Rheinmetall: Boundless Growth Within Sight

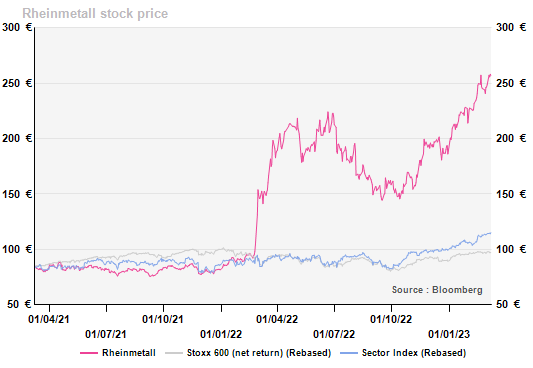

Remember the good-old days when we were naïve enough to think that the next war (if ever any) would be a proxy war? When governments focused on securing their IT rather than maintaining their metal armoury? The Russia-Ukraine war has proved that a flat land traditional war can never be ruled out, thus reinventing the purpose and need for defence companies. When Russia invaded Ukraine, the markets were quick to react and drove a defence sector price rally, followed by multiple jumps as a response to news-flow. However, the ytd performances of sectors which will not benefit from the war have shown that the market is still turning a blind eye to the likelihood of a fully-fledged war. If this were to happen, investors won’t waste time buying into Rheinmetall, eclipsing its already-brisk 1-year performance.

In our current Rheinmetall financials, we have included only the orders that have been placed or are highly likely to be placed (for example increased spending by the German government on ammunition). Encapsulating these, our figures are in line with the company’s updated mid-term guidance announced during its CMD 2022. But given the current escalation, we cannot overlook the possibility of a fully-fledged war, which can change the global dynamics and economy. In that case, these numbers will no longer hold good.

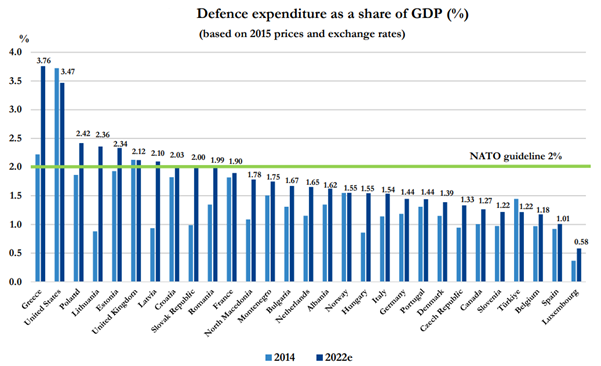

Spending will far exceed the NATO guideline

The increase in defence spending to 2% of GDP as required by NATO amounts to $100bn a year for those countries below the line. We are being conservative when we say that, in the event of a fully-fledged war, countries will at least aim to reach the US’s level of defence spending, which translates into more than $300bn of additional spending each year. Just to give an idea of how conservative we are currently, the US alone spent more than $5tn (>40% of its GDP) during WW2.

Source: NATO

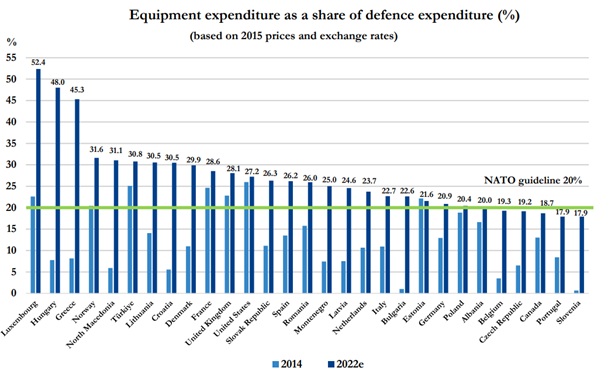

Other players will also pick up the hammer

NATO countries are supposed to maintain at least 30-days of ammunitions inventory but, in reality, countries have a much lower level. Based on the current rumours, Germany has just 5 days. To top this off, Ukraine is currently firing 10k artillery rounds/day or 3.6m rounds/year (vs Rheinmetall’s capacity of 120k rounds/year i.e. 3% of the current requirement). Demand is only set to increase from here. Hence, non-defence companies with hammer bashing capabilities (for example those belonging to sectors like automobile, civil aerospace, capital goods, etc.) can lend a hand to at least service the ammunition needs. In turn, Rheinmetall may be asked to focus its efforts, human-hours and resources on the more-sophisticated but lower-margin-generating (when compared to weapons and ammunitions) Vehicular System business.

