Porsche SE: A Winning Stroke?

Porsche SE, the holding company for Volkswagen, experienced a decline in its share price while its subsidiary, Porsche AG, saw a successful IPO. Porsche SE underperformed its main holdings and the automotive sector. Its performance is closely tied to Volkswagen, which has extracted value through IPOs. While no immediate IPO announcements are expected, Porsche SE holds a 25% ownership of Porsche AG's common stock, providing direct exposure. Trading at a discount to net asset value (NAV), Porsche SE offers potential upside. Despite governance concerns, it presents an attractive investment opportunity with residual exposure to the auto industry.

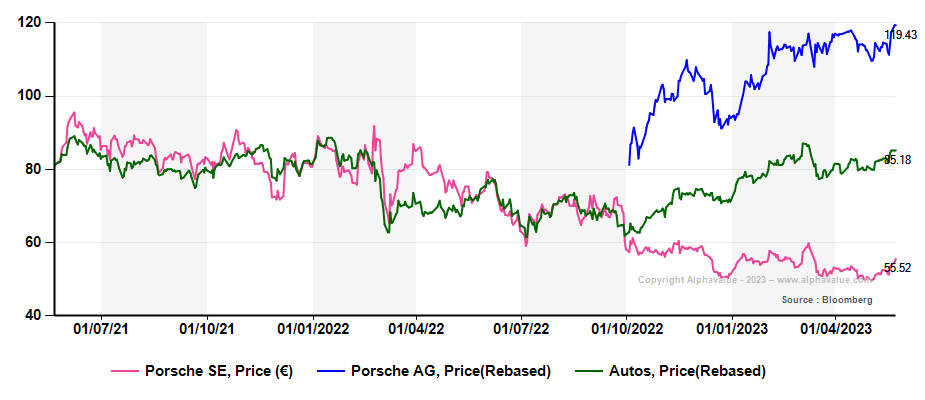

Last time we looked, Porsche SE, the listed vehicle through which the Porsche/Piëch families hold Volkswagen, had achieved an impressive share price appreciation. Today, the picture looks quite different. As with many other holding companies in the AlphaValue universe, the Equity Story of Porsche SE saw a number of decisive turn-toes in 2022. Chief among these was the long-awaited IPO of Porsche AG. While the latter proved to be a resounding success for the sports and luxury automaker, posting an impressive c.39% uplift from its listing on 29 September 2022, the same cannot be said for Porsche SE. It crashed as if the value exited the SE to swell that of the AG.

Porsche SE, Porsche AG Stock price momentum

While it had been regarded as the winner of the IPO, in half a year Porsche Automobil Holding, has underperformed its two main shareholdings: Porsche AG and Volkswagen, and even worse, the broader automotive sector. Porsche While we have repeatedly inquired as to the reasons for such a discrepancy, we have come to the conclusion that there were no fundamental grounds - in other words, Porsche SE is worth a look.

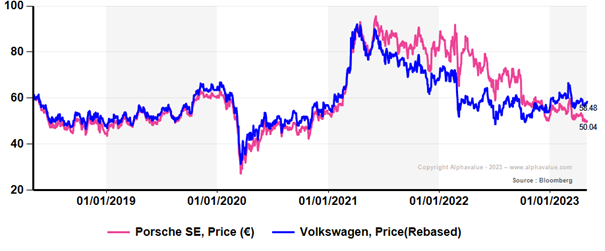

A Volkswagen-centric play up to the Porsche AG listing project

Porsche SE Price Momentum VS Volkswagen Price Momentum

Given that VW remains the HoldCo’s largest asset, and overwhelmingly so, its performance is closely tied to the underlying share price and earnings progression in spite of the recent disconnect. Admittedly, VW had to weather automotive industry headwinds including semiconductor shortages, supply chain pressures, and henceforth the clear downgrade of EVs. Regardless of all these elements, VW offers a compelling value proposition across its many brands. VW stands more as a holding company-like akin to a private equity player than a traditional car manufacturer. Over the past few years, VW has been a proven performer in extracting value from its assets, first with the IPO of its heavy truck division, Traton, for €1.9bn in April 2019, and later with the IPO of Porsche AG for c.€10.6bn last September. Luckily for Porsche SE, this might not be the end of the road. Under the impetus of the new head of the group, every VW brand has conducted pre-IPO exercises. These potential IPOs could allow Porsche SE to replenish its pockets, as was the case with the €3.1bn pocketed from the Porsche AG IPO. Our automotive analyst is not betting on an IPO announcement in the short term. However, a closer look at the performance of each brand should undoubtedly help the management understand their weaknesses.

