Schneider Electric: Tale Unchanged Despite Change of Guard

The article discusses the recent developments in Schneider Electric, particularly the announcement of the CEO's departure and the appointment of a new one. The article also talks about the company's portfolio and its position among its peers, as well as its target to become a company of 25. Additionally, the article discusses the company's long-term drivers of electrification and automation and how it is ideally placed to generate both stakeholder and shareholder value.

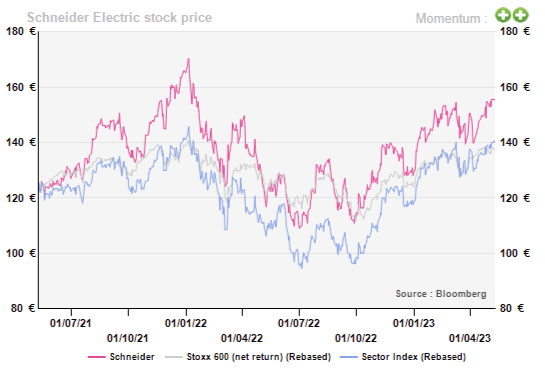

Poring over the performance of Schneider Electric since we last teased about it might give the reader the impression that its peers seem to be doing better. And they would not be totally amiss here as both Siemens and ABB have sent positive signals in the market of late. Siemens did so through its strong FY23 outlook, followed by an upgrade and ABB by solidly marching towards its profitability (EBITA) margin target of at least 15%. The latter’s shares are also supported by a buyback. For Schneider Electric though, we would like the reader to perceive this lag as more of a breather after a solid bout of outperformance rather than a cause for concern. This is affirmed by the group’s outperformance of its peers over longer horizons as well as good YTD returns that are relatively superior to the index and not far from its peer group.

Schneider Electric Stock Price Momentum

JPT passes on the baton…

With its 2022 results Schneider Electric announced that Mr. Jean Pascal Tricoire, who has been leading the group for almost two decades, will step down as the group’s CEO effective 4th May 2023. This is a notable event for the group as his leadership and forward-thinking vision have been central to transforming Schneider Electric into a global leader within its sector. The strategic decisions taken by him to align the group towards the important trends in electrification and automation have resulted in a superlative portfolio of offerings that are now ready to be further scaled up. More recently, under his guidance, the group has also divested non-core operations, completed a €1.0bn cost-savings programme and rounded out its software portfolio by acquiring the remaining shares in AVEVA. So, the decision to step-down at this juncture makes sense. Moreover, this decision is a clear positive from a governance standpoint as Mr. Tricoire also held the role of Chairman of the board during his tenure. This move finally separates the two roles. Furthermore, Mr. Tricoire will continue as the Chairman of the board at least until 2025, another positive for the group’s strategy and the upcoming transition.

… to Mr. Peter Herweck

Effective 4th May 2023, Mr. Peter Herweck will assume the role of group CEO. He has around three decades of experience in electrification and automation including a 12-year long stint at Siemens, where he held executive positions in Automation, Power Distribution and Building Technologies. He joined Schneider Electric in 2016 as the Executive Vice President of Industrial Automation and Industrial Software and was appointed as the CEO of Aveva in May 2021. Looking at his background, we find his experience to be broad and extensive. Additionally, the time taken by the board (four years) to appoint him and the fact that it is an internal promotion are also positives in our view. Lastly, a neutral reaction from the market around the time of the announcement indicates that it is on board although the market may wait to take stock until the group’s CMD in Q4 2023.

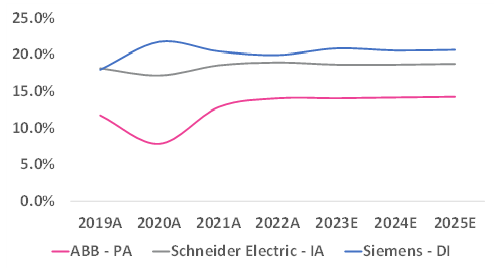

The portfolio remains as competitive as ever

Within Energy Management (77% of group revenues and 79% of adjusted EBITA, before corporate costs), Schneider Electric is a clear leader. This is evident in a margin comparison versus its peers. While some of this competitiveness comes from scale, it can also be attributed to the breadth of its portfolio, cross-selling opportunities across both Energy Management and Industrial Automation, and its strong partner network accounting for c. 60% of total group revenues. In addition, the group continues to offer training programmes for electricians and installers to familiarise themselves with the various products.

This collaboration also serves the purpose of helping the group improve its products by garnering useful feedback. These electricians and installers always value easier installation, product reliability and homogeneity, which saves them time for an item that is a small part of the overall budget. Collectively, these traits create switching costs, brand recall and pricing power, moats that are hard to replicate. On the Industrial Automation side, although we consider Siemens to be the leader, Schneider’s competitiveness is better than those of its peers in Energy Management. Also, having brought AVEVA fully into the fold, further progress in its SaaS transition can unlock margin upside in the medium-term. Hence, we consider Schneider to be a solid combination of two value-creating businesses and expect this picture to only improve barring any questionable capital allocation decisions under the new leadership.

Beyond 2024, Schneider Electric aims to be a company of 25. This means that the adjusted EBITA margin plus the organic revenue growth rate will equal 25. Here, the group’s target is to grow revenues organically by 5% or more, implying that the adjusted EBITA margin will move up from the current levels to 19% or more. In our view, part of this margin gain will come from the margin improvement at AVEVA, an improved product mix (increased penetration of software and services), portfolio optimisation and stringent control over costs.

For the top-line growth, the long-term drivers of electrification and automation are intact. Moreover, these trends are bolstered with an increased emphasis on energy efficiency, reshoring, digitalisation and sustainability. Thus, the group remains ideally placed to generate both stakeholder and shareholder value.

