L'Oréal: Market Outperformer

The better-than-expected top-line lfl growth of 8.1% led the group to end the year with total revenue of €38.26bn (10.9% lfl).

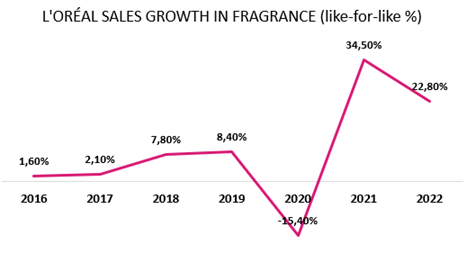

All divisions and product categories recorded better-than-expected growth despite the fact that L’Oréal luxe was significantly impacted by the COVID-related disruption in China. Benefiting from the booming Asian fragrance market and advanced omnichannel distributions in Haircare, the Fragrance and haircare businesses continued to lead the growth, increasing by 22.8% lfl and by 12% lfl, respectively. Skincare continued to be the largest contributor with sales up by 10% lfl, accounting for 40% of total group sales. Makeup continued to recover from COVID-19, with sales up 9.2% lfl (20% of total sales), driven by normalized social life and innovations.

All geographies experienced double-digit lfl growth except for North Asia. The beauty market in China was inevitably affected by the COVID-related disruption.

E-commerce sales accounted for 28% of total sales at the end of FY22

The gross profit for FY22 came in at €27.7bn, reflecting a gross margin of 72.4% (vs. 73.9% for FY21)

Research & Innovation expenses increased by 10% and contributed 3% of total sales.

Marketing expenses were reduced by 130bps, accounting for 31.5% of sales.

The operating profit grew by 21% yoy to €7.5bn, reflecting an operating margin of 19.5% (vs. 19.1% for FY21)

Outlook

Th group is confident that it can continue to outperform the market and achieve another year of growth in sales and profits in 2023.

Analysis

A promising fragrance market

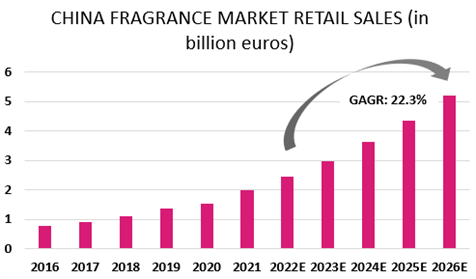

As expected, the fragrance market continued to gain pace driven by the promising Eastern fragrance market. Sales jumped by 23% lfl to €4.5bn for FY22, accounting for 12% of the group’s total revenue.

In the post-pandemic world, the return to social life and willingness to self-reward have significantly accelerated the growth of the fragrance business. The daily usage of fragrance increased by 10 points in the US between 2017 and 2021, and advanced from 40 to 52 in China. Over half of Chinese luxury consumers use fragrance every day (fragrance is often seen as an affordable luxury).

The Chinese fragrance market has a penetration rate of around 5%, which leaves a very large gap with the European and American markets and allows a lot of room for development. The lack of a fragrance culture (due to differences in perspiration) had previously led to fragrances being considered unnecessary luxury goods for Chinese people.

However, this has changed with the expansion of the upper-middle classes and rising standards of living. Perfume is now becoming an everyday necessity and a third of perfume consumers have turned collecting perfume into their daily hobby. The Chinese fragrance market is largely driven by the high-end fragrance market, which is remains dominated by the international brands.

With over 20% of the global luxury fragrance market and a long-standing leadership position in China, L’Oréal has a best-in-class fragrance portfolio including YSL, Prada and Valentino. The group is well placed to benefit from the buoyant Chinese fragrance market.

Advanced omnichannel development

L’Oréal demonstrated a strong resilience with positive growth of 5.5% lfl in China in FY22 compared to the market decline of 6% lfl. The group has continued to benefit from its greater online penetration in China (>50%) and solid leadership in the skincare market.

L’Oréal was once again the biggest winner in the Tmall double eleven shopping festival in 2022 despite the COVID-driven challenging trading conditions. Four brands in the Top-10 skincare rankings came from the L’Oréal group with L’Oréal Paris reigning at the top of the list and Lancôme in second place. Half of the top 10 makeup rankings were from the L’Oréal group, with the top three brands all coming from the group.

The greater penetration in the Chinese e-commerce market and advanced omnichannel development should enable the group to better benefit from the recovery in the Chinese market.

Better balanced operating expenses

The war in Ukraine and the lingering COVID-related disruption in China led to higher raw material prices and logistics costs, which inevitably impacted the group’s gross margin. The group accelerated its product innovation with R&I expenses increased by 10%.

The more disciplined expenses in marketing and SG&A offset the higher input costs and R&I expenses, seeing the operating margin advance 40bps from FY21.

The better-than-expected margin generation under the tougher operating environment in FY22 showed the better flexibility and balance of the group’s cost structure.

Impact

L’Oréal’s strong resilience within a very challenging trading environment, especially following disappointing reports from its peers, again confirms its leadership in the beauty market and the strength of its advanced omnichannel development.

More importantly, the low penetration of the fragrance market in China means that the scope for improvement and the pace of growth will remain very promising in the coming years.

All divisions and product categories recorded better-than-expected growth despite the fact that L’Oréal luxe was significantly impacted by the COVID-related disruption in China. Benefiting from the booming Asian fragrance market and advanced omnichannel distributions in Haircare, the Fragrance and haircare businesses continued to lead the growth, increasing by 22.8% lfl and by 12% lfl, respectively. Skincare continued to be the largest contributor with sales up by 10% lfl, accounting for 40% of total group sales. Makeup continued to recover from COVID-19, with sales up 9.2% lfl (20% of total sales), driven by normalized social life and innovations.

All geographies experienced double-digit lfl growth except for North Asia. The beauty market in China was inevitably affected by the COVID-related disruption.

E-commerce sales accounted for 28% of total sales at the end of FY22

The gross profit for FY22 came in at €27.7bn, reflecting a gross margin of 72.4% (vs. 73.9% for FY21)

Research & Innovation expenses increased by 10% and contributed 3% of total sales.

Marketing expenses were reduced by 130bps, accounting for 31.5% of sales.

The operating profit grew by 21% yoy to €7.5bn, reflecting an operating margin of 19.5% (vs. 19.1% for FY21)

Outlook

Th group is confident that it can continue to outperform the market and achieve another year of growth in sales and profits in 2023.

Analysis

A promising fragrance market

As expected, the fragrance market continued to gain pace driven by the promising Eastern fragrance market. Sales jumped by 23% lfl to €4.5bn for FY22, accounting for 12% of the group’s total revenue.

In the post-pandemic world, the return to social life and willingness to self-reward have significantly accelerated the growth of the fragrance business. The daily usage of fragrance increased by 10 points in the US between 2017 and 2021, and advanced from 40 to 52 in China. Over half of Chinese luxury consumers use fragrance every day (fragrance is often seen as an affordable luxury).

The Chinese fragrance market has a penetration rate of around 5%, which leaves a very large gap with the European and American markets and allows a lot of room for development. The lack of a fragrance culture (due to differences in perspiration) had previously led to fragrances being considered unnecessary luxury goods for Chinese people.

However, this has changed with the expansion of the upper-middle classes and rising standards of living. Perfume is now becoming an everyday necessity and a third of perfume consumers have turned collecting perfume into their daily hobby. The Chinese fragrance market is largely driven by the high-end fragrance market, which is remains dominated by the international brands.

With over 20% of the global luxury fragrance market and a long-standing leadership position in China, L’Oréal has a best-in-class fragrance portfolio including YSL, Prada and Valentino. The group is well placed to benefit from the buoyant Chinese fragrance market.

Advanced omnichannel development

L’Oréal demonstrated a strong resilience with positive growth of 5.5% lfl in China in FY22 compared to the market decline of 6% lfl. The group has continued to benefit from its greater online penetration in China (>50%) and solid leadership in the skincare market.

L’Oréal was once again the biggest winner in the Tmall double eleven shopping festival in 2022 despite the COVID-driven challenging trading conditions. Four brands in the Top-10 skincare rankings came from the L’Oréal group with L’Oréal Paris reigning at the top of the list and Lancôme in second place. Half of the top 10 makeup rankings were from the L’Oréal group, with the top three brands all coming from the group.

The greater penetration in the Chinese e-commerce market and advanced omnichannel development should enable the group to better benefit from the recovery in the Chinese market.

Better balanced operating expenses

The war in Ukraine and the lingering COVID-related disruption in China led to higher raw material prices and logistics costs, which inevitably impacted the group’s gross margin. The group accelerated its product innovation with R&I expenses increased by 10%.

The more disciplined expenses in marketing and SG&A offset the higher input costs and R&I expenses, seeing the operating margin advance 40bps from FY21.

The better-than-expected margin generation under the tougher operating environment in FY22 showed the better flexibility and balance of the group’s cost structure.

Impact

L’Oréal’s strong resilience within a very challenging trading environment, especially following disappointing reports from its peers, again confirms its leadership in the beauty market and the strength of its advanced omnichannel development.

More importantly, the low penetration of the fragrance market in China means that the scope for improvement and the pace of growth will remain very promising in the coming years.

Subscribe to our blog

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...