Porsche AG at a discount

If we portrayed Porsche SE as a VW bet, it is as of now also a Porsche AG play. We consider this exposure to Porsche AG to be part of the reason for the disconnect between Porsche SE and AG. Investors that had been exposed to Porsche SE to gain access to AG have, we suspect, exited their positions for a more direct position subsequent to the IPO. Yet, with 25% of Porsche AG’s common stock, we see Porsche SE as an excellent cheap proxy that offers more direct exposure than AG's meager c.20% free float of preferred shares.

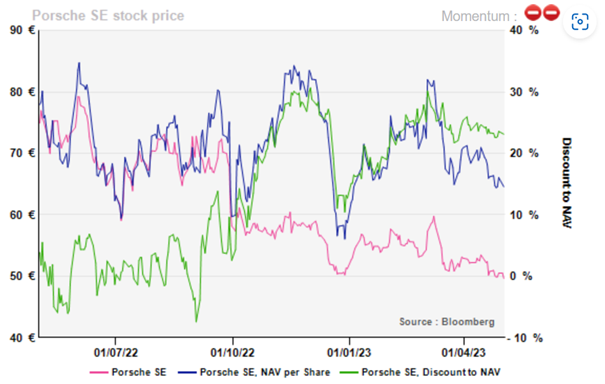

Bargain valuation partly justified

The current 23% discount to NAV offers definite upside potential, as it remains above the five-year historical average of 18%. Readers should be reminded that our estimate of NAV is conservative with an extra 30% discount, which makes the size of the bargain even larger.

Porsche SE share price momentum, Porsche SE NAV per share, Porsche SE Discount to NAV

To some extent, the discount to NAV is arguably justifiable, bearing in mind that Porsche SE shares are preference shares with no voting rights, not to mention the governance which leaves much to be desired with the Porsche-Piëch family seeking to maintain a stranglehold on its holdings. Dr. Wolfgang Porsche serves as Chairman of the Supervisory Board of Porsche Automobil Holding SE, Porsche AG and VW, binding the subsidiaries to the parent company. This intricately woven tie is set to run for another five years, as Wolfgang Porsche will file for another stint at VW's upcoming AGM on May 10. As if this were not complicated enough, in September 2022, Olivier Blume replaced Herbert Diess as chairman of the board of VW AG, running both Porsche AG and its main shareholder. Even when it comes to the dividend payment, a conflict of interest does arise, with Mr. Meschke, Porsche AG's CFO, responsible for investment management on the board of Porsche SE. From a legal perspective, Porsche SE also suffers a discount in the wake of its involvement in two scandals, the so-called Dieselgate affair and the increase of the shareholding in VW AG case. In 2022, the German holding company emerged triumphant from the two legal disputes with the Higher Regional Court of Celle and the Higher Regional Court of Stuttgart.

Still, we see no reason for a 23% discount on top of the 30% discount we apply. Even more so, charging a governance discount on a company that holds an already discounted company for the same governance puzzles us. It goes without saying that, with a better-than-expected first quarter and lackluster reactions, playing Porsche AG or VW is not a great idea. Should we consider VW group to be a HoldCo of car brands, Porsche SE is an unsexy HoldCo of a HoldCo. Yet, while all eyes are on one of the most talked-about crashes waiting to happen, Porsche SE stands out as offering cheap residual exposure to the auto sector.

