Q1 Earnings Beat Analysis

We counted 17 earnings beats on 20 analyst-commented releases by 8:45 on 26-04. That is a lot. And the count will be higher as there is no way a morning review can go through the extra 9 stocks that released before the market opening.

Beats are events managed by corporates so need to be taken with the usual pinch of salt but the substance of many of these beats is still a surprise. Think of the amazing deliveries of Enskilda or Handelsbanken for a start: incomes are above, costs are below and the outlook is not such that one would rush for the door. This comment also applies across sectors. Yesterday for instance, German forklift suppliers struck investors with their good figures and relaxed view of 2023.

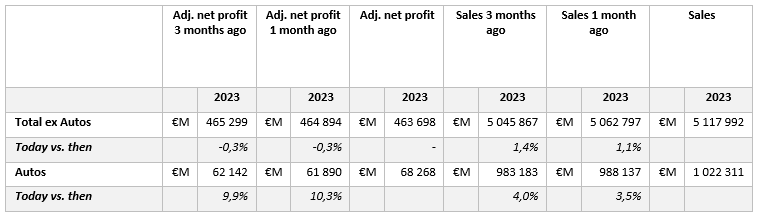

We took another look at 2023 sales and 2023 earnings revisions over 1 month and 3 months. We excluded Oils, Mining & Metals, Transport (shipping wild rates), Banks and Insurance for the obvious reason that their top lines are not really within their control.

We also excluded Autos as they are experiencing a massive set of upgrades (price factor) ahead of a … pricing crisis. They are isolated and rightly so.

Revision tables are never easy to read. What the following table highlights is that for the universe ex Autos, Deep Cyclicals and Financials, essentially nothing was going on before the Q1 releases. It was even rather negative with gains on sales (inflation presumably) not feeding through the bottom line (cost inflation presumably). The music is different with Autos: sales upgrades of 3%-4% are morphing into a 10% earnings pull.

2023 revisions deciphered

So here is the conundrum

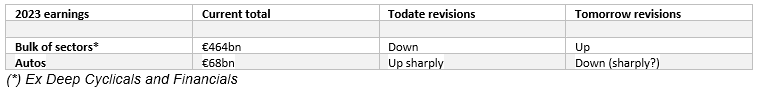

The Q1 beats are sector wide meaning that 2023 sales need to be upgraded. Most upgrades seem such that there are positive implications for profits … again, i.e. contrarily to expectations that cost inflation would start to bite sharply. We are surprised by such developments but this is also what we are hearing through corporate calls. So earnings upgrades are warranted on the €464bn in 2023 profits.

On the other hand the fantastic upgrades recorded for the car sector (and backed by very strong Q1 releases) are singular for the fact that the pricing situation for EVs has become ominous since Tesla broke down the retail price structure by shifting list prices nearly weekly. The €68bn in 2023 earnings foreseen for the car sector may suddenly become a challenge.

So the summary view of the earnings revision dynamics would be the following:

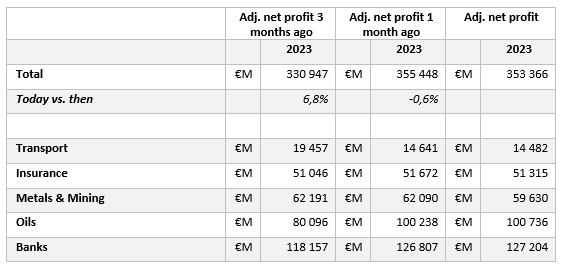

Finally here is how 2023 earnings have been developing for those sectors not really in control of their top lines. Upgrades there are, courtesy of Banks and Oils.

Beats are events managed by corporates so need to be taken with the usual pinch of salt but the substance of many of these beats is still a surprise. Think of the amazing deliveries of Enskilda or Handelsbanken for a start: incomes are above, costs are below and the outlook is not such that one would rush for the door. This comment also applies across sectors. Yesterday for instance, German forklift suppliers struck investors with their good figures and relaxed view of 2023.

We took another look at 2023 sales and 2023 earnings revisions over 1 month and 3 months. We excluded Oils, Mining & Metals, Transport (shipping wild rates), Banks and Insurance for the obvious reason that their top lines are not really within their control.

We also excluded Autos as they are experiencing a massive set of upgrades (price factor) ahead of a … pricing crisis. They are isolated and rightly so.

Revision tables are never easy to read. What the following table highlights is that for the universe ex Autos, Deep Cyclicals and Financials, essentially nothing was going on before the Q1 releases. It was even rather negative with gains on sales (inflation presumably) not feeding through the bottom line (cost inflation presumably). The music is different with Autos: sales upgrades of 3%-4% are morphing into a 10% earnings pull.

2023 revisions deciphered

So here is the conundrum

The Q1 beats are sector wide meaning that 2023 sales need to be upgraded. Most upgrades seem such that there are positive implications for profits … again, i.e. contrarily to expectations that cost inflation would start to bite sharply. We are surprised by such developments but this is also what we are hearing through corporate calls. So earnings upgrades are warranted on the €464bn in 2023 profits.

On the other hand the fantastic upgrades recorded for the car sector (and backed by very strong Q1 releases) are singular for the fact that the pricing situation for EVs has become ominous since Tesla broke down the retail price structure by shifting list prices nearly weekly. The €68bn in 2023 earnings foreseen for the car sector may suddenly become a challenge.

So the summary view of the earnings revision dynamics would be the following:

Finally here is how 2023 earnings have been developing for those sectors not really in control of their top lines. Upgrades there are, courtesy of Banks and Oils.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...