No attraction in weaker balance sheets

Every now and then we check whether “trash” as defined by a non-investment grade rating is a good investment theme.

Not currently, it would seem. We defined non-investment grade issuers as those that rank below BBB on AlphaValue’s proprietary rating metrics. This is carried out on an annual basis. We selected the 95 non-financial stocks (ex Property) which are non-investment grade on their 2018 rating.

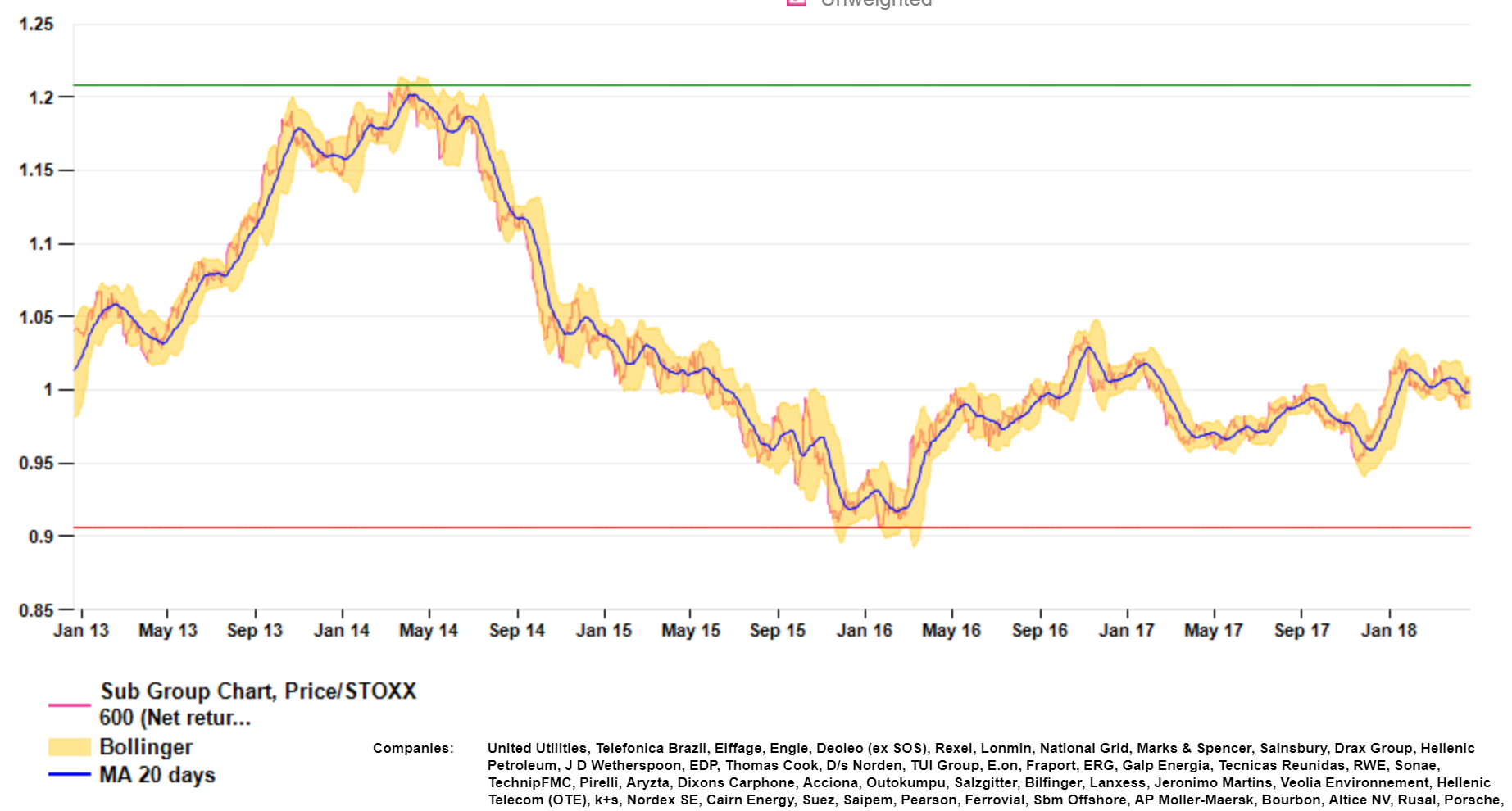

The following 5-year relative performance chart (vs. Stoxx600) is quite telling. Since mid-2016, when the deflation scare essentially disappeared, trash stocks have had an undifferentiated performance. The performance below is an unweighted one. Had it been on a weighted basis it would have a straight-line decline over five years with a 40% relative loss vs. the Stoxx600.

