Pharmas Crushed By The Novo Spell

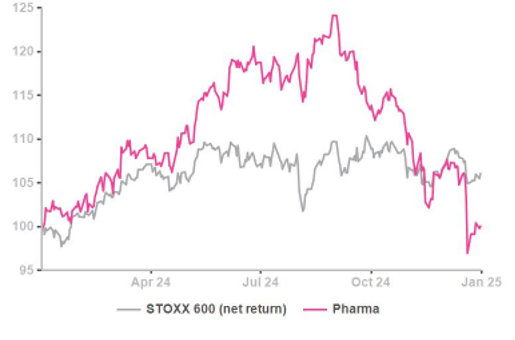

Pharmas closed the year with a dreadful performance, itself the reflection of dashed excessive hopes for GLP-1 developments. The unwarranted Novo Nordisk collapse on 19-12 on a marginal miss in its latest drug performance (see: CagriSema results are not worthy of panic, dated 20-12-2024) ended up pulling down the whole sector. Novo failed to recover and so did the sector which finished the year the year with a mediocre 1.5% gain. Not as bad as F&B (-10.5%), but not brilliant for an industry that is expected to see top-line growth of 5% a year, admittedly with a bit of acquired growth. AZN’s own serious Chinese problems contributed to the sector's demise.

Pharmas avoided a negative 2024 performance, just

The 2024 Pharma miss was a miss for the single largest European sector (say about 11% of the total market cap) - meaning that investors were seriously hurt. Few offset this by going for Banks, up … by 30% and on their way to matching Pharmas, market cap wise.

The skin sensitivity of investors about weight-loss drugs indicates that there is a long learning curve about the many variations that already exist in this field (see ‘Pick you Weight Loss Molecule’, 18-12-2024). Knee jerks are bound to happen again.

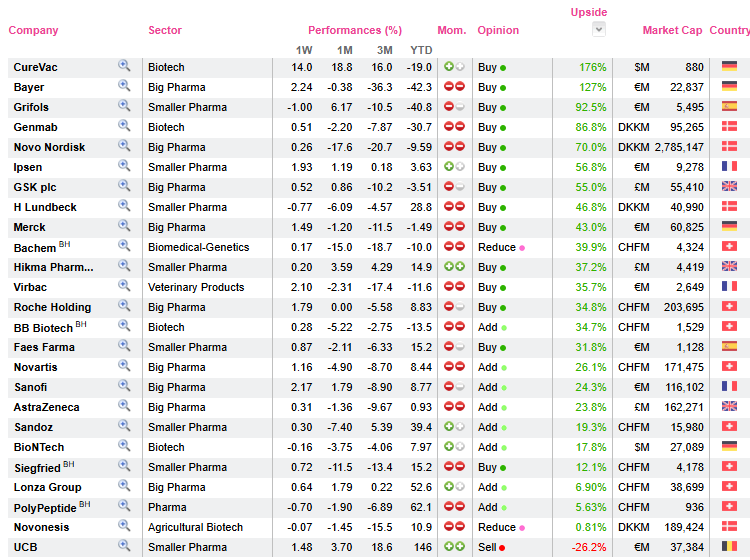

Is this priced in? Maybe not given the sector valuation at c.17x 2025 earnings. The 10% eps growth might seem good enough to justify this 17x but it's worth highlighting the fact that 25% of these earnings is owed to Novo and another 20% to AZN. This means that the sector's 2025 earnings growth is possibly less serene than what investors have been used to.

Pharma’s valuation essentials: eps growth effectively driven by Novo and AZN

2025 earnings are not everything when it comes to finding investment opportunities. The AlphaValue analysts see 41% upside potential for Pharmas, a massive number for such a big sector. Sadly the mood is a disaster (see table). Amongst the second liners, one may consider Ipsen, Hikma and Lundbeck while Big Pharma looks like a screaming buy.

Pharmas avoided a negative 2024 performance, just

The 2024 Pharma miss was a miss for the single largest European sector (say about 11% of the total market cap) - meaning that investors were seriously hurt. Few offset this by going for Banks, up … by 30% and on their way to matching Pharmas, market cap wise.

The skin sensitivity of investors about weight-loss drugs indicates that there is a long learning curve about the many variations that already exist in this field (see ‘Pick you Weight Loss Molecule’, 18-12-2024). Knee jerks are bound to happen again.

Is this priced in? Maybe not given the sector valuation at c.17x 2025 earnings. The 10% eps growth might seem good enough to justify this 17x but it's worth highlighting the fact that 25% of these earnings is owed to Novo and another 20% to AZN. This means that the sector's 2025 earnings growth is possibly less serene than what investors have been used to.

Pharma’s valuation essentials: eps growth effectively driven by Novo and AZN

2025 earnings are not everything when it comes to finding investment opportunities. The AlphaValue analysts see 41% upside potential for Pharmas, a massive number for such a big sector. Sadly the mood is a disaster (see table). Amongst the second liners, one may consider Ipsen, Hikma and Lundbeck while Big Pharma looks like a screaming buy.

Subscribe to our blog

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhy...