OTE (Hellenic Telecom) Goes FTTH Faster At A Short Term Cost To Pay-outs.

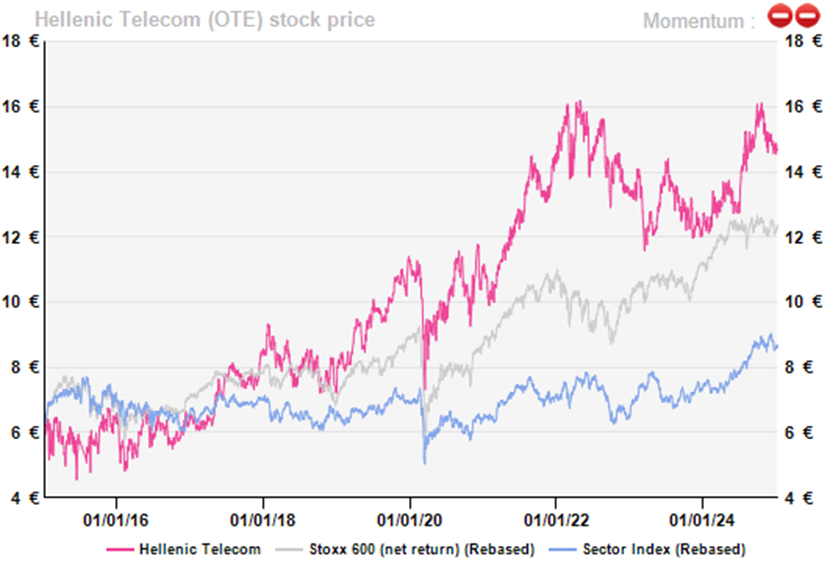

Between 2016 and 2021, OTE's (Add; Greece) stock price doubled due to consistent dividend increases and regular share buybacks. However, for the past three years, telecom stocks have fluctuated with interest rates. OTE has been no exception, experiencing a 25% decline in 2022, a flat performance in 2023 and is now starting 2025 at €14.5, 10% below the levels reached at the end of 2021.

So, as with most European telcos, do we have to wait for a drop in interest rates to see the stock possibly rise again to above €16.5 or can we expect a favourable trend in the group's fundamentals, i.e. its “cash” free cash flow, in the coming years? This is all the more important as the group has had a clear remuneration policy for five years now, aimed at distributing between 70% and 100% of its net FCF every year, through a combination of dividend pay-outs (for c.65%) and share buybacks (for c.35%). Shareholder remuneration rose from €265m in 2018 to €500m in 2022, the latter year benefiting from a one-off tax advantage of c.€100m. In 2024, remuneration was €450m (o/w €300m in dividends).

Greece's fiber coverage to be completed by 2028

Operationally things have been going well in Greece (which accounted for 92% of OTE’s revenue and 97.5% of its EBITDA in 2024) for several years. OTE thus reported a 6.7% yoy revenue increase in Greece for the first 9m, primarily driven by a 52.5% rise in ICT revenues, including IT and cloud solutions. This growth was due to strong demand and the deferral of certain projects following the Greek general elections in summer 2023. However, a demanding comparison base in the upcoming quarters is expected to moderate this trend. Telecom service revenue rose by c.2.5% yoy during this 9m period, aligning with the typical sector performance. Fixed service revenues remained stable as growth in broadband, spurred by fibre upselling, and higher TV service subscriber numbers were offset by declines in legacy services. OTE’s TV segment reached 710k subscribers at end September, a yoy increase of 7%. OTE achieved record additions of 24k TV subscribers in the quarter, the highest increase in over two years, demonstrating the benefits of the recent OTE-NOVA sports content-sharing agreement. Meanwhile, mobile service revenues maintained positive momentum, increasing by c.3.5%, as customers continued to transition to higher-value services. Overall, revenue is projected to increase by approximately 3-4% in the coming years thanks to a resurgence in the fixed segment.

