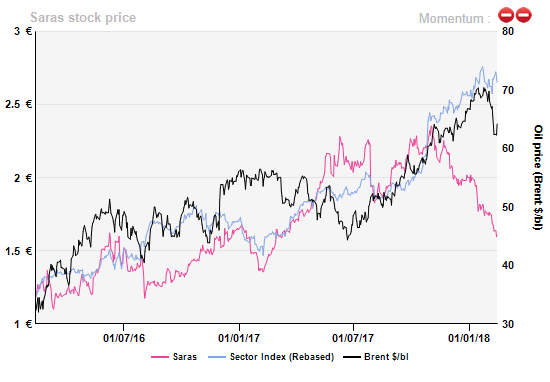

Saras oversold ?

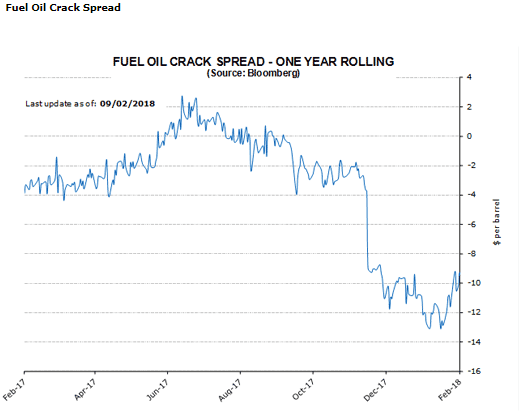

[dropcap]S[/dropcap]aras has slumped almost 20% since the opening of the year. The heavy fuel oil crack spread, a structural loss-making but minor side of the refining business, fell from a short-lived $2/bbl to a more normal -$13/bbl (see chart at the end). This may have broken nerves as it came on top of lower gasoline demand. Both have dragged down Saras benchmark margin, which hit a three-year bottom (-$0.6/bbl) over Q1 18. Since early February 2018, margins have picked up and may justify looking again at the refiner.

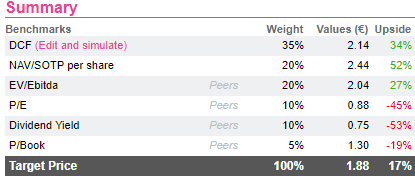

We concentrate here on the refining boom/bust outlook as the other essential business of Saras, power generation, is a steady contributor to earnings. Our figures (table below) take a cautious view of refining (with therefore much upside risk) so that power generation may indeed account for 2/3rds of the 2018 and 2019 EBITA and should provide a valuation floor at about 2/3rds of the current market cap or say €1.1/share.

We concentrate here on the refining boom/bust outlook as the other essential business of Saras, power generation, is a steady contributor to earnings. Our figures (table below) take a cautious view of refining (with therefore much upside risk) so that power generation may indeed account for 2/3rds of the 2018 and 2019 EBITA and should provide a valuation floor at about 2/3rds of the current market cap or say €1.1/share.

Gasoline inventory rebuilt

Oil product demand remained healthy in 2017, with diesel running slightly ahead of gasoline. US gasoline inventories have been rebuilt by Q1 18 after a significant slump due to hurricanes. European gasoline inventory started to climb as a result from Q1 18, pressuring Saras’ gasoline crack spreads which dropped around $6/bbl by Q1 18 from its peak of $22/bbl last September. This is obviously fully priced in. We expect global gasoline demand to stick to historical averages due to the strong demand in Asia and increasing demand in Latin America. Hopefully this would mean that gasoline crack spreads should not plunge much more.

“Diesel Gate” may not be a pain

European diesel demand is significantly impacted by automotive demand. In the EU, more than 41% of cars were powered by diesel before the “Diesel Gate “scandal, whereby NOx emissions have been grossly underestimated at the expense of public health. Since then, pro Diesel European countries have taken restricting measures to the use of diesel engines, starting with higher duties on the fuel itself. European diesel demand should erode from 2018 with a degree of offset stemming from gasoline. This may not be a net negative as Asia at large is short of diesel meaning that any European excess should find a market and European refiners were anyway complaining historically about the costs to them of matching an unbalanced market (too much demand for diesel, not enough for gasoline).

Bunker fuels emission cap

As previously mentioned, the IMO (International Maritime Organization) requires a global sulphur cap of 0.5% on marine fuels from January 2020 (vs. current limit of 3.5%). Considering that 71% of heavy fuel consumption comes from shipping, and that solutions like “Scrubbers” (exhaust gas cleaning system) or LNG are still expensive, this emission constraint should boost demand significantly for middle distillates. Saras hints that it has already engaged ad hoc capital spending to upgrade their hydrocrackers so as to meet IMO regulation.

