Rudderless Thyssenkrup best avoided still

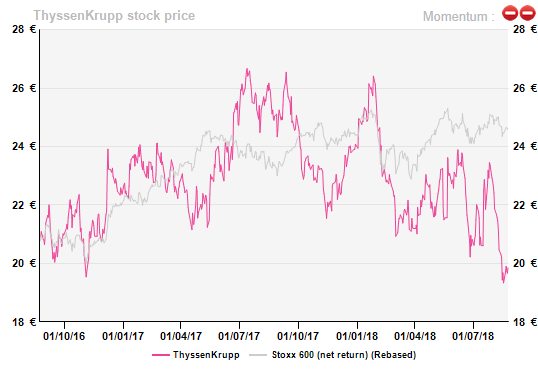

[dropcap]W[/dropcap]hat ThyssenKrupp’s management had long worked for, i.e. bringing Steel Europe into a joint-venture with Tata, has resulted in turmoil at the helm of ThyssenKrupp and a share price correction instead of an appreciation.

We see no point in rushing to buy today before the management issues are sorted out.

Shareholders initially welcomed management’s strategy, but it took very/too long before the deal eventually closed (and leaving TK saddled with some of the pension risks anyway).

Meanwhile, the steel industry’s fortunes changed which allowed Steel Europe to continue improving its profits whereas Tata’s operations came under some earnings pressure.

However, both sides had initially agreed to a merger of equals, i.e. both parties would eventually end up with each controlling 50% of the new entity thereby avoiding the full consolidation.

Just before the deal was signed, activist shareholders had argued that the 50/50 deal was not in the best interest of ThyssenKrupp. To calm opposing shareholders’ tensions, the final contract includes a clause saying that if the new activity is to be listed (this decision is at the sole discretion of ThyssenKrupp), ThyssenKrupp is entitled to 55% of the potential proceeds.

This raises the question of whether the deal is a genuine 50/50 transaction or, alternatively, whether ThyssenKrupp would not have to consolidate fully the entire new operation.

Headless

The lengthy merger procedure thus looks “incomplete”. It resulted in the sudden departure of CEO Heinrich Hiesinger. He was possibly blamed by activist shareholders Cevian (13.7%) and Elliott (<3%) and, surprisingly, also by the Krupp Foundation (20.9%) for having contributed Steel Europe at a bargain to the joint-venture.

As Supervisory Board Chairman Ulrich Lehner had also come under fire, he resigned as well. ThyssenKrupp is thus without a CEO (the former CFO was made a temporary CEO) and the temporary Board Chairman is Markus Grolms, a union representative.

As a result, shareholders are currently in a minority position on the Board. Problems at the helm need to be solved first before the value in the asset portfolio can be polished up.

We have de-consolidated Steel Europe from the group’s accounts as did ThyssenKrupp with its June 2018 accounts. Weird as it may seem, Steel Europe contributes a sizeable profit through discontinued operations this year while we assume at-equity profits from next year onward.

The group’s new Q3 P&L (to 30/06), i.e. excluding Steel Europe in both last and this year, shows an 86% EBIT fall to €35m. For the 9M18 the decrease is 26% to €501m. Simultaneously, pension provisions fell by €3.7bn to €4.2bn since the beginning of the current fiscal year whereas net debt almost doubled to €3.7bn.

It is happy that the new group’s balance sheet is made lighter by the magic wand of externalised pension obligations but the EBIT mediocrity of the new perimeter leaves it trading at 20x on an EV/EBIT basis.

Such a hefty multiple assumes that the 50% owned in Steel is worth €3.1bn. If it ever has to be written down (say on higher pension obligations…) then the EV multiple will be even steeper.

What is TK all about?