The EBITDA margin however decreased by 2ppt yoy over the first 9m, primarily due to the higher contribution from ICT revenues. EBITDA increased by only 1.35% yoy during this period, aligning with the service revenue trend adjusted for wholesale. It is evident that OTE's EBITDA will not significantly drive dividend growth in the coming years. The EBITDA margin which had improved by 0.5ppt in 2022-23 despite inflation and higher energy costs, reaching an impressive 43.5% (worthy of KPN - Add; Netherlands, and Swisscom - Add; Switzerland the champions of the European telcos in the field) should stabilise at c.42% as ICT revenues now represent c.10% of OTE’s global activity in Greece.

So, a closer examination of capex is necessary to assess future dividend growth.

OTE is bolstering its leadership in Greece's network infrastructure by leveraging its competitive edge in FTTH and 5G coverage. By the end of 2024, OTE had extended FTTH to over 1.7m homes and businesses, representing 75% of the country's total installed FTTH lines and 37.5% of Greek households. The group expected 2024 capex in Greece to be between €635m and €645m, including leases, which equates to nearly 20% of its revenues. This elevated investment level supports the rapid FTTH deployment, with full coverage expected by 2028. But meanwhile, EBITDA minus capex is expected to grow in line with revenues.

More attractive shareholder remuneration from 2026

The company was initially projected to achieve 2024 FCF of c.€470m, comparable to the €500m recorded in 2023, which included a €40m income tax refund. However, a recent tax audit conclusion in Romania necessitates an extraordinary payment of €33.5m, reducing the expected FCF to €435m. Consequently, shareholder remuneration in 2025 is likely to be only €435m, with a reduction in share buy-backs. But we believe this will be counterbalanced by the announcement of a 2025 FCF target of c.€500m.

Note also that visibility will be improved through the definitive exit from Romania. OTE sold its fixed-line assets in Romania two years ago to Orange (Buy; France) for c.€270m. The future of the remaining mobile unit has been under consideration since then, although a deal to sell to an operator like Orange would presumably have raised EU competition concerns. In October, OTE announced it has entered negotiations to sell Telekom Romania Mobile to Digi Romania and Vodafone Romania. The companies have not disclosed the purchase price.

An additional point that is likely to please investors is that, last November, OTE's board approved the initiation of the spin-off process for the "Mobile Passive Infrastructure Sector" and the establishment of a new company for this purpose. Similarly to other European telcos, the group aims to enhance the value of its towers under improved conditions and may bring in a partner in exchange for cash.

OTE consistently offers low risk and decent returns, often overlooked by mainstream equity investors. Note also that Deutsche Telekom (Add; Germany), which owns 50% of OTE, shows no signs of divesting this profitable asset. However, Deutsche Telekom carries a huge €130bn debt, primarily from its significant investment in T-Mobile US, and may aim to reduce its leverage. Should Deutsche Telekom ever contemplate cashing in on its OTE holding, this would just open the valuation game to new highs.

So, as with most European telcos, do we have to wait for a drop in interest rates to see the stock possibly rise again to above €16.5 or can we expect a favourable trend in the group's fundamentals, i.e. its “cash” free cash flow, in the coming years? This is all the more important as the group has had a clear remuneration policy for five years now, aimed at distributing between 70% and 100% of its net FCF every year, through a combination of dividend pay-outs (for c.65%) and share buybacks (for c.35%). Shareholder remuneration rose from €265m in 2018 to €500m in 2022, the latter year benefiting from a one-off tax advantage of c.€100m. In 2024, remuneration was €450m (o/w €300m in dividends).

