Telecoms Without A 'K'

Drop Deutsche Telekom, that quintessential member of the US telecom oligopoly, and the 20 telcos stocks covered by AlphaValue have gained 28% ytd, not bad for a sleepy sector. Looking more closely, the performance was driven by Ses, Eutelat, Telecom Italia, Millicom and United Internet i.e. issuers that most investors will not pay attention to. After the 28% gain, there is another 14% left to go for.

What has turned defensive telcos into racehorses remains elusive beyond the agreed upon fact that they repay their debts, including on their fibre investment, pay decent dividends, and hope to see a turn in Europe’s pro-competition stance that prevented them from taking any initiative over the last 20 years. Tomato prices have gone up in Europe, not the 4-play subscriptions.

Deutsche Telekom encapsulates neatly the EU telco conundrum. Its €148bn market cap is largely owed to its 52% stake in T-Mobile, worth €110bn. The next biggest guy in telco town is French Orange (€36bn), which is now narrowed down to a very French proposition, following which comes Swiss supercentric Swisscom (CHF30bn), only now testing Italian waters.

Below is the 5-year performance of the Telcos ex DT, a 20-strong European cohort. It is set against the Stoxx600. It was not a brilliant trade. The recovery since late February 2025 was impressive, but from September, seems to have already petered out.

Telcos at lasting pain vs. the Stoxx600 (5 years)

Are Telcos already expensive?

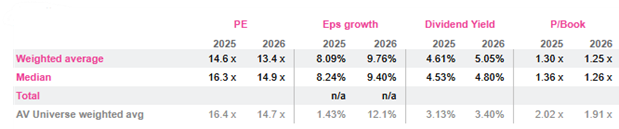

No, as per the following valuation table excluding DT. The very decent yield matches the low PEs, but the surprise is earnings growth over 2025 and 2026. Trumpian uncertainty has been beneficial.

For the record, the above table is hardly impacted by the integration of DT.

The good news is that 2025 earnings have not suffered downgrades as steeply as those seen in industrials. The limited cuts have to do with FX matters in high inflation economies like Brazil. The collapse of the greenback is only a reporting issue for DT.

The above relative performance chart translates into a Telco weakness what is primarily a Stoxx600 strength. This brings to the fore the age-old issue of risk aversion with 3 options:

- AI bulls need no telcos of course

- AI bears should be long telcos ex DT and hopefully find a way to escape the worst of the AI bubble crash

- Go long DT and Short T-Mobile as a bet on Europe finding its own Telco dynamic through the proxy of a DT narrowed down to Germany, Central Europe, Greece etc.

What has turned defensive telcos into racehorses remains elusive beyond the agreed upon fact that they repay their debts, including on their fibre investment, pay decent dividends, and hope to see a turn in Europe’s pro-competition stance that prevented them from taking any initiative over the last 20 years. Tomato prices have gone up in Europe, not the 4-play subscriptions.

Deutsche Telekom encapsulates neatly the EU telco conundrum. Its €148bn market cap is largely owed to its 52% stake in T-Mobile, worth €110bn. The next biggest guy in telco town is French Orange (€36bn), which is now narrowed down to a very French proposition, following which comes Swiss supercentric Swisscom (CHF30bn), only now testing Italian waters.

Below is the 5-year performance of the Telcos ex DT, a 20-strong European cohort. It is set against the Stoxx600. It was not a brilliant trade. The recovery since late February 2025 was impressive, but from September, seems to have already petered out.

Telcos at lasting pain vs. the Stoxx600 (5 years)

Are Telcos already expensive?

No, as per the following valuation table excluding DT. The very decent yield matches the low PEs, but the surprise is earnings growth over 2025 and 2026. Trumpian uncertainty has been beneficial.

For the record, the above table is hardly impacted by the integration of DT.

The good news is that 2025 earnings have not suffered downgrades as steeply as those seen in industrials. The limited cuts have to do with FX matters in high inflation economies like Brazil. The collapse of the greenback is only a reporting issue for DT.

The above relative performance chart translates into a Telco weakness what is primarily a Stoxx600 strength. This brings to the fore the age-old issue of risk aversion with 3 options:

- AI bulls need no telcos of course

- AI bears should be long telcos ex DT and hopefully find a way to escape the worst of the AI bubble crash

- Go long DT and Short T-Mobile as a bet on Europe finding its own Telco dynamic through the proxy of a DT narrowed down to Germany, Central Europe, Greece etc.

Subscribe to our blog

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...