Utilities get more attractive, slowly

[dropcap]U[/dropcap]tilities have lost their shine since October 2017. This can easily be associated with firmer rates and a dash for cyclical/value stocks now that Europe is looking like a better growth proposition.

Some of the underperformance is self-harm with the likes of Suez tripping themselves up on exotic water contracts or Innogy (77% owned by RWE) crashing the sector last December when it made clear that the going was tough in Germany and the UK with rising costs. Disastrous performances from Centrica and E.on duly confirmed the message.

The poor last 5-6 months have opened up 8% upside potential on AlphaValue’s fundamental metrics. The sector is not fashionable but it looks as if it is leaner when it comes to capital employed (see chart) meaning that it has potential for a higher performance. The trouble, as can be deduced from the ROCE trend on the same chart, is that the rotation to a less capital intensive business model has yet to show up.

The sector is contemplating a combined 5% ROCE in 2018 with a 6.3% combined Wacc. However one may opine that a territorially focused Hera is capable of booking a 7% ROCE even though it relentlessly adds to its asset base by means of acquisitions while Orsted, focused on offshore wind farms, hovers close to 10% in its high risk ventures. Without its nuke assets, the sector may well be closer to a 6% ROCE rather than the current 5%.

What about the impact of top line growth in recovering European economies? Utilities certainly rank close to Property as an “a-cyclical” businesses. Still, they may enjoy a better ride even if energy consumption growth remains below GDP growth. A 1% addition to the top line amounts to €5bn of additional revenues and, assuming no special leverage on net margins, an extra €300m in earnings. This is marginal vs. the expected 2018 earnings (€25bn) but significant in terms of extra earnings growth (€2.3bn instead of €2bn for the sector).

The sector is rotating away from cumbersome business models. Worth keeping an eye out as it may after all benefit from a combination of lighter operations and a degree of cyclical recovery.

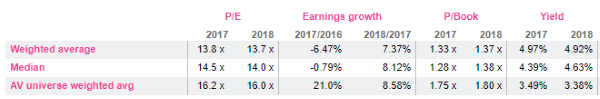

Utilities valuation essentials

Utilities lose ground

Capital employed of consistent universe of 19 utilities

Utilities valuation essentials

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...