Greece's fiber coverage to be completed by 2028

Operationally things have been going well in Greece (which accounted for 92% of OTE’s revenue and 97.5% of its EBITDA in 2024) for several years. OTE thus reported a 6.7% yoy revenue increase in Greece for the first 9m, primarily driven by a 52.5% rise in ICT revenues, including IT and cloud solutions. This growth was due to strong demand and the deferral of certain projects following the Greek general elections in summer 2023. However, a demanding comparison base in the upcoming quarters is expected to moderate this trend. Telecom service revenue rose by c.2.5% yoy during this 9m period, aligning with the typical sector performance. Fixed service revenues remained stable as growth in broadband, spurred by fibre upselling, and higher TV service subscriber numbers were offset by declines in legacy services. OTE’s TV segment reached 710k subscribers at end September, a yoy increase of 7%. OTE achieved record additions of 24k TV subscribers in the quarter, the highest increase in over two years, demonstrating the benefits of the recent OTE-NOVA sports content-sharing agreement. Meanwhile, mobile service revenues maintained positive momentum, increasing by c.3.5%, as customers continued to transition to higher-value services. Overall, revenue is projected to increase by approximately 3-4% in the coming years thanks to a resurgence in the fixed segment.

The EBITDA margin however decreased by 2ppt yoy over the first 9m, primarily due to the higher contribution from ICT revenues. EBITDA increased by only 1.35% yoy during this period, aligning with the service revenue trend adjusted for wholesale. It is evident that OTE's EBITDA will not significantly drive dividend growth in the coming years. The EBITDA margin which had improved by 0.5ppt in 2022-23 despite inflation and higher energy costs, reaching an impressive 43.5% (worthy of KPN - Add; Netherlands, and Swisscom - Add; Switzerland the champions of the European telcos in the field) should stabilise at c.42% as ICT revenues now represent c.10% of OTE’s global activity in Greece.

So, a closer examination of capex is necessary to assess future dividend growth.

OTE is bolstering its leadership in Greece's network infrastructure by leveraging its competitive edge in FTTH and 5G coverage. By the end of 2024, OTE had extended FTTH to over 1.7m homes and businesses, representing 75% of the country's total installed FTTH lines and 37.5% of Greek households. The group expected 2024 capex in Greece to be between €635m and €645m, including leases, which equates to nearly 20% of its revenues. This elevated investment level supports the rapid FTTH deployment, with full coverage expected by 2028. But meanwhile, EBITDA minus capex is expected to grow in line with revenues.

More attractive shareholder remuneration from 2026

The company was initially projected to achieve 2024 FCF of c.€470m, comparable to the €500m recorded in 2023, which included a €40m income tax refund. However, a recent tax audit conclusion in Romania necessitates an extraordinary payment of €33.5m, reducing the expected FCF to €435m. Consequently, shareholder remuneration in 2025 is likely to be only €435m, with a reduction in share buy-backs. But we believe this will be counterbalanced by the announcement of a 2025 FCF target of c.€500m.

Note also that visibility will be improved through the definitive exit from Romania. OTE sold its fixed-line assets in Romania two years ago to Orange (Buy; France) for c.€270m. The future of the remaining mobile unit has been under consideration since then, although a deal to sell to an operator like Orange would presumably have raised EU competition concerns. In October, OTE announced it has entered negotiations to sell Telekom Romania Mobile to Digi Romania and Vodafone Romania. The companies have not disclosed the purchase price.

An additional point that is likely to please investors is that, last November, OTE's board approved the initiation of the spin-off process for the "Mobile Passive Infrastructure Sector" and the establishment of a new company for this purpose. Similarly to other European telcos, the group aims to enhance the value of its towers under improved conditions and may bring in a partner in exchange for cash.

OTE consistently offers low risk and decent returns, often overlooked by mainstream equity investors. Note also that Deutsche Telekom (Add; Germany), which owns 50% of OTE, shows no signs of divesting this profitable asset. However, Deutsche Telekom carries a huge €130bn debt, primarily from its significant investment in T-Mobile US, and may aim to reduce its leverage. Should Deutsche Telekom ever contemplate cashing in on its OTE holding, this would just open the valuation game to new highs.

Subscribe to our blog

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhy...