P/Book subliminal messages

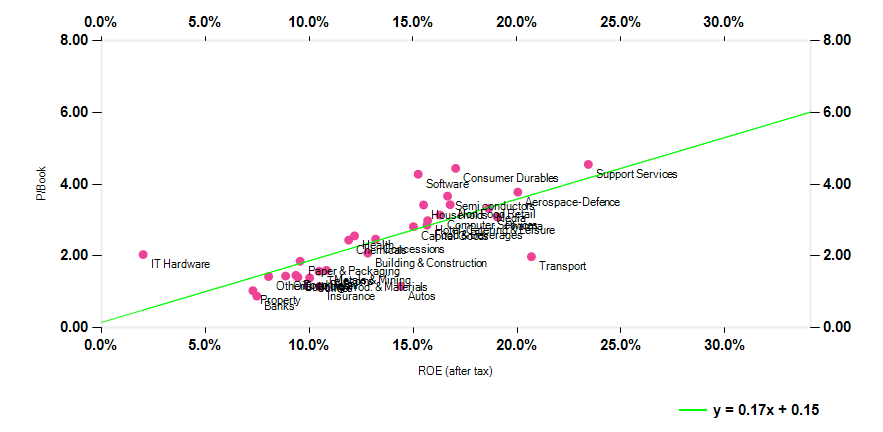

On the mathematically correct view that P/Books are a function of ROEs, the 30 sectors tracked by AlphaValue do a nice job of sitting on the regression line.

2018 P/Book and ROEs: two sides of the same coin

Outliers include: IT Hardware as investors give it a new lease of life on 5G dreams so that valuations are running ahead of returns; Software; and Consumer Durables where Luxury is the next big thing in China again.

On the wrong side of the fence sit Transport (pulled down by AP Moller and Airlines) and Autos as nobody wants to be seen with wheels above 1x book.

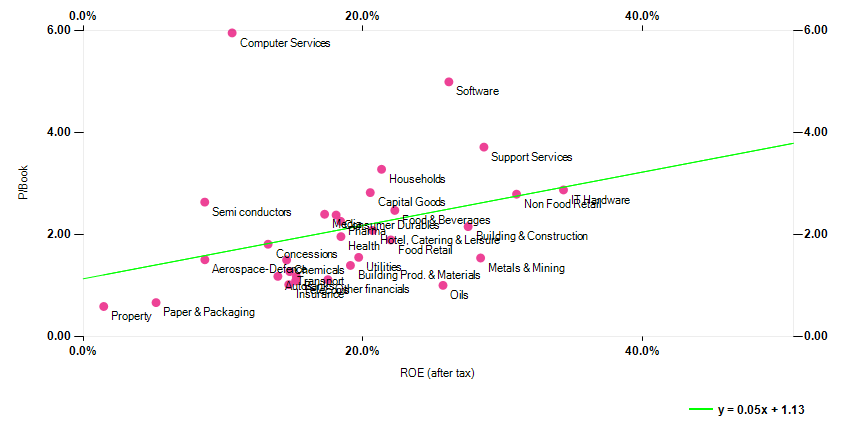

11 years ago (2007) the slope was less steep and the regression was more of a potato shape. Software was expensive but Computer Services were even more so. Transport and Autos were not a preferred choice already but jointly with Oils and Metals.

2007 P/Book and ROEs: two sides of the same coin

Outliers include: IT Hardware as investors give it a new lease of life on 5G dreams so that valuations are running ahead of returns; Software; and Consumer Durables where Luxury is the next big thing in China again.

On the wrong side of the fence sit Transport (pulled down by AP Moller and Airlines) and Autos as nobody wants to be seen with wheels above 1x book.

11 years ago (2007) the slope was less steep and the regression was more of a potato shape. Software was expensive but Computer Services were even more so. Transport and Autos were not a preferred choice already but jointly with Oils and Metals.

2007 P/Book and ROEs: two sides of the same coin

The implied message is that, in spite of early bumpy 2018 markets, it looks as if markets are more efficient when it comes to pricing sectors but valuations are steeper ones as implied by the slope of the first chart.

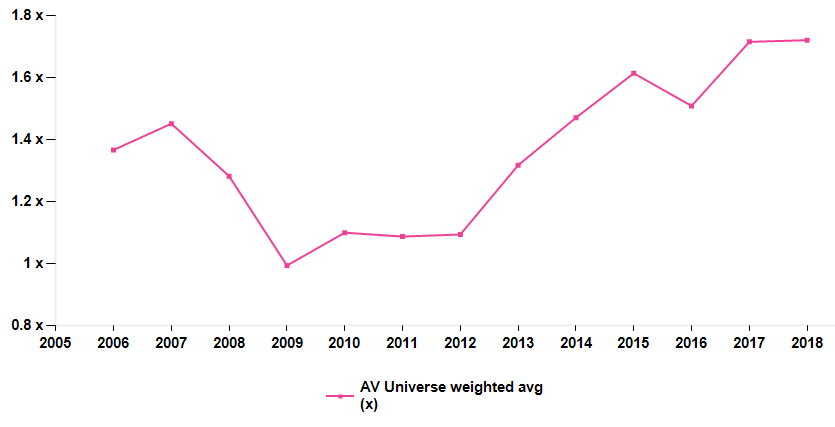

Another simpler way to put this view is the following chart of P/Book history. The great banking depression that capped P/Books below 1.4x is receding fast.

P/Book in Europe 2006-18

The implied message is that, in spite of early bumpy 2018 markets, it looks as if markets are more efficient when it comes to pricing sectors but valuations are steeper ones as implied by the slope of the first chart.

Another simpler way to put this view is the following chart of P/Book history. The great banking depression that capped P/Books below 1.4x is receding fast.

P/Book in Europe 2006-18

As we mentioned earlier in similar short papers, rising P/Books are at odds with the inconvenient truth that goodwill is building up across the board. This is clear on a universe excluding Financials and Deep Cyclicals. If this goodwill is not made to sweat proper returns, P/tangible equity may look expensive.

Steeper P/Book may also reflect that sector borders are fast becoming irrelevant as every industry goes capital light, blockchain-based and global. Higher P/Books are consistent with the fact that a fully digital society will tie up less risk capital.

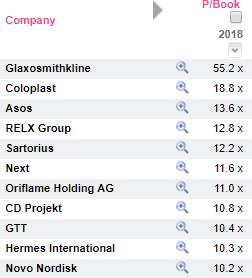

For the record, the dearest sector on a P/Book is Support Services at 4.5x, while issuers with a P/Book above 10x in 2018 are the following:

As we mentioned earlier in similar short papers, rising P/Books are at odds with the inconvenient truth that goodwill is building up across the board. This is clear on a universe excluding Financials and Deep Cyclicals. If this goodwill is not made to sweat proper returns, P/tangible equity may look expensive.

Steeper P/Book may also reflect that sector borders are fast becoming irrelevant as every industry goes capital light, blockchain-based and global. Higher P/Books are consistent with the fact that a fully digital society will tie up less risk capital.

For the record, the dearest sector on a P/Book is Support Services at 4.5x, while issuers with a P/Book above 10x in 2018 are the following:

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...