Luxury Nervousness Matched to EV/SALES

Over the week to 7-07, the Luxury sector lost close to 5% with a mid-week drop of above 6%. The sector has recovered a bit since but this is a lot of volatility for a sector worth nearly €800bn, with about half stemming from LVMH.

The sector has been discussed by pundits for ages about whether such mega valuations are a case of outright luck (Chinese demand), excellent management (fair), a megatrend (more ‘rich’ people as the Gini coefficient worsens) or exceptional products meeting untapped demand. The jury is bound to remain out for a long while.

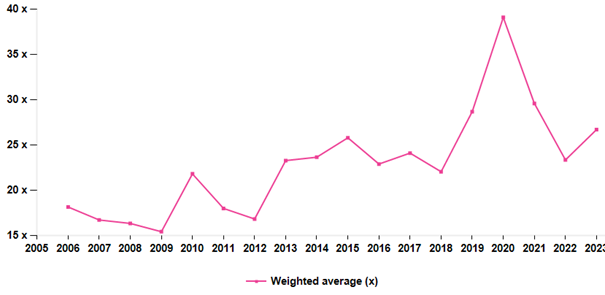

The sector PEs are less ridiculously expensive than they have been as the industry has delivered extraordinarily well on the earning front.

Luxury PEs are no longer out of this world

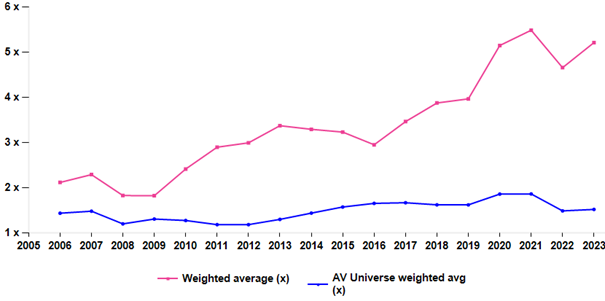

More interesting than the PE angle which is more or less a reflection on the ability of markets to accept excesses, the EV/ revenues angle is inherently more stable and conveys a message of still excessive optimism.

There is no need to rebase the average EV/revenues of the market (blue line) to that of Luxury to see that, since 2009, investors have been ready to pay up. With a magnifier, the valuation gap contracted a bit between 2013 and 2016 but has been accelerating since then.

Luxury EV/Sales: asking for trouble?

The ongoing 2023 sector EV/Sales at 5.21x stands above that of Semiconductors (5.14x) whereas the latter posts near-term eps growth rates (20%/y) about twice that of Luxury.

The above is not new news. The only piece of news motivating this valuation update is the building up of nervousness concerning the sector, presumably driven by the negative political vibes coming from China.

Our recent trip to China has further raised our concerns about the recovery shape of luxury consumption in China in the post-pandemic era. Small and medium-sized city residents have less money in their pockets, unemployment among young Chinese people has reached new record highs and the property market remains sluggish, all of which have made Chinese residents more eager to save than to spend.

The scene is set for a substantial and overdue correction. For the sake of helping one gauge risks, the average EV/Sales over 2006 and 2023 was 3.4x (2023 at 5.2x). The average for LVMH was also 3.4x for the same period (2023 at 5.2x). That of Hermès was 7.9x (with a current peak at 14x).

We leave it to industry experts to decide whether the potential for a correction is 35% (reverting to the EV/Sales 17-year average, the sector has little by way of debt) or whether ‘true’ luxury aka Hermès is forever worth 10x sales or more.

The sector has been discussed by pundits for ages about whether such mega valuations are a case of outright luck (Chinese demand), excellent management (fair), a megatrend (more ‘rich’ people as the Gini coefficient worsens) or exceptional products meeting untapped demand. The jury is bound to remain out for a long while.

The sector PEs are less ridiculously expensive than they have been as the industry has delivered extraordinarily well on the earning front.

Luxury PEs are no longer out of this world

More interesting than the PE angle which is more or less a reflection on the ability of markets to accept excesses, the EV/ revenues angle is inherently more stable and conveys a message of still excessive optimism.

There is no need to rebase the average EV/revenues of the market (blue line) to that of Luxury to see that, since 2009, investors have been ready to pay up. With a magnifier, the valuation gap contracted a bit between 2013 and 2016 but has been accelerating since then.

Luxury EV/Sales: asking for trouble?

The ongoing 2023 sector EV/Sales at 5.21x stands above that of Semiconductors (5.14x) whereas the latter posts near-term eps growth rates (20%/y) about twice that of Luxury.

The above is not new news. The only piece of news motivating this valuation update is the building up of nervousness concerning the sector, presumably driven by the negative political vibes coming from China.

Our recent trip to China has further raised our concerns about the recovery shape of luxury consumption in China in the post-pandemic era. Small and medium-sized city residents have less money in their pockets, unemployment among young Chinese people has reached new record highs and the property market remains sluggish, all of which have made Chinese residents more eager to save than to spend.

The scene is set for a substantial and overdue correction. For the sake of helping one gauge risks, the average EV/Sales over 2006 and 2023 was 3.4x (2023 at 5.2x). The average for LVMH was also 3.4x for the same period (2023 at 5.2x). That of Hermès was 7.9x (with a current peak at 14x).

We leave it to industry experts to decide whether the potential for a correction is 35% (reverting to the EV/Sales 17-year average, the sector has little by way of debt) or whether ‘true’ luxury aka Hermès is forever worth 10x sales or more.

Subscribe to our blog

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...