Turbulent times for Altice – good news for telcos?

The Altice corruption probe stems from Altice Portugal. Altice’s co-founder, Armando Pereira, stands accused by the Portuguese authorities of fraudulent behaviour and money laundering. Altice has acknowledged the accusations and resulting investigation in a statement in which it presented itself as the victim of any fraud by an individual. The extent of the fraud seems too deep to have gone unnoticed though. The ongoing scandal has triggered the suspension of a number of key people connected with the group in recent days. Any knock-out impact on Altice has implications for European telcos and the competitive balance.

AlphaValue’s current sources on the subject are press articles in l’Informé, Les Echos, and Mediapart, all with reference to the ongoing investigation in Portugal.

Legal entities which matter include the following:

Next Alt Sarl is the holding of Patrick Drahi which controls Next Private BV and Altice Luxembourg.

Altice France Holding is a limited liability corporation incorporated in the Grand Duchy of Luxembourg with headquarters in Luxembourg. The company is controlled by Altice Luxembourg. The ultimate controlling shareholder of Altice Luxembourg is Next Alt which is itself controlled by Mr Patrick Drahi. Altice France Holding holds 100% of the capital of Altice France SA minus one share held by Altice Luxembourg.

Altice International is a limited liability corporation incorporated in the Grand Duchy of Luxembourg with headquarters in Luxembourg. The company is a wholly-owned subsidiary of Altice Luxembourg. As of 30 September 2022, Next Alt indirectly held 90.2% of the share capital of Altice International (we assume Altice Luxembourg is 90.2% owned by Next Alt but could also be held by Next Private BV).

Altice UK is fully owned by Patrick Drahi but we don’t know how.

Next (Next Alt ?), the private holding company of Patrick Drahi had announced in September 2020 a public offer on the capital of Altice Europe (at this time Altice France + Altice International) at €4.11 in cash per share (valuing Altice at €4.9bn). Next announced in December a sharp increase in its offer price from €4.11 to €5.35 in cash (€5.7bn). The Next concert owned 52% of Altice Europe in 2018 post the split from Altice USA and 77% after the first public offer. Altice Europe was delisted at the beginning of 2021.

Drahi’s empire as we know it today

- Altice France (ex SFR):

o €11.3bn revenues (2022) with a 44% EBITDA margin (36% in terms of EBITDAaL) and net debt (including €6bn of leases) of c.€29bn corresponding to 5.65x its EBITDA (€4.95bn). The group did not distribute dividends during the year 2022.

o The group owns 50.01% of XpFibre (the balance worth €1.8bn in 2019 is owned by a consortium led by OMERS Infrastructure, AXA IM – Real Assets and Allianz Capital Partners). XpFibre is the largest alternative FTTH infrastructure wholesale operator in France with 2.6m lines.

o Altice France towers have been sold to Cellnex (10k sites for €5.2bn).

o The meeting of the Board on 29 April 2021 approved an exceptional dividend distribution of €4.56bn.

- Altice International with two main subsidiaries MEO-Altice Portugal and HOT-Altice Israël:

o €5.05bn revenues (2022) with a 38.5% EBITDA margin (35.6% in terms of EBITDAaL) and net debt (including €1bn of leases) of €9.7bn corresponding to 5x its EBITDA. The group did not distribute dividends for 2021 in 2022.

o Portugal: €2.63bn revenues with a 34.5% EBITDA margin. The group owns 50% of Altice Portugal FTTH (with Morgan Stanley Infra for the other 50%) and sold its 3k towers (OMTEL) in two steps in 2018 and 2021 to Horizon Equity and Morgan Stanley Infra.

o Israël: €1.2bn of revenues with a 34% margin

o Dominican Republic: €600m with a 52% margin

- Altice UK:

o Drahi first bought into BT in mid-2021. Altice UK currently holds 24.5% of BT. We believe that the loss on that holding to be close to £1.1bn.

o The last we heard was that Drahi was interested in raising his stake in BT to as much as 29.9%, the highest he could have without triggering a mandatory takeover offer under UK market rules. The CEO of BT, Philip Jansen, has announced he is stepping down so BT has a leaving leader over the next few months when its shareholding could move significantly. Following Altice, the main shareholder is Deutsche Telekom which still owns 12% of the group. As a foot note, remember that by the end of 2021 there were rumours that Reliance Industries was considering a bid for BT (according to the Indian Economic Times).

