Last Word for 2023 from AlphaValue

As an independent (mostly) equity research house, AlphaValue is figures based, with proprietary data discipline at the core of its researching efforts. Month after month over 2023, those disciplined earnings forecasts have looked up when the instinct was that the reverse would have been correct.

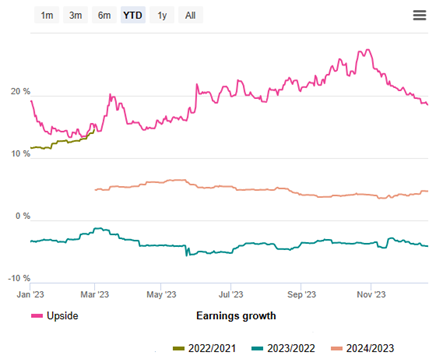

While investment themes came and went, rarely lasting more than a few weeks, the end result of such fast-changing markets is that the Stoxx600 could well close 15% up AND the upside potential remains a solid 20%. That has never been seen over the last 15 years as 20% + upsides are a by-product of a market correction. This 20% upside potential stems from that very figure-based bottom up researching effort as opposed to a simplistic top-down regression line.

2023 was strange, courtesy of the Fed facing forever hopeful markets. 2024 starts on a strange footing too with this 20% upside based on earnings that would be, for the fourth year in a row, 50% above their pre Covid run rate.

Substantial upside potential (in pink) left as earnings growth sticks

Perplexity dominates. It dominates not only because the risk-taking mode at the close of 2023 is self-propelled but also because the 2024 earnings resilience is based on sectors for which few investors are willing to take a substantial punt: Banks, Autos, Oils and Mines. So that buyers into a rosy 2024 at a PE nominally below 14x are effectively already paying 17x ex those mentioned sectors. Only a month ago we were of the view that markets were reasonably priced with some doubts about their earnings resilience. We are now less sure.

What to track in 2024?

Beyond the endless list of what goes wrong and may go worse (but is likely discounted; say Ukraine Russia, Property in China, consumers relenting etc) we would venture the following interesting items:

- The bloody Sino Chinese competition between Temu and Shein bringing down deflation benefits to the rest of the world at a huge cost to them and their western competitors. (Walmart, Amazon, Zalando, … Tesco et al.)

- The first signs of similar deflationary effect of AI gaining ground in knowledge based services.

- The fast erosion of EV prices under the pressure of curtailed subsidies as European governments cannot balance their books.

- The lasting travails of renewable energy economics, still too reliant on government assistance. Add a healthy dose of doubts about the H2 version ever breaking even on its own.

- The strong possibility that weather-related events shall be worsening fast at a considerable cost to developing countries as well as to insurers in developed ones.

While investment themes came and went, rarely lasting more than a few weeks, the end result of such fast-changing markets is that the Stoxx600 could well close 15% up AND the upside potential remains a solid 20%. That has never been seen over the last 15 years as 20% + upsides are a by-product of a market correction. This 20% upside potential stems from that very figure-based bottom up researching effort as opposed to a simplistic top-down regression line.

2023 was strange, courtesy of the Fed facing forever hopeful markets. 2024 starts on a strange footing too with this 20% upside based on earnings that would be, for the fourth year in a row, 50% above their pre Covid run rate.

Substantial upside potential (in pink) left as earnings growth sticks

Perplexity dominates. It dominates not only because the risk-taking mode at the close of 2023 is self-propelled but also because the 2024 earnings resilience is based on sectors for which few investors are willing to take a substantial punt: Banks, Autos, Oils and Mines. So that buyers into a rosy 2024 at a PE nominally below 14x are effectively already paying 17x ex those mentioned sectors. Only a month ago we were of the view that markets were reasonably priced with some doubts about their earnings resilience. We are now less sure.

What to track in 2024?

Beyond the endless list of what goes wrong and may go worse (but is likely discounted; say Ukraine Russia, Property in China, consumers relenting etc) we would venture the following interesting items:

- The bloody Sino Chinese competition between Temu and Shein bringing down deflation benefits to the rest of the world at a huge cost to them and their western competitors. (Walmart, Amazon, Zalando, … Tesco et al.)

- The first signs of similar deflationary effect of AI gaining ground in knowledge based services.

- The fast erosion of EV prices under the pressure of curtailed subsidies as European governments cannot balance their books.

- The lasting travails of renewable energy economics, still too reliant on government assistance. Add a healthy dose of doubts about the H2 version ever breaking even on its own.

- The strong possibility that weather-related events shall be worsening fast at a considerable cost to developing countries as well as to insurers in developed ones.

Subscribe to our blog

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...