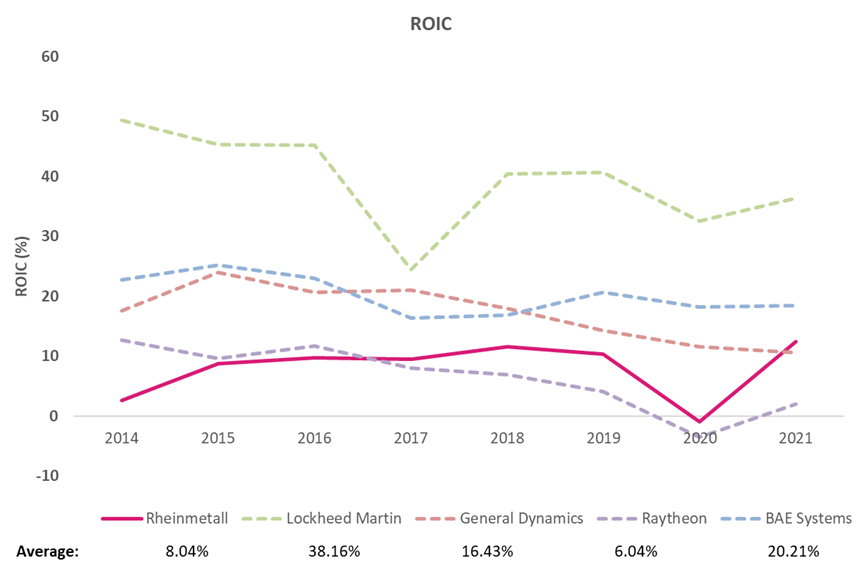

On the surface, this may look like a shift towards less-profitable business given that munitions are sold at a >20% operating margin and vehicles at <15%. But we are more concerned about ROCE. To facilitate rapid production, Germany can change its payment on delivery policy and make intermediate payments instead, improving the company’s balance sheet health and, thus, its trading multiples (like that of its US peers).

The war should also help increase the company’s exports, as demand will flow in from all directions. This will further help with cash inflows since international sales increase pre-payments and higher benefits from export.

Retrofitting no longer a side business?

The politics surrounding the delivery of Leopard 1 & 2 main battle tanks are so tangled in shameful constraints that Rheinmetall

increasingly seems to be becoming the hub where old gear will be refurbished before being sent on to Ukraine. Obviously at a steep profit. This was already the case as the Leopard 1s (smaller bore guns) bought, updated and sold. Now Germany seems to be bidding for mothballed Swiss Leopard 2s to be refurbished by Rheinmetall and to be subsequently used by the Bundeswehr. The Bundeswehr would part with the handful of tanks that it owns and that still work, sending them to Ukraine, so that the Swiss government would not send out of order tanks to a country at war but to a working democracy. This is pathetic stuff but presumably excellent business for Rheinmetall as your repair-trade expert. As the Leopard 2A7+ goes for $18m a pop and assuming that a renovated tank goes for half the price and a 50% profit margin would imply c.€3-5m profit margin per tank.

It’s still not too late to buy Rheinmetall

Rheinmetall’s share price has increased by 169% since Russia invaded Ukraine and we expect the momentum to continue as the industry enters the watershed era. We expect the magnitude of orders placed to be bigger than what is currently being anticipated by the market. Over the next few years, Rheinmetall will be busy not just replenishing defence inventories, but also helping NATO countries reach the guided level of inventory. After all, countries have learnt the lesson that the likelihood of a traditional war is at least as high as that of a proxy war (if not more) and thus they need to be permanently on their toes. Hence, while our current upside is limited as we are missing fresh data on the order intake side, the stock remains a screaming buy.

