Time To Book Defence Profits?

The AlphaValue coverage of Aerospace & Defence was bound to become defence driven as we suggested … 2 years ago. It happened.

Still the sector is off to a surprisingly strong 2026 start. Non Ukrainian defence matters led the sector up 12.5% ytd (to 9-01 close), while the AlphaValue coverage does not even allow for Saab up 30% ytd, nor Hensoldt up 26%.

Defence surge

Having Maduro sharing a bed in a US jail, kicking the Danes out of Greenland, or seizing a rusted Russian tanker on the high seas, is not enough of a trigger for such a bout of enthusiasm. Conversely peace talks in Ukraine, while dragging, are not entirely dead, and should have acted as a cooler. They seem to be forgotten for now.

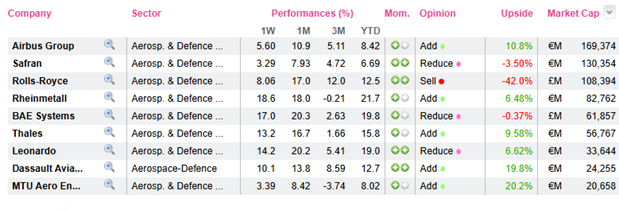

One wonders why the sector should be trading at 31x its 2026 earnings. It assumes that the 21% earnings growth is safe (see next table). This implies superb execution in a sector known for repeatedly falling by the wayside.

Aerospace & Defence valuation essentials

When the sector PE moved from 15x to 25x by late 2024 we were supportive of taking the risk. At 31x for 2026, there may be a case for cashing out, at least partially.

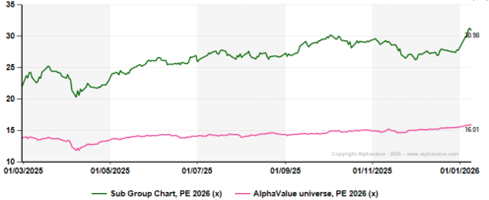

2026 Aerospace & Defence PE (green) vs. market PE (pink) – last 9 months

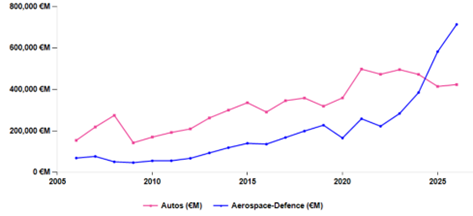

And this chart comparing the market cap of Autos (pink) and A&D (blue) will also speak for itself.

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airbus as a structural holding, it is clear that booking profits on Rolls-Royce and Rheinmetall are good starting points.

Still the sector is off to a surprisingly strong 2026 start. Non Ukrainian defence matters led the sector up 12.5% ytd (to 9-01 close), while the AlphaValue coverage does not even allow for Saab up 30% ytd, nor Hensoldt up 26%.

Defence surge

Having Maduro sharing a bed in a US jail, kicking the Danes out of Greenland, or seizing a rusted Russian tanker on the high seas, is not enough of a trigger for such a bout of enthusiasm. Conversely peace talks in Ukraine, while dragging, are not entirely dead, and should have acted as a cooler. They seem to be forgotten for now.

One wonders why the sector should be trading at 31x its 2026 earnings. It assumes that the 21% earnings growth is safe (see next table). This implies superb execution in a sector known for repeatedly falling by the wayside.

Aerospace & Defence valuation essentials

When the sector PE moved from 15x to 25x by late 2024 we were supportive of taking the risk. At 31x for 2026, there may be a case for cashing out, at least partially.

2026 Aerospace & Defence PE (green) vs. market PE (pink) – last 9 months

And this chart comparing the market cap of Autos (pink) and A&D (blue) will also speak for itself.

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airbus as a structural holding, it is clear that booking profits on Rolls-Royce and Rheinmetall are good starting points.

Subscribe to our blog

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhy...

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...