Offshore propelled Gamesa

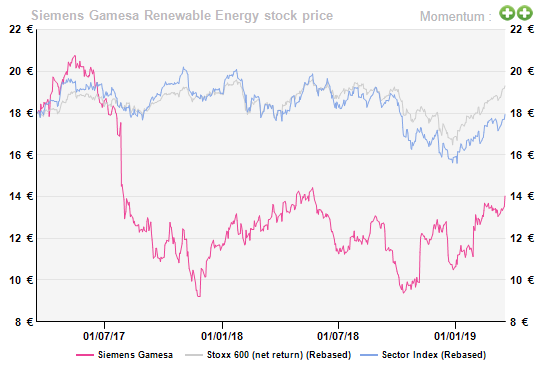

Siemens Gamesa (SGRE) outlook appears brighter and presumably at sea as the industry is now offshore driven. Wind turbine manufacturers declined sharply in 2017 due to the introduction of the auction system in nearly all markets, thus exerting price pressure across the value chain.

This presumably cleaned up the market, gave it a firmer ground and made it simpler to project offshore wind farms. The excess supply picture has been turned upside down suddenly with strong orders and an encouraging stabilisation in pricing, triggering renewed interest from investors. SGRE is benefitting as would be expected from the second largest player in what looks like an oligopoly.

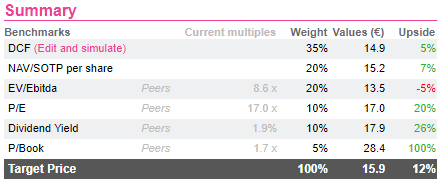

Although Vestas jointly with MHI has made a comeback in offshore turbines, SGRE has accumulated the right “at sea” expertise to battle on. In addition it offers the attraction of progress on its €2bn cost savings target for FY20. We see another 12% upside and most likely a potential for earnings revisions.

Orders back

Stronger order intakes and backlogs reflect the general dash for renewables spurred by governments’ targets and all manners of encouragement even though subsidies has essentially been binned now that wind MWh are converging with spot prices. SGRE’s backlog of €23.1bn including 46% in services suggests a revenue coverage of 92% and presumably comfortable margins of c.23%, provides good visibility for 2019 .

Order intake by business (in €m)

Orders back

Stronger order intakes and backlogs reflect the general dash for renewables spurred by governments’ targets and all manners of encouragement even though subsidies has essentially been binned now that wind MWh are converging with spot prices. SGRE’s backlog of €23.1bn including 46% in services suggests a revenue coverage of 92% and presumably comfortable margins of c.23%, provides good visibility for 2019 .

Order intake by business (in €m)

More research available on www.alphavalue.com

More research available on www.alphavalue.com

Source: SGRE company

Source: SGRE company, AlphaValue

Source: SGRE and Vestas company, AlphaValue

Source: Bloomberg Intelligence, AlphaValue

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...