Energy Management margins (%)

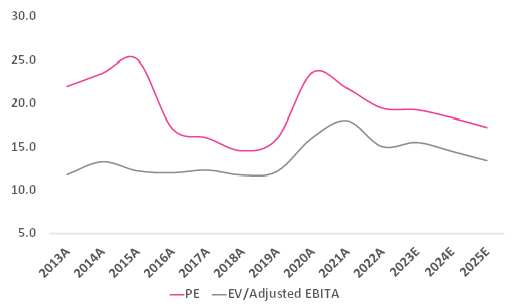

Quality assets are seldom cheap

Since 2018 Schneider Electric has been in the scale-up phase and this is reflected in the group's adjusted EBITA margin, which has expanded by more than 200bps between 2019 and 2022. This step change in margins hasn’t gone unnoticed by the market and is now also reflected in the forward P/E and EV/Adjusted EBITA ratios for the group. In other words, the market has already rerated the stock and expects the story to continue to play out. We agree with the market (part of AV’s Buy & Hold list) and believe that the group’s shares offer ownership of lucrative assets that are supported by a progressive dividend and share buybacks. As such, they are less likely to come at a bargain. While some may wait for a positive signal after the CEO transition, more enterprising investors can look to accumulate the stock.

Schneider Electric Stock Price Momentum

JPT passes on the baton…

With its 2022 results Schneider Electric announced that Mr. Jean Pascal Tricoire, who has been leading the group for almost two decades, will step down as the group’s CEO effective 4th May 2023. This is a notable event for the group as his leadership and forward-thinking vision have been central to transforming Schneider Electric into a global leader within its sector. The strategic decisions taken by him to align the group towards the important trends in electrification and automation have resulted in a superlative portfolio of offerings that are now ready to be further scaled up. More recently, under his guidance, the group has also divested non-core operations, completed a €1.0bn cost-savings programme and rounded out its software portfolio by acquiring the remaining shares in AVEVA. So, the decision to step-down at this juncture makes sense. Moreover, this decision is a clear positive from a governance standpoint as Mr. Tricoire also held the role of Chairman of the board during his tenure. This move finally separates the two roles. Furthermore, Mr. Tricoire will continue as the Chairman of the board at least until 2025, another positive for the group’s strategy and the upcoming transition.

… to Mr. Peter Herweck

Effective 4th May 2023, Mr. Peter Herweck will assume the role of group CEO. He has around three decades of experience in electrification and automation including a 12-year long stint at Siemens, where he held executive positions in Automation, Power Distribution and Building Technologies. He joined Schneider Electric in 2016 as the Executive Vice President of Industrial Automation and Industrial Software and was appointed as the CEO of Aveva in May 2021. Looking at his background, we find his experience to be broad and extensive. Additionally, the time taken by the board (four years) to appoint him and the fact that it is an internal promotion are also positives in our view. Lastly, a neutral reaction from the market around the time of the announcement indicates that it is on board although the market may wait to take stock until the group’s CMD in Q4 2023.

The portfolio remains as competitive as ever

Within Energy Management (77% of group revenues and 79% of adjusted EBITA, before corporate costs), Schneider Electric is a clear leader. This is evident in a margin comparison versus its peers. While some of this competitiveness comes from scale, it can also be attributed to the breadth of its portfolio, cross-selling opportunities across both Energy Management and Industrial Automation, and its strong partner network accounting for c. 60% of total group revenues. In addition, the group continues to offer training programmes for electricians and installers to familiarise themselves with the various products.

This collaboration also serves the purpose of helping the group improve its products by garnering useful feedback. These electricians and installers always value easier installation, product reliability and homogeneity, which saves them time for an item that is a small part of the overall budget. Collectively, these traits create switching costs, brand recall and pricing power, moats that are hard to replicate. On the Industrial Automation side, although we consider Siemens to be the leader, Schneider’s competitiveness is better than those of its peers in Energy Management. Also, having brought AVEVA fully into the fold, further progress in its SaaS transition can unlock margin upside in the medium-term. Hence, we consider Schneider to be a solid combination of two value-creating businesses and expect this picture to only improve barring any questionable capital allocation decisions under the new leadership.

Beyond 2024, Schneider Electric aims to be a company of 25. This means that the adjusted EBITA margin plus the organic revenue growth rate will equal 25. Here, the group’s target is to grow revenues organically by 5% or more, implying that the adjusted EBITA margin will move up from the current levels to 19% or more. In our view, part of this margin gain will come from the margin improvement at AVEVA, an improved product mix (increased penetration of software and services), portfolio optimisation and stringent control over costs.

For the top-line growth, the long-term drivers of electrification and automation are intact. Moreover, these trends are bolstered with an increased emphasis on energy efficiency, reshoring, digitalisation and sustainability. Thus, the group remains ideally placed to generate both stakeholder and shareholder value.

Energy Management margins (%)

Quality assets are seldom cheap

Since 2018 Schneider Electric has been in the scale-up phase and this is reflected in the group's adjusted EBITA margin, which has expanded by more than 200bps between 2019 and 2022. This step change in margins hasn’t gone unnoticed by the market and is now also reflected in the forward P/E and EV/Adjusted EBITA ratios for the group. In other words, the market has already rerated the stock and expects the story to continue to play out. We agree with the market (part of AV’s Buy & Hold list) and believe that the group’s shares offer ownership of lucrative assets that are supported by a progressive dividend and share buybacks. As such, they are less likely to come at a bargain. While some may wait for a positive signal after the CEO transition, more enterprising investors can look to accumulate the stock.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...