Less heavy sources

Saras has developed an expertise in going for heavy crudes which are rather more difficult to refine and thus sell at a discount. The heavy-sour and light-sweet differential is part and parcel of Saras’ margins over its “EMC Benchmark”. However, the current light-sweet/heavy-sour price differential has shrunk due to the OPEC production cut and the relative increase of light sweet supply (mainly driven by increasing production in the US, followed by Libya and Nigeria). In the short term, only Iranian feedstocks meet Saras' preference for extracting more from cheap and heavier crudes meaning that the gap between light and heavy is not ideal. Things are expected to revert to a more “normal” balance partly because of the new IMO sulphur caps but this is not a foregone conclusion if the US output surge swamps the market with light crudes. Obviously the jury is always out on the issues of feedstock balance.

Fast buck

Our valuation remains cautious, owing to the lack of visibility and inevitable volatility on refining at large. Low short-term margins expectations reflect the abundant supply of light crude but the spring maintenance cycle of global refiners is coming with several significant planned shutdowns at Middle Eastern refiners. By contrast, Saras benefits from recently updated plant and relies on a strong balance sheet. Any turnaround in the feedstock balance should percolate quickly enough to its bottom line. Not for the faint-hearted but worth a look and there is no share overhang since Rosneft departed in early 2017.

Gasoline inventory rebuilt

Oil product demand remained healthy in 2017, with diesel running slightly ahead of gasoline. US gasoline inventories have been rebuilt by Q1 18 after a significant slump due to hurricanes. European gasoline inventory started to climb as a result from Q1 18, pressuring Saras’ gasoline crack spreads which dropped around $6/bbl by Q1 18 from its peak of $22/bbl last September. This is obviously fully priced in. We expect global gasoline demand to stick to historical averages due to the strong demand in Asia and increasing demand in Latin America. Hopefully this would mean that gasoline crack spreads should not plunge much more.

“Diesel Gate” may not be a pain

European diesel demand is significantly impacted by automotive demand. In the EU, more than 41% of cars were powered by diesel before the “Diesel Gate “scandal, whereby NOx emissions have been grossly underestimated at the expense of public health. Since then, pro Diesel European countries have taken restricting measures to the use of diesel engines, starting with higher duties on the fuel itself. European diesel demand should erode from 2018 with a degree of offset stemming from gasoline. This may not be a net negative as Asia at large is short of diesel meaning that any European excess should find a market and European refiners were anyway complaining historically about the costs to them of matching an unbalanced market (too much demand for diesel, not enough for gasoline).

Bunker fuels emission cap

As previously mentioned, the IMO (International Maritime Organization) requires a global sulphur cap of 0.5% on marine fuels from January 2020 (vs. current limit of 3.5%). Considering that 71% of heavy fuel consumption comes from shipping, and that solutions like “Scrubbers” (exhaust gas cleaning system) or LNG are still expensive, this emission constraint should boost demand significantly for middle distillates. Saras hints that it has already engaged ad hoc capital spending to upgrade their hydrocrackers so as to meet IMO regulation.

Less heavy sources

Saras has developed an expertise in going for heavy crudes which are rather more difficult to refine and thus sell at a discount. The heavy-sour and light-sweet differential is part and parcel of Saras’ margins over its “EMC Benchmark”. However, the current light-sweet/heavy-sour price differential has shrunk due to the OPEC production cut and the relative increase of light sweet supply (mainly driven by increasing production in the US, followed by Libya and Nigeria). In the short term, only Iranian feedstocks meet Saras' preference for extracting more from cheap and heavier crudes meaning that the gap between light and heavy is not ideal. Things are expected to revert to a more “normal” balance partly because of the new IMO sulphur caps but this is not a foregone conclusion if the US output surge swamps the market with light crudes. Obviously the jury is always out on the issues of feedstock balance.

Fast buck

Our valuation remains cautious, owing to the lack of visibility and inevitable volatility on refining at large. Low short-term margins expectations reflect the abundant supply of light crude but the spring maintenance cycle of global refiners is coming with several significant planned shutdowns at Middle Eastern refiners. By contrast, Saras benefits from recently updated plant and relies on a strong balance sheet. Any turnaround in the feedstock balance should percolate quickly enough to its bottom line. Not for the faint-hearted but worth a look and there is no share overhang since Rosneft departed in early 2017.

Fuel oil crack spreads

Fuel oil crack spreads

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...