Porsche SE, Porsche AG Stock price momentum

While it had been regarded as the winner of the IPO, in half a year Porsche Automobil Holding, has underperformed its two main shareholdings: Porsche AG and Volkswagen, and even worse, the broader automotive sector. Porsche While we have repeatedly inquired as to the reasons for such a discrepancy, we have come to the conclusion that there were no fundamental grounds - in other words, Porsche SE is worth a look.

A Volkswagen-centric play up to the Porsche AG listing project

Porsche SE Price Momentum VS Volkswagen Price Momentum

Given that VW remains the HoldCo’s largest asset, and overwhelmingly so, its performance is closely tied to the underlying share price and earnings progression in spite of the recent disconnect. Admittedly, VW had to weather automotive industry headwinds including semiconductor shortages, supply chain pressures, and henceforth the clear downgrade of EVs. Regardless of all these elements, VW offers a compelling value proposition across its many brands. VW stands more as a holding company-like akin to a private equity player than a traditional car manufacturer. Over the past few years, VW has been a proven performer in extracting value from its assets, first with the IPO of its heavy truck division, Traton, for €1.9bn in April 2019, and later with the IPO of Porsche AG for c.€10.6bn last September. Luckily for Porsche SE, this might not be the end of the road. Under the impetus of the new head of the group, every VW brand has conducted pre-IPO exercises. These potential IPOs could allow Porsche SE to replenish its pockets, as was the case with the €3.1bn pocketed from the Porsche AG IPO. Our automotive analyst is not betting on an IPO announcement in the short term. However, a closer look at the performance of each brand should undoubtedly help the management understand their weaknesses.

Porsche AG at a discount

If we portrayed Porsche SE as a VW bet, it is as of now also a Porsche AG play. We consider this exposure to Porsche AG to be part of the reason for the disconnect between Porsche SE and AG. Investors that had been exposed to Porsche SE to gain access to AG have, we suspect, exited their positions for a more direct position subsequent to the IPO. Yet, with 25% of Porsche AG’s common stock, we see Porsche SE as an excellent cheap proxy that offers more direct exposure than AG's meager c.20% free float of preferred shares.

Bargain valuation partly justified

The current 23% discount to NAV offers definite upside potential, as it remains above the five-year historical average of 18%. Readers should be reminded that our estimate of NAV is conservative with an extra 30% discount, which makes the size of the bargain even larger.

Porsche SE share price momentum, Porsche SE NAV per share, Porsche SE Discount to NAV

To some extent, the discount to NAV is arguably justifiable, bearing in mind that Porsche SE shares are preference shares with no voting rights, not to mention the governance which leaves much to be desired with the Porsche-Piëch family seeking to maintain a stranglehold on its holdings. Dr. Wolfgang Porsche serves as Chairman of the Supervisory Board of Porsche Automobil Holding SE, Porsche AG and VW, binding the subsidiaries to the parent company. This intricately woven tie is set to run for another five years, as Wolfgang Porsche will file for another stint at VW's upcoming AGM on May 10. As if this were not complicated enough, in September 2022, Olivier Blume replaced Herbert Diess as chairman of the board of VW AG, running both Porsche AG and its main shareholder. Even when it comes to the dividend payment, a conflict of interest does arise, with Mr. Meschke, Porsche AG's CFO, responsible for investment management on the board of Porsche SE. From a legal perspective, Porsche SE also suffers a discount in the wake of its involvement in two scandals, the so-called Dieselgate affair and the increase of the shareholding in VW AG case. In 2022, the German holding company emerged triumphant from the two legal disputes with the Higher Regional Court of Celle and the Higher Regional Court of Stuttgart.

Still, we see no reason for a 23% discount on top of the 30% discount we apply. Even more so, charging a governance discount on a company that holds an already discounted company for the same governance puzzles us. It goes without saying that, with a better-than-expected first quarter and lackluster reactions, playing Porsche AG or VW is not a great idea. Should we consider VW group to be a HoldCo of car brands, Porsche SE is an unsexy HoldCo of a HoldCo. Yet, while all eyes are on one of the most talked-about crashes waiting to happen, Porsche SE stands out as offering cheap residual exposure to the auto sector.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...