In our current Rheinmetall financials, we have included only the orders that have been placed or are highly likely to be placed (for example increased spending by the German government on ammunition). Encapsulating these, our figures are in line with the company’s updated mid-term guidance announced during its CMD 2022. But given the current escalation, we cannot overlook the possibility of a fully-fledged war, which can change the global dynamics and economy. In that case, these numbers will no longer hold good.

Spending will far exceed the NATO guideline

The increase in defence spending to 2% of GDP as required by NATO amounts to $100bn a year for those countries below the line. We are being conservative when we say that, in the event of a fully-fledged war, countries will at least aim to reach the US’s level of defence spending, which translates into more than $300bn of additional spending each year. Just to give an idea of how conservative we are currently, the US alone spent more than $5tn (>40% of its GDP) during WW2.

Source: NATO

Other players will also pick up the hammer

NATO countries are supposed to maintain at least 30-days of ammunitions inventory but, in reality, countries have a much lower level. Based on the current rumours, Germany has just 5 days. To top this off, Ukraine is currently firing 10k artillery rounds/day or 3.6m rounds/year (vs Rheinmetall’s capacity of 120k rounds/year i.e. 3% of the current requirement). Demand is only set to increase from here. Hence, non-defence companies with hammer bashing capabilities (for example those belonging to sectors like automobile, civil aerospace, capital goods, etc.) can lend a hand to at least service the ammunition needs. In turn, Rheinmetall may be asked to focus its efforts, human-hours and resources on the more-sophisticated but lower-margin-generating (when compared to weapons and ammunitions) Vehicular System business.

On the surface, this may look like a shift towards less-profitable business given that munitions are sold at a >20% operating margin and vehicles at <15%. But we are more concerned about ROCE. To facilitate rapid production, Germany can change its payment on delivery policy and make intermediate payments instead, improving the company’s balance sheet health and, thus, its trading multiples (like that of its US peers).

The war should also help increase the company’s exports, as demand will flow in from all directions. This will further help with cash inflows since international sales increase pre-payments and higher benefits from export.

Retrofitting no longer a side business?

The politics surrounding the delivery of Leopard 1 & 2 main battle tanks are so tangled in shameful constraints that Rheinmetall

increasingly seems to be becoming the hub where old gear will be refurbished before being sent on to Ukraine. Obviously at a steep profit. This was already the case as the Leopard 1s (smaller bore guns) bought, updated and sold. Now Germany seems to be bidding for mothballed Swiss Leopard 2s to be refurbished by Rheinmetall and to be subsequently used by the Bundeswehr. The Bundeswehr would part with the handful of tanks that it owns and that still work, sending them to Ukraine, so that the Swiss government would not send out of order tanks to a country at war but to a working democracy. This is pathetic stuff but presumably excellent business for Rheinmetall as your repair-trade expert. As the Leopard 2A7+ goes for $18m a pop and assuming that a renovated tank goes for half the price and a 50% profit margin would imply c.€3-5m profit margin per tank.

It’s still not too late to buy Rheinmetall

Rheinmetall’s share price has increased by 169% since Russia invaded Ukraine and we expect the momentum to continue as the industry enters the watershed era. We expect the magnitude of orders placed to be bigger than what is currently being anticipated by the market. Over the next few years, Rheinmetall will be busy not just replenishing defence inventories, but also helping NATO countries reach the guided level of inventory. After all, countries have learnt the lesson that the likelihood of a traditional war is at least as high as that of a proxy war (if not more) and thus they need to be permanently on their toes. Hence, while our current upside is limited as we are missing fresh data on the order intake side, the stock remains a screaming buy.

Subscribe to our blog

As contrarian born market participants, what would we buy into this quality universe with closed eye?