Metals & Mining: Noticable Recovery Ahead?

Against all odds, the Metals & Mining sector is trying for another comeback. After a tough H1, the markets seem to be paying attention to the sector’s quality proposition. While there’s clearly big value in the iron ore side of the business, there are various other critical/attractive themes at play. Overall, there’s a material upside on offer but, in terms of risk-reward, the likes of Rio Tinto, Glencore, Norsk Hydro and Antofagasta are clearly compelling bets.

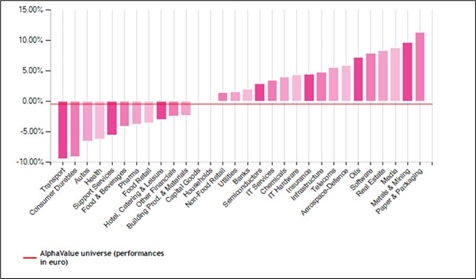

Metals & Mining is no longer the worst-performing sector (in year-to-date terms) in the AV universe. The recovery that got underway almost three months ago has, so far, had sturdy legs. Interestingly, Metals & Mining ranks second in three-month return terms (illustrated below) and is only behind Paper & Packaging – which was another casualty of weaker (Chinese) macros, despite the ownership of quality green assets exhibiting an undisputed long-term demand potential.

The rebound in Metals & Mining has been driven by recovering iron ore prices. No wonder, Rio Tinto (the biggest iron ore play in our coverage) has led from the front, gaining >18% in share price terms.

Analysis

The recovery in iron ore seems counter-intuitive, given that China has a big role on the demand-side and its macro situation still remains gloomy. But the reality is that the easiest way for the Chinese government to revive economic activity is to propel industrial demand, where the government has had a big and growing influence over the years. While we don’t expect overall metals demand to recover to the levels seen when China had very high economic growth rates, it should be adequate enough to support commodity prices; however, the painful lows seen after the COVID-19 outbreak are unlikely to be tested again.

While there is value across the board – with c.25% upside for diversified miners and c.42% upside for the non-ferrous names, the following are some of the best theme-wise plays in our coverage:

1/ Rio Tinto to milk prevalent iron ore pricing tailwinds. Remember, iron ore accounted for c.95% of the group’s H1 23 operating profits and posted a whopping 57% margin. This also means that there should be an adequate cash flow / gearing cushion towards the end of 2023 to pursue growth investments and sustain healthy – of course not ‘euphoric’ – shareholder rewards.

2/ Glencore to play green transition opportunities. Besides sizeable exposure to copper, cobalt and nickel, a series of lithium deals struck this year means that the firm has an enviable green transition metals portfolio. Add on top the recent acquisition of Teck Resources’ met coal assets and the firm has very importantly re-iterated and made critical progress towards its abandonment of coal promise.

3/ Norsk Hydro being well-positioned to exploit European opportunities / insecurities. While aluminium prices have suffered a lot in the past couple of quarters, the likes of Norsk have managed to maintain decent margins / cash flows, thanks to the benefits of an integrated business model. Also, with various green investments – including battery and green hydrogen initiatives – underway, the firm’s an attractive play to expedite Europe’s aggressive but vulnerable greening ambitions.

4/ Antofagasta as a reliable and pureplay copper proxy. Besides controlling c.3% of global copper supplies, there are ample (brownfield and, hence, less-expensive) growth options to increase medium-term output. Controlled/restrained global supplies imply that there is a valuable pricing cushion on the downside and, hence, a quality existing copper player – with both AV Fundamental Strength and Sustainability score of 7/10 – is well-placed to exploit markets’ never-ending supply fears.

Impact

Overall, we remain ‘Overweight’ on the Metals & Mining sector.

The rebound in Metals & Mining has been driven by recovering iron ore prices. No wonder, Rio Tinto (the biggest iron ore play in our coverage) has led from the front, gaining >18% in share price terms.

Analysis

The recovery in iron ore seems counter-intuitive, given that China has a big role on the demand-side and its macro situation still remains gloomy. But the reality is that the easiest way for the Chinese government to revive economic activity is to propel industrial demand, where the government has had a big and growing influence over the years. While we don’t expect overall metals demand to recover to the levels seen when China had very high economic growth rates, it should be adequate enough to support commodity prices; however, the painful lows seen after the COVID-19 outbreak are unlikely to be tested again.

While there is value across the board – with c.25% upside for diversified miners and c.42% upside for the non-ferrous names, the following are some of the best theme-wise plays in our coverage:

1/ Rio Tinto to milk prevalent iron ore pricing tailwinds. Remember, iron ore accounted for c.95% of the group’s H1 23 operating profits and posted a whopping 57% margin. This also means that there should be an adequate cash flow / gearing cushion towards the end of 2023 to pursue growth investments and sustain healthy – of course not ‘euphoric’ – shareholder rewards.

2/ Glencore to play green transition opportunities. Besides sizeable exposure to copper, cobalt and nickel, a series of lithium deals struck this year means that the firm has an enviable green transition metals portfolio. Add on top the recent acquisition of Teck Resources’ met coal assets and the firm has very importantly re-iterated and made critical progress towards its abandonment of coal promise.

3/ Norsk Hydro being well-positioned to exploit European opportunities / insecurities. While aluminium prices have suffered a lot in the past couple of quarters, the likes of Norsk have managed to maintain decent margins / cash flows, thanks to the benefits of an integrated business model. Also, with various green investments – including battery and green hydrogen initiatives – underway, the firm’s an attractive play to expedite Europe’s aggressive but vulnerable greening ambitions.

4/ Antofagasta as a reliable and pureplay copper proxy. Besides controlling c.3% of global copper supplies, there are ample (brownfield and, hence, less-expensive) growth options to increase medium-term output. Controlled/restrained global supplies imply that there is a valuable pricing cushion on the downside and, hence, a quality existing copper player – with both AV Fundamental Strength and Sustainability score of 7/10 – is well-placed to exploit markets’ never-ending supply fears.

Impact

Overall, we remain ‘Overweight’ on the Metals & Mining sector.

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.