- Altice USA (now a quasi-independent entity from Drahi’s empire):

o Revenues of €9.65bn with a 40% EBITDA margin and net debt (including leases) of $27bn (6.95 x EBITDA)

o Listed with 455m shares at $3.35 ($1.52bn)

o Next Private BV (held Next Alt) is the first shareholder with only 12.33%, The Vanguard Group owns 8.3%, Mr Dexter Goei 3.45% and Mr Patrick Drahi 2.35% ($35m)

- Vodafone announced in March that it has completed the sale of 50% of its German FTTH company to ‘Altice’ (unknown sub entity). FibreCo will deploy FTTH to up to 7m homes in Germany over a 6-year period. Over the roll-out period, FibreCo intends to invest up to c.€7bn, which will be partly financed by debt that will be non-recourse to Vodafone and Altice. Total debt facilities of up to €4.6bn have been arranged with a group of leading financial institutions to support the network deployment.

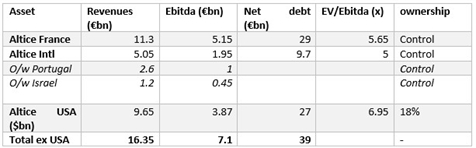

A summary and approximate table of Mr Drahi’s holdings and debt (by transparency of holding companies) would be the following:

Altice USA is only c.18% controlled so that in effect its debts are not a Drahi Empire’s risk. In addition, Altice USA is the 4th cable operator in the US. It owns two cable operators Suddenlink (Texas) and Cablevision (New York) so that its local asset base is deemed to cover its debt. This is what its $1.5bn market cap is implying anyway (divided by 10 since the mid-2017 listing)

Mr Drahi’s telco interests total c. €43bn in net debt, including the financing of the BT holding. At current industry multiples (5.5× 2023 EBITDA), the EV is less than €40bn so that the equity value is negative at c.€3bn.

For the debt castle to stand upright a bit longer, the Altice units need the support of their lenders and bankers. Their confidence is clearly shaken by the Portuguese crisis which suggests that nobody at Altice, its auditors and lenders had seen a corruption loop at the expense of Altice at large (suppliers overcharging and paying kickbacks to senior managers’ holding companies in tax free jurisdictions). That corruption loop may have extended to Altice France according to investigations mentioned in the media.

Altice’s debt is trading at a widening discount (10% to 40%) to par that expanded brutally when the news started to crop up 10 days ago. The prime issue is what can Altice do to keep on servicing its debts. The default strategy would be to protect its cash flows, i.e. raise its prices.

Impact

We thus contemplate a scenario of a much weakened Altice with positive implications for the following companies

- French telcos: SFR/Altice will need to ramp up their prices to meet their debt repayment obligations. This is good news for Bouygues SA, Orange and Iliad. Iliad is not listed but a stronger French contribution will come in handy to fund its Italian expansion (so may be not great news for Telcom Italia).

Orange’s service revenues, in France, are currently at €11bn per year so that a 1% increase (€100m) could boost the global French EBIT (excluding Enterprise) by 4%. As for Bouygues Service, revenues are €5.75bn per year so that a 1% increase (€55m) could boost its EBIT by 8%.

- Portuguese telcos: Sonae which owns 36% of listed NOS (not covered) can only be delighted to face a weaker Altice Portugal. NOS (ex Portugal Telecom) has 4.6m subscribers, while Altice Portugal has 6m.

- BT: the 24% stake is presumably up for sale which is likely to have a wide echo for the UK telco industry, already experiencing a difficult competition balancing. Deutsche Telekom with 12% of BT was not a buyer but may change its mind at crashed prices. This would imply going for 100%, however with rather complex strategic implications around Openreach (the heart of BT’s valuation)

- Vodafone: a possibility is that Altice exits its German fibre JV with Vodafone so that Vodafone would be left with the hot potato. Not an easy projection as Vodafone is intending to straighten up its finances.

- US Assets: it would be surprising if lenders to US operations do not pre-empt the consequences of a disaster in Europe which could have ripple effects up to the very foundation of the US debt castle.

A handful of key figures for mentioned companies:

Debtors

For the 13 tranches (c.€13bn in all at issuance) listed on Bloomberg, Altice’s debt trades between 55% and 90% depending on tranches and maturities, implying a c. €16bn loss on principal if and when a debt restructuring is overdue for the European entities. The leveraged debt is clearly not held by banks but presumably by leveraged debt funds. Their lawyers may well be busy reading again the contracts.