URW: No recap, what impact?

In a late press release, URW announced that management’s Reset Plan didn’t reach the two-thirds required majority. The recap failed. The three dissident candidates jumped onto the Supervisory Board. Governance changes will probably occur in 2021-22, in our view. The new strategy will stretch the balance sheet. Clever or not?: the answer is in about one to three years. Pfizer could help.

We don’t fear a second EGM. We believe therefore that the EGM decision will be applied.

The Refocus plan (the dissidents, but call them “the Concert” from now on) will propel the three Concert candidates onto the Supervisory Board of 10 members assuming that the Concert welcomes more than 50% of the votes cast. These three members could therefore weigh c. 20% of the 13 members. This significant decision should support some changes in both the Supervisory Board and management team and increase the Concert’s weight as some members are likely to resign, in our view.

The clear majority propelling the three candidates onto the Board indicates a very clear sign from the market. And much clearer than we expected, that’s right.

URW’s balance sheet will push it to accelerate and increase its disposal plan, whatever the Supervisory Board’s components. Sacrifices required (discounts vs. book values)?

And the winner is…

On 5 November, on top to its initial 5.7% stake (once Amiral Gestion is included), the Concert announced as having received the support from both CalPERS and Florida SBA (Florida State Board of Administration). Mr Jean-Paul Dumortier (71 years old, ENA-Guernica, Caisse des Dépôts) joined the action too. He is a French real estate investor, as the founder of Foncière Paris France (Offices in the City of Paris, delisted by Allianz, Covéa and COFITEM-Cofimur in 2012 following a hostile takeover bid). He has been president of the French Association of Real Estate – FSIF – welcoming 30 of the biggest players). Please note that the incumbents’ stakes were unavailable, nevertheless. It was therefore close to impossible to measure the size of the full Concert’s power before the EGM.

Whatever the opportune contribution of Pfizer announced at 12:45, as the vote cast closed yesterday at 3:00pm, the fact is that the dissidents win with a clear majority. As the three Concert candidates will integrate the Board, we assume that it reached the 50% majority of votes cast. It should be revealed as a great success, lead to a major application of Concert’s strategy, and lead to some changes in both the management team and Supervisory Board in 2021-22.

Short sellers: what impact?

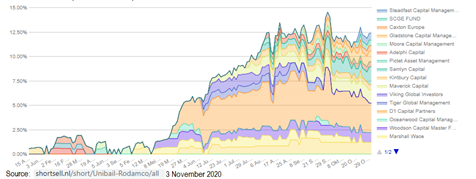

According to shortsell.nl (chart below), the net short position was c. 12% on URW, just a few days ago and without accounting for a potential beginning of a short squeeze yesterday. However, only 3.4% of the existing shares traded on Euronext Paris, when URW’s share closed at +24% (+30% at its €45.00 peak at 2:30pm).

Without being able to interpret it in full, we have noticed the strong changes in URW’s ownership from both: i/ Morgan Stanley: 9.50% on 24 September (AMF N°220C3826), 10.2% on 20 October (AMF N°220C4456), 4.34% on 29 October (AMF N°220C4690) and ii/ Goldman Sachs: 10.3% on 2 November (AMF N°220C4760) vs. 13.15% on 30 September (AMF N°220C3978). At 3 November’s virtual analysts meeting, Mr Cuvillier (CEO of URW), mentioned that maybe some long funds had repatriated shares in order to be ready for voting. To some extent, this could explain why URW’s share performed well last week.

During our call with Concert’s manager (see our Latest of 29 October: ”_ Private contact with the Concert_”), Mr ROUGET told us that, due to the specific structure of the short position (some investors maybe trading URW’s dividends only, without exposing themselves to the URW share price?), a corner was not its best assumption, even if the recap would have been cancelled. We’ll look at this soon.

We remind that the recap was guaranteed in full by a syndicate welcoming the Bank of America, BNP Paribas, Crédit Agricole, Goldman Sachs, JP Morgan and Société Générale. It is not public whether the syndicate still covered (through short-selling) the equivalent of their statistical subscription at the end of the day. The usual behaviour would have been a short-sell of c. 15-20% of the recap (i.e. €500-700m, or 4-6% of the ex-post market cap) between the recap announcement and… 10-20 November, post the EGM). The risk, leading to cover a portion of its commitment or not, leans on the price per new share it had advised management for proceeding.

Share price behaviour and a wide read-across

The recent behaviours of landlords’ share prices have been interesting. They didn’t adjust massively for the second lockdown, but the massacred shares reacted especially well to Pfizer’s announcement yesterday.

We do not derive from such recent behaviour that the sector has reached its tipping point, as some pieces of bad news remain to be released in the coming months: i/ retailers’ further bankruptcies; ii/ increasing pressure on the MGR uplift in Q4 20; and iii/ increasing vacancy in Q1 21 or H1 21. But the vaccine is the premise of a long way to returning to normal footfall sometime in H2 21 or FY 22.

However, and as mentioned earlier (we did on Mercialys) as some shares look less vulnerable to bad news, we may have to shift some opinions from negative to positive. This would not exclude that the major e-shift hurting shopping malls’ business will stop, at all. It should continue to put pressure on NAVs. It would only translate that, based on future cash flows, in the perspective of an eroding business, some discounts could end-up appearing as excessive vs. eroding NAVs. In a nutshell, URW and the full sector will face a kind of a “transitional period” as it will stretch its balance sheet voluntarily.

We can identify two big risks deriving from such a potential change in our recommendation’s hierarchy, pushing us not to hurry:

1/ Should a very slow macro recovery be confirmed, at the end of the day, the bulk of the landlords we cover would not avoid a second tranche of recaps (or a first one for leveraged players). But, if the model stabilises at the same time (rents, vacancy, values), the same second (or first) tranche could be revealed as “accretive” for current shareholders retrospectively (i.e. the issuance price of new shares above both the current share price and the first tranche of recap, even much below both current and forward NAVs).

2/ A prolonged period of lockdowns, followed by a middle of the range curfews could possibly be erased by vaccines (Pfizer and others), pushing the market to look beyong the wide valley nevertheless. Hope was back yesterday.

We still point out that both retailers and consumers acquired experience in 2020. They adapted to the virus and can now live with such a permanent threat, should both the ECB’s and governments’ support be accentuated. We are not talking, here, about the long-term heart-breaking consequences of such a support as investment horizons could be different (both public and private debt, macros vs. cash-equity).

In short, the risk-reward profile could improve soon, even if for a transitional period, before landlords reconnect with e-devils. The nice resistance of shares in late October may have been a good signal.

Over-leveraged companies should benefit from the upturn, first, even staying more fragile than if all the companies had proceeded with recaps. Due to our perception of the shopping malls sector in the long run, we believe that companies having escaped the first wave of recap won’t avoid them in the future, maybe through prolonged dividend cuts, paid in scrip, or stronger disposals. The restructuring phase should be far from ending, whatever the vaccine. Some of the players will run their businesses as if nothing had happened: they won’t prepare for the next crisis by reducing leverage nor learn the lessons of 2020. We will have to be very attentive to the next crisis in the future.

We will have to adjust our forecasts for the no-recap scenario later today. The LTV could peak in 2021-22, depending on the calendar of increasing disposals. The price of the latter (discounts vs. book values) will determine both URW’s risk level itself and the NAV.

URW will not escape paying strong dividends in scrip in the future. Dilution should occur, but much lower than that attributable to the now dead recap. The risk will stay here for a long time. Let’s get pass the end of the lockdowns first maybe… don’t run too fast?

Read more : click here