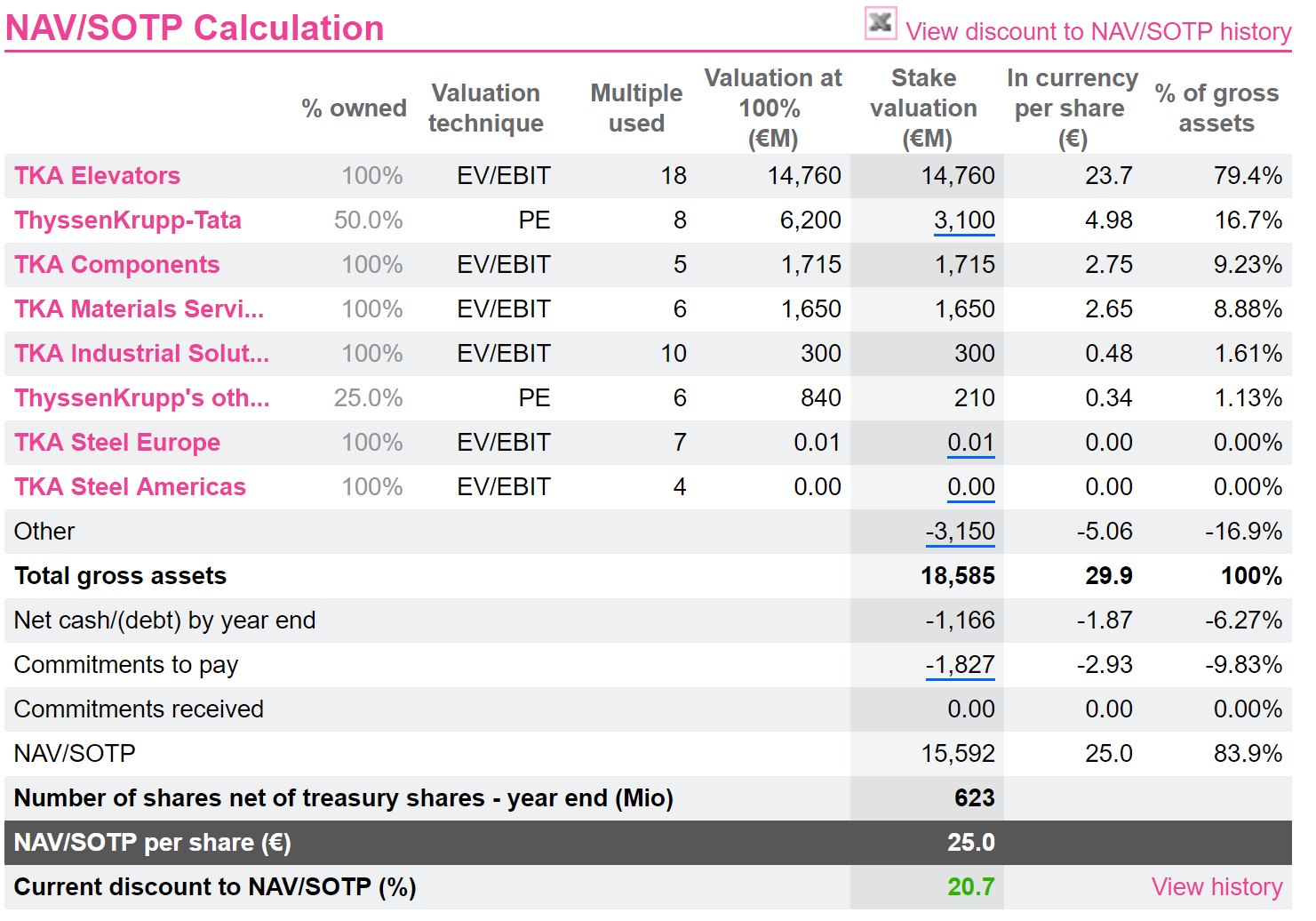

Which brings forward the issue of what ThyssenKrupp is all about. Still booked as a steel stock in most analyses (including ours), it is essentially a holding company with a dominant industrial wrap up. Our breakdown below shows that this holding company profile is made confusing by the high proportion of liabilities. A more traditional view is that new ThyssenKrupp is nothing but the next Schindler or Kone once it finds a management with opened eyes.

Shareholders initially welcomed management’s strategy, but it took very/too long before the deal eventually closed (and leaving TK saddled with some of the pension risks anyway).

Meanwhile, the steel industry’s fortunes changed which allowed Steel Europe to continue improving its profits whereas Tata’s operations came under some earnings pressure.

However, both sides had initially agreed to a merger of equals, i.e. both parties would eventually end up with each controlling 50% of the new entity thereby avoiding the full consolidation.