“Trash” stocks in line since mid-2016

It is worth pointing out a previously made comment: over the deflation scare period (say mid 2014 to mid 2016), the same universe underperformed. Cheaper money was not regarded as a genuine plus if the drop in revenue due to falling prices (deflation) was to be quicker than any unlikely saving on financing costs. Issuers with a weak balance sheet actually never experience the benefits of lower cost of money in a deflationary context as they are unlikely to generate enough cash flow to repay the principal so that lenders want higher spreads.

So much so that, QE or end of QE, it is hard to find a period of time when lesser quality balance sheets do make a difference in terms of share price performance.

This observation is a bit perplexing as the talk is one of a sounder European context and possibly soft inflation which should be a proper background to give a fresh lease of life to businesses with stretched finances.

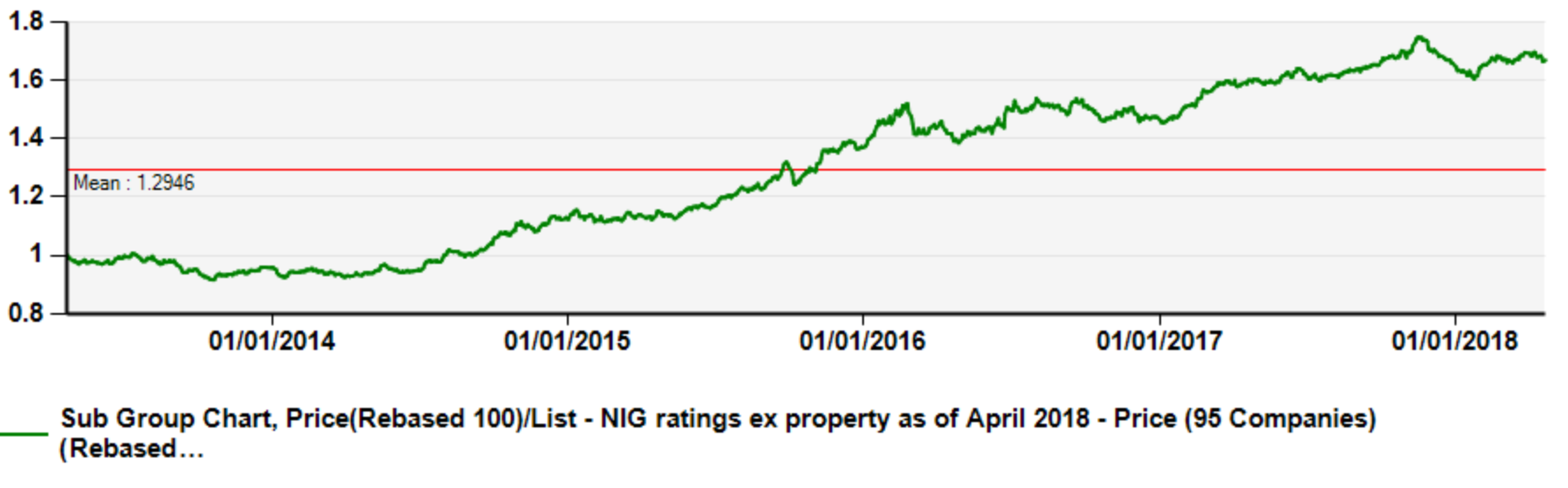

Conversely, sticking to A rated or better stocks would have been a winning strategy. The following chart provides a 5-year relative price performance of A rated or better stocks vs. the NIG sort. It was a no-brainer.

Relative outperformance of A-AAA rated stocks vs. NIGs

It is worth pointing out a previously made comment: over the deflation scare period (say mid 2014 to mid 2016), the same universe underperformed. Cheaper money was not regarded as a genuine plus if the drop in revenue due to falling prices (deflation) was to be quicker than any unlikely saving on financing costs. Issuers with a weak balance sheet actually never experience the benefits of lower cost of money in a deflationary context as they are unlikely to generate enough cash flow to repay the principal so that lenders want higher spreads.

So much so that, QE or end of QE, it is hard to find a period of time when lesser quality balance sheets do make a difference in terms of share price performance.

This observation is a bit perplexing as the talk is one of a sounder European context and possibly soft inflation which should be a proper background to give a fresh lease of life to businesses with stretched finances.

Conversely, sticking to A rated or better stocks would have been a winning strategy. The following chart provides a 5-year relative price performance of A rated or better stocks vs. the NIG sort. It was a no-brainer.

Relative outperformance of A-AAA rated stocks vs. NIGs

The next stepis to keep an eye and see when the market backs the risk takers by breaking that trend.

The next stepis to keep an eye and see when the market backs the risk takers by breaking that trend.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...