the brand. The group said that Gucci had made encouraging progress sequentially but added that it viewed the reorganization of the Gucci brand "as a journey, not a race".

Short-term pain for long-term gain

Scarcity and experience are the main characteristics of luxury products. All luxury groups have tried to reduce the wholesale channel and increase the share of retail sales to reinforce the exclusivity and rareness of their brands.

Kering’s other brands still have relatively larger wholesale exposure. Gucci is the exception as it was the first to complete its wholesale rationalization (91% of sales come from retail channel). Wholesale still accounted for 24% of the group’s total sales at the end of March 2023 (24% of Saint Laurent/20% of Bottega Veneta/33% of Other Houses). The group aims to achieve around 85% of its sales through the retail network by the end of the year, which means that the ongoing wholesale rationalization will continue to result in double-digit contractions in wholesale sales for the rest of the year ( -10% for BV and -15%-20% for YSL and Balenciaga).

Since the end of 2020, Saint Laurent has maintained strong momentum in terms of top-line growth and margin expansion, and Bottega Veneta and Balenciaga are also standing at the doorstep of new growth trajectories. We thus believe the more exclusive distribution network will provide them a better track for upscaling going forward.

Normalization in the US

The group has experienced a softer start to the year in North America due to an ongoing lack of aspirational customers and tougher comparisons in the US. The group said that the uncertain macroenvironment in the US may shift the allocation of wallet among aspirational customers.

American shoppers have been the main driver for the luxury industry for more than 24 months. The end of the post-pandemic effect (build-up of savings, self-reward spending, stimulus cheques, etc.) and the normalization of the macroeconomic environment (US growth slowed sharply in first quarter) have weighed on the growth of luxury consumption in the country. Unlike Hermès, which will be protected by its exclusive wealthy customer base and its endless waiting list, the demand for entry price points products from the group’s brands will be under pressure.

Transition priced

The transition period at Gucci, the ongoing wholesale rationalization and the continued brand elevation of Bottega Veneta may continue to widen the sales performance gap between Kering and its industry rivals.

However, as a member of the ‘Khol’ quatuor, Kering has lost the plot since Spring 2020. Key to Kering, Gucci (52% of total sales/67% of operating profit) was first affected by its larger exposure to tourism during the pandemic then suffered from the uncertainty associated with the need to have new collections and from its dependence on Chinese consumers. The brand has been struggling to return to its peak margin in 2019 and revitalize its brand heat.

Kering Stock Price Performance

Gucci is in transition

We didn’t expect the Aria collection to be the farewell show for Alessandro Michele (Gucci designer who left in Nov. 2022), but we did expect the lingering COVID-related restrictions in China last year to have significantly weighed on the brand’s performance. More importantly, we noticed that the brand had lost popularity on social media, especially in China, since last summer. As the chart below shows, from last summer to April 2023, the growth in the number of followers on Chinese Weibo for Gucci has lagged that of its industry rivals.

Gucci's greater exposure to younger customers and newness has resulted in greater earnings volatility. In recent years, Gucci has focused on the product rather than storytelling. High quality and craftsmanship are the basic expectations of luxury consumers rather than the decisive factors. The attitude of the brand, the culture and the community it represents are the main pulls of a luxury brand.

The rapid loss of brand momentum has prompted Kering's CEO to announce a plan to bring a "change of pace" at Gucci. The plan includes the appointment of a new creative director and the reorganization of the key management teams, which will strengthen the brand's fundamentals and leadership in fashion while ‘capitalizing on its rich heritage’.

In January the group announced that Italian designer Sabato De Sarno will take over as creative director of Gucci. He will present his first collection for Gucci at Milan Women's Fashion Week in September 2023, with the collection expected to arrive in shops by 2024. While we believe that the arrival of a new creative director and a series of strategic reorganizations for the brand, particularly in the Chinese market, will open a new chapter for Gucci, one cannot be but in wait-and-see mode as to whether the new collections/changes bear fruit and revive the brand's popularity.

This week, Gucci reported lower than expected results for Q1 23 confirming a transition period for the brand. The group said that Gucci had made encouraging progress sequentially but added that it viewed the reorganization of the Gucci brand "as a journey, not a race".

Short-term pain for long-term gain

Scarcity and experience are the main characteristics of luxury products. All luxury groups have tried to reduce the wholesale channel and increase the share of retail sales to reinforce the exclusivity and rareness of their brands.

Kering’s other brands still have relatively larger wholesale exposure. Gucci is the exception as it was the first to complete its wholesale rationalization (91% of sales come from retail channel). Wholesale still accounted for 24% of the group’s total sales at the end of March 2023 (24% of Saint Laurent/20% of Bottega Veneta/33% of Other Houses). The group aims to achieve around 85% of its sales through the retail network by the end of the year, which means that the ongoing wholesale rationalization will continue to result in double-digit contractions in wholesale sales for the rest of the year ( -10% for BV and -15%-20% for YSL and Balenciaga).

Since the end of 2020, Saint Laurent has maintained strong momentum in terms of top-line growth and margin expansion, and Bottega Veneta and Balenciaga are also standing at the doorstep of new growth trajectories. We thus believe the more exclusive distribution network will provide them a better track for upscaling going forward.

Normalization in the US

The group has experienced a softer start to the year in North America due to an ongoing lack of aspirational customers and tougher comparisons in the US. The group said that the uncertain macroenvironment in the US may shift the allocation of wallet among aspirational customers.

American shoppers have been the main driver for the luxury industry for more than 24 months. The end of the post-pandemic effect (build-up of savings, self-reward spending, stimulus cheques, etc.) and the normalization of the macroeconomic environment (US growth slowed sharply in first quarter) have weighed on the growth of luxury consumption in the country. Unlike Hermès, which will be protected by its exclusive wealthy customer base and its endless waiting list, the demand for entry price points products from the group’s brands will be under pressure.

Transition priced

The transition period at Gucci, the ongoing wholesale rationalization and the continued brand elevation of Bottega Veneta may continue to widen the sales performance gap between Kering and its industry rivals.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...