Just before the deal was signed, activist shareholders had argued that the 50/50 deal was not in the best interest of ThyssenKrupp. To calm opposing shareholders’ tensions, the final contract includes a clause saying that if the new activity is to be listed (this decision is at the sole discretion of ThyssenKrupp), ThyssenKrupp is entitled to 55% of the potential proceeds.

This raises the question of whether the deal is a genuine 50/50 transaction or, alternatively, whether ThyssenKrupp would not have to consolidate fully the entire new operation.

Headless

The lengthy merger procedure thus looks “incomplete”. It resulted in the sudden departure of CEO Heinrich Hiesinger. He was possibly blamed by activist shareholders Cevian (13.7%) and Elliott (<3%) and, surprisingly, also by the Krupp Foundation (20.9%) for having contributed Steel Europe at a bargain to the joint-venture.

As Supervisory Board Chairman Ulrich Lehner had also come under fire, he resigned as well. ThyssenKrupp is thus without a CEO (the former CFO was made a temporary CEO) and the temporary Board Chairman is Markus Grolms, a union representative.

As a result, shareholders are currently in a minority position on the Board. Problems at the helm need to be solved first before the value in the asset portfolio can be polished up.

We have de-consolidated Steel Europe from the group’s accounts as did ThyssenKrupp with its June 2018 accounts. Weird as it may seem, Steel Europe contributes a sizeable profit through discontinued operations this year while we assume at-equity profits from next year onward.

The group’s new Q3 P&L (to 30/06), i.e. excluding Steel Europe in both last and this year, shows an 86% EBIT fall to €35m. For the 9M18 the decrease is 26% to €501m. Simultaneously, pension provisions fell by €3.7bn to €4.2bn since the beginning of the current fiscal year whereas net debt almost doubled to €3.7bn.

It is happy that the new group’s balance sheet is made lighter by the magic wand of externalised pension obligations but the EBIT mediocrity of the new perimeter leaves it trading at 20x on an EV/EBIT basis.

Such a hefty multiple assumes that the 50% owned in Steel is worth €3.1bn. If it ever has to be written down (say on higher pension obligations…) then the EV multiple will be even steeper.

What is TK all about?

Which brings forward the issue of what ThyssenKrupp is all about. Still booked as a steel stock in most analyses (including ours), it is essentially a holding company with a dominant industrial wrap up. Our breakdown below shows that this holding company profile is made confusing by the high proportion of liabilities. A more traditional view is that new ThyssenKrupp is nothing but the next Schindler or Kone once it finds a management with opened eyes.

Indeed, the real question is who is going to be at the helm? Will the foundation and the employees stick to their latest statements that the current setup will prevail (call it a holding company and a good case for a discount to net assets) or will activist shareholders succeed and streamline the business to narrow it down to an elevator company and money back to shareholders as soon as it can rid itself of the Steel business?

It may be in the interest of the Alfried Krupp-Stiftung not to go the activist way as the foundation’s raison d’être is to protect its income generation in the shape of a balanced and low risk portfolio.

Raising the management question means that the issue is not sorted. With the current balance of power, it will be extremely difficult to find a new board chairman whose first priority will be to find a new CEO to execute a strategy that pleases the Foundation and the “pirates”.

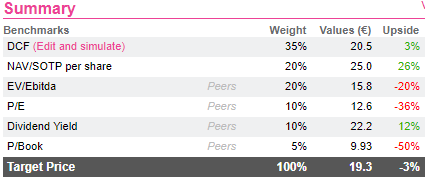

We certainly do not have an answer yet and choose to stay away as there is no sufficient upside to justify taking the risk.

Indeed, the real question is who is going to be at the helm? Will the foundation and the employees stick to their latest statements that the current setup will prevail (call it a holding company and a good case for a discount to net assets) or will activist shareholders succeed and streamline the business to narrow it down to an elevator company and money back to shareholders as soon as it can rid itself of the Steel business?

It may be in the interest of the Alfried Krupp-Stiftung not to go the activist way as the foundation’s raison d’être is to protect its income generation in the shape of a balanced and low risk portfolio.

Raising the management question means that the issue is not sorted. With the current balance of power, it will be extremely difficult to find a new board chairman whose first priority will be to find a new CEO to execute a strategy that pleases the Foundation and the “pirates”.

We certainly do not have an answer yet and choose to stay away as there is no sufficient upside to justify taking the risk.

To access the full report : click here

To access the full report : click here

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...