Ofgem-restrained National Grid

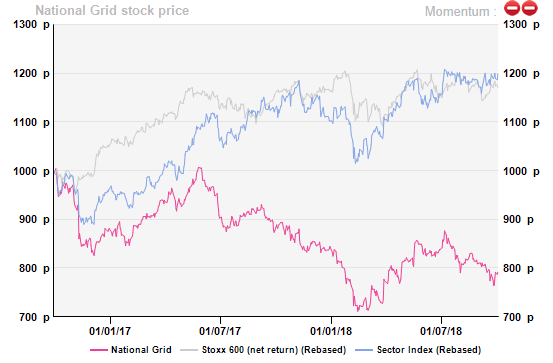

[dropcap]F[/dropcap]ully-regulated players have been left in the dust as integrated peers benefited from rising carbon and electricity prices, yet we like National Grid’s model as it offers a compelling mix of growth and resiliency.

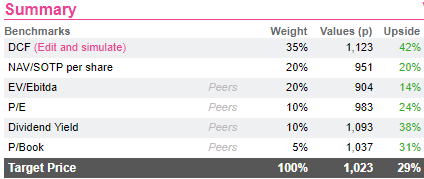

However, the timing isn’t perfect as the drawing of the new post-2021 regulation is set to dominate the headlines in December, when Ofgem publishes details on its new price-setting methodology. These unknowns are worth a 29% upside potential.

Falling behind integrated peers

A mix of growth and resiliency

The RAV-based remuneration in place in the UK ties returns to investments (capex), inflation (RPI) and depreciations. The group is not exposed to volume risk. Rather, revenue growth rests upon the UK’s need for new network infrastructures which - fortunately enough - remain high as the country transitions away from coal, steps up its renewable capacity and plans to connect new, third-gen nuclear reactors to the grid.

If the visibility of earnings truly is an asset, the biggest part of the upside comes from the US where NG is supplying gas and electricity to c.20m customers in Massachusetts, New York and Rhode Island.

The US has been the centre of NG’s growth strategy and channels more than half of the group’s investments. North America now represents 41% of the group’s total RAV vs 36% and 17% for UK electricity and gas networks, respectively.

FX aside, the risk is limited there too as NG earns a return on investments through a ROE-based mechanism. The group expects the rate base to grow by at least 7% from FY18 onwards.

To put things into perspective, the regulated asset base in the UK is growing at a slightly slower rate as money is being diverted from the domestic market to the US. The UK RAV is expected to grow at an annual rate of 4-5% over the remaining three years of the current regulatory period.

Ofgem-restrained

The current regulatory period (RIIO1) for gas and electricity transmission as well as gas distribution will end in March 2021.

Although Ofgem’s final decision is only expected by the end of 2020, the regulator will provide further details on the methodology used to set allowed returns.

For now, is it still unclear how network operators will be financially impacted yet Ofgem warned of a ‘tough’ RIIO2, arguing affordability was the main objective. What happened recently in the UK Water industry advocated for a cautious approach.

Unfortunately, Ofgem-related stress doesn't always follow a precise RIIO2-like schedule and sometimes manifests out of the blue, as illustrated by the recent debate around the cost of Hinkley Point C’s connection to the grid.

Valued at c.£839m by National Grid, Ofgem imagined a “competition proxy” to shave 20% off the cost and sweeten the £93/MWh pill sold by EDF.

Thanks to this, UK households near Hinkley Point should be able to cook their eggs without taking out a loan. Yet it came at the expense of NG shareholders and the share price fell 2% in the first hours of trading following the announcement.

On-boarding investors should keep these short-term regulatory bumps in mind.

29% upside can wait

In the mid-term, we see no major risk on the horizon besides the regulatory one. Cash flows will be able to finance both the growing dividends (at least RPI) and capex (£10bn over the next three years).

The current 6% yield should create a floor to the share price. The US dollar is winning back ground against sterling after 18 months of continued decline and its yoy movements could turn in NG’s favour by Q4 18.

Add to that the regulatory fog dissipation post December announcements, an RPI inflation consistently above the 2% mark, a business model that offers a natural protection in a no-deal Brexit and you have a quite compelling 2019 story.

A post-Christmas rendezvous.

A mix of growth and resiliency

The RAV-based remuneration in place in the UK ties returns to investments (capex), inflation (RPI) and depreciations. The group is not exposed to volume risk. Rather, revenue growth rests upon the UK’s need for new network infrastructures which - fortunately enough - remain high as the country transitions away from coal, steps up its renewable capacity and plans to connect new, third-gen nuclear reactors to the grid.

If the visibility of earnings truly is an asset, the biggest part of the upside comes from the US where NG is supplying gas and electricity to c.20m customers in Massachusetts, New York and Rhode Island.

The US has been the centre of NG’s growth strategy and channels more than half of the group’s investments. North America now represents 41% of the group’s total RAV vs 36% and 17% for UK electricity and gas networks, respectively.

FX aside, the risk is limited there too as NG earns a return on investments through a ROE-based mechanism. The group expects the rate base to grow by at least 7% from FY18 onwards.

To put things into perspective, the regulated asset base in the UK is growing at a slightly slower rate as money is being diverted from the domestic market to the US. The UK RAV is expected to grow at an annual rate of 4-5% over the remaining three years of the current regulatory period.

Ofgem-restrained

The current regulatory period (RIIO1) for gas and electricity transmission as well as gas distribution will end in March 2021.

Although Ofgem’s final decision is only expected by the end of 2020, the regulator will provide further details on the methodology used to set allowed returns.

For now, is it still unclear how network operators will be financially impacted yet Ofgem warned of a ‘tough’ RIIO2, arguing affordability was the main objective. What happened recently in the UK Water industry advocated for a cautious approach.

Unfortunately, Ofgem-related stress doesn't always follow a precise RIIO2-like schedule and sometimes manifests out of the blue, as illustrated by the recent debate around the cost of Hinkley Point C’s connection to the grid.

Valued at c.£839m by National Grid, Ofgem imagined a “competition proxy” to shave 20% off the cost and sweeten the £93/MWh pill sold by EDF.

Thanks to this, UK households near Hinkley Point should be able to cook their eggs without taking out a loan. Yet it came at the expense of NG shareholders and the share price fell 2% in the first hours of trading following the announcement.

On-boarding investors should keep these short-term regulatory bumps in mind.

29% upside can wait

In the mid-term, we see no major risk on the horizon besides the regulatory one. Cash flows will be able to finance both the growing dividends (at least RPI) and capex (£10bn over the next three years).

The current 6% yield should create a floor to the share price. The US dollar is winning back ground against sterling after 18 months of continued decline and its yoy movements could turn in NG’s favour by Q4 18.

Add to that the regulatory fog dissipation post December announcements, an RPI inflation consistently above the 2% mark, a business model that offers a natural protection in a no-deal Brexit and you have a quite compelling 2019 story.

A post-Christmas rendezvous.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...