STELLANTIS: How Sustainable are These Margins?

Stellantis shares had a formidable run over the past twelve months, unlike most of its peers, and so did its profitability. Such premium-OEM-like margins with about 3x the volumes of BMW and Mercedes-Benz Group trigger the million-dollar question: how sustainable is it? Its remaining firepower in terms of synergies, a favourable geographical mix and performance driven management supporting quick decision-making and cost flexibility could be a solid enough answer.

We also expect a sea-change as the automotive industry evolves towards the EV world and would not presume to claim that Stellantis is on the right track. However, in our view, the company is showing that it has the legs to dodge obstacles, which could ultimately be the winning configuration – and a key argument supporting our current preference for the stock.

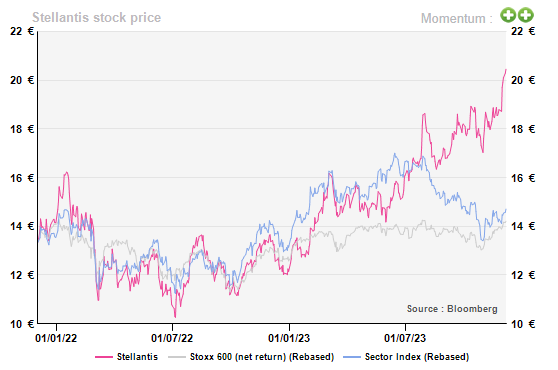

Stellantis share price momentum

How sustainable are these margins?

“Double-digit adjusted operating income margin” has become the base case guidance for Stellantis from its first day of listing in January 2021. While the group’s admittedly ambitious 2030-horizon plan factors a prolongation of this 10% margin floor until 2027 (12% from 2030), this stickiness is resulting from conflicting underlying trends:

We believe that the latter synergies are the most underestimated part of the plan, certainly because it goes far beyond the foreseeable cost avoidance of having a unique headquarter instead of two, and far beyond a 5-year-post-merger-horizon. The Renault-Nissan alliance is a good example of how the synchronisation of product cycles can take time with a creation of their alliance in 1999 and a first common platform released in 2015.

Frontrunner on Tesla’s (future) core market

Stellantis broke the €25k BEV barrier in pole position! The company introduced last month its Citroen ë-C3 with an announced starting price of €23.3k before allowing for ecological subsidies. The car features an LFP battery (read “a cheaper but less performant battery chemistry widely used in the Chinese market”) and a 320km range. Its launch is scheduled for H2 24. Another version will be launched by 2025 starting below the €20k price barrier. This looks a serious answer to the coming Chinese competition, which, on the other hand, is struggling not to go bankrupt with the risk of kamikaze price cuts. Tesla has yet to reveal its people’s car, which is the key milestone of its volume-oriented strategy – and of its $700bn+ market cap.

Stellantis makes the leap in China

Stellantis is having a Chinese moment as the group is acquiring 20% of the Chinese EV start-up Leapmotor for €1.5bn. This echoes VW’s €700m investment in 5% of Xpeng earlier this year. Stellantis’ CFO also stipulated that there are no plans to leverage Leapmortor’s platform to Stellantis’ other brands, which looks like a clear mark of confidence in the company’s homemade BEV platform (hardware + software) capabilities.

An equity story calling for better trading multiples than VW’s

While our DCF-based valuation fairly reflects the upside potential of Stellantis achieving its 2021-30 plan, most of our valuation methodologies confirm the undervaluation of the stock, even after allowing for the industry's dismal multiples. With the Agnelli and Peugeot families on board as long-term supporters, and Carlos Tavares in the driving seat with his remarkable track record at the helm of PSA from 2014, the governance structure certainly matches the world challenge faced by the company. Nevertheless, keep an eye on the controversies around the CEO’s remuneration package when talks on job cuts in the sector inevitably pair with the EV transition.

For now, Stellantis may have demonstrated that European car manufacturers can successfully adapt to a brave new EV world even on the volume side of the business. At least, this is what the invisible hand is telling us. Fingers crossed.

To access the full research, please contact us at sales@alphavalue.eu

We also expect a sea-change as the automotive industry evolves towards the EV world and would not presume to claim that Stellantis is on the right track. However, in our view, the company is showing that it has the legs to dodge obstacles, which could ultimately be the winning configuration – and a key argument supporting our current preference for the stock.

Stellantis share price momentum

How sustainable are these margins?

“Double-digit adjusted operating income margin” has become the base case guidance for Stellantis from its first day of listing in January 2021. While the group’s admittedly ambitious 2030-horizon plan factors a prolongation of this 10% margin floor until 2027 (12% from 2030), this stickiness is resulting from conflicting underlying trends:

- the headwinds from lower profitability BEVs enhanced by the price pressure from new entrants,

- the tailwinds from its geographic exposure with the US and the so-called “third engine” region (MEA + LATAM + APAC) recording Porsche-like adjusted EBIT margins of 17.5% and 18.1% in H1 23, respectively, and

- the synergies between ex-FCA and ex-PSA brands.

We believe that the latter synergies are the most underestimated part of the plan, certainly because it goes far beyond the foreseeable cost avoidance of having a unique headquarter instead of two, and far beyond a 5-year-post-merger-horizon. The Renault-Nissan alliance is a good example of how the synchronisation of product cycles can take time with a creation of their alliance in 1999 and a first common platform released in 2015.

Frontrunner on Tesla’s (future) core market

Stellantis broke the €25k BEV barrier in pole position! The company introduced last month its Citroen ë-C3 with an announced starting price of €23.3k before allowing for ecological subsidies. The car features an LFP battery (read “a cheaper but less performant battery chemistry widely used in the Chinese market”) and a 320km range. Its launch is scheduled for H2 24. Another version will be launched by 2025 starting below the €20k price barrier. This looks a serious answer to the coming Chinese competition, which, on the other hand, is struggling not to go bankrupt with the risk of kamikaze price cuts. Tesla has yet to reveal its people’s car, which is the key milestone of its volume-oriented strategy – and of its $700bn+ market cap.

Stellantis makes the leap in China

Stellantis is having a Chinese moment as the group is acquiring 20% of the Chinese EV start-up Leapmotor for €1.5bn. This echoes VW’s €700m investment in 5% of Xpeng earlier this year. Stellantis’ CFO also stipulated that there are no plans to leverage Leapmortor’s platform to Stellantis’ other brands, which looks like a clear mark of confidence in the company’s homemade BEV platform (hardware + software) capabilities.

An equity story calling for better trading multiples than VW’s

While our DCF-based valuation fairly reflects the upside potential of Stellantis achieving its 2021-30 plan, most of our valuation methodologies confirm the undervaluation of the stock, even after allowing for the industry's dismal multiples. With the Agnelli and Peugeot families on board as long-term supporters, and Carlos Tavares in the driving seat with his remarkable track record at the helm of PSA from 2014, the governance structure certainly matches the world challenge faced by the company. Nevertheless, keep an eye on the controversies around the CEO’s remuneration package when talks on job cuts in the sector inevitably pair with the EV transition.

For now, Stellantis may have demonstrated that European car manufacturers can successfully adapt to a brave new EV world even on the volume side of the business. At least, this is what the invisible hand is telling us. Fingers crossed.

To access the full research, please contact us at sales@alphavalue.eu

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.