Vallourec: Walking dead or Phoenix

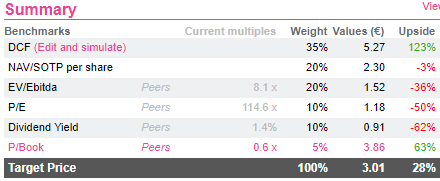

After three disastrous years (FY15-17) and a rather disappointing FY18, shoots of life seem to be visible at last. Before jumping in, there are quite a few ifs: restored management credibility, successful transformation plan, avoiding another capital increase. A green light on these three fronts would warrant a substantial rerating. We see a 28% upside after a €600m rights issue.

Mind the gap

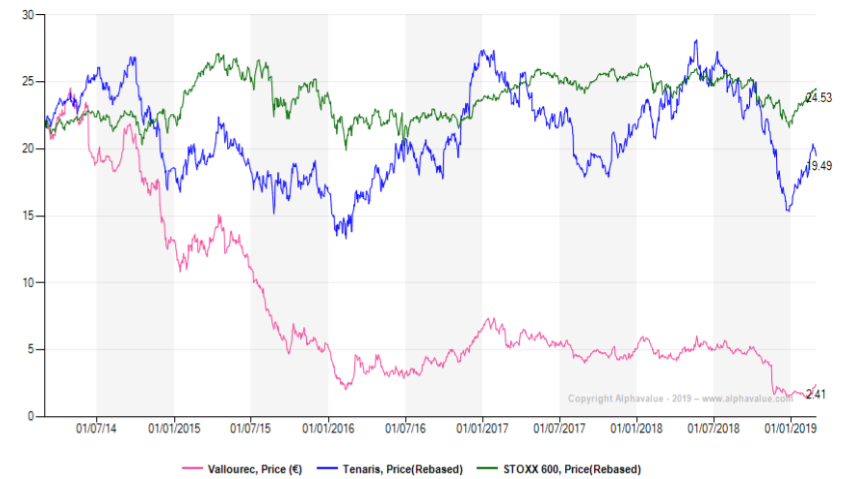

The last 5-year underperformance slashed 89% of the price. Tenaris’ comparably stupendous performance is living proof that all of Vallourec’s woes can be solely blamed on a (truly) very depressed OCTG (steel pipes for the oil industry) market.

Seamlessly sinking

The dire showing is obviously the consequence of the collapse in the oil price (-75% for the Brent between early 2014 and 2016, with a rebound that still leaves it 40% behind), and the following cut in capex by oil majors, which has roughly halved since FY14 to c.US$400bn. The impact has been brutal with the French group losing a third of its revenues between FY14 and FY18. Its once decent EBITDA margin (15%) was divided in four (4% last year).

The group’s ROCE, which hasn't exceeded its WACC anyway since FY10 (this is a capital-intensive business), is nowhere close to doing so in a foreseeable future (4.9% in…FY20, or hardly half of its 9.2% WACC). Long-term targets set in early 2016 look out of reach (EBITDA €1.2-1.4bn, ROCE above WACC and a FCF over €600m by 2020 on FY14 volumes (the amount reached again in FY18)). The good point though is that even gullible analysts have for long held promises for what they are: a fairy tale.

FY19? Probably “less bad”

After a long period of denial, management reacted very late not only to restructure but quite simply to survive. The “transformation plan” is made of old recipes: reduce capacity, restructure the industrial tool, cut staff, move production out of Europe. This had broadly been done (no less than 3-4 years after oil prices started to fall!): the share of Europe in Vallourec’s capacities is about 25% (vs 45% previously), staff has been reduced by c.20% to c.19,000 in four years (despite the 1,000 extra workers in China and before some more lay-offs in Germany), Brazilian operations have been reshaped and Chinese Tianda has been fully acquired to lower the cost basis.

Altogether, management claims costs have gone down by €445m (2016-18), with a target of €650m by 2020. Fair enough. Not enough though: despite these efforts (and the rebound in the US/Canadian shale oil&gas markets in FY18), profitability, albeit improving, was still miserable last year. Q4 18 has shown some light (EBITDA 8%) but that has to prove sustainable. Vallourec’s biggest hope lies in the fact it is more exposed to EAMEA than to the US.

This explains at the same time why the rebound in its results has not been very spectacular in FY18 and could be more substantial going forward. This part of the world accounts for c.50% of Vallourec’s revenues with the corresponding operational leverage. Fingers crossed but, at least, our oil analyst and experts do confirm this view that the investment cycle has turned positive, in both oil and gas, in this region.

(un)Funded?

After a 40% rebound (from admittedly ultra-low prices) on the FY18 results and the Q4 positive FCF, why are investors not jumping in and short massively closing positons? We see four reasons:

First, management has lost credibility since FY15. Denying a capital increase only weeks before announcing one was not a proper way to build confidence and raised the question of the decision-making process at Vallourec. The market is probably discounting this mishap in the group’s communication, as well as the fact it issued too optimistic outlooks/forecasts when the crisis began.

The second reason is that the cost-savings initiatives are still hardly readable in the P&L. The increase in material costs in FY17-18 and the appalling situation of the group “pre-savings” definitely make it hard to post positive margins, even after restructuring.

Thirdly, the group has indicated that H1 19 could suffer from pressure on the US side, after some weakness seen in Q4, in line with the views of Tenaris.

Last but not least, will there be a capital issue? No! shouts management. We acknowledge the likelihood of a capital increase (prompted by the 100% gearing covenant tested each year-end) has gone down. The positive Q4 18 free cash flow gives hopes, despite the fact that the cash needs are highly seasonal and bearing in mind that €153m was burnt in Q3 alone.

It is happy that the covenant calculation “neutralises” foreign currency translation reserves (i.e. it is computed on a higher apparent equity) so that it allows for a maximum net debt of c.€2.9bn at year-end 2018 (about the same number in FY19 on our estimates) vs a €2.2bn net debt. In other words, there is a c.€700m cushion, even if management would of course have to react before numbers force them to. One should also not forget the €1bn issue of FY16 has been entirely burnt in two years.

Our opinion remains one of caution about the issue of a refinancing as our forecasts still include a €600m capital increase in FY19, to be on the safe side. We have not yet reached the degree of confidence that could lead us to trust fully management’s forecasts, as mentioned above. Anyway this still leaves a nice 28% upside potential to the share price.

Valuation €3 or €4.2?

To be complete, we must say that without a capital increase in FY19, our target price would even be… €4.20. A massive c.70% upside. It is no surprise that the valuation be supported by DCF, the only “dynamic” metric while the current picture is far less appealing. This is exactly what the market is currently saying: the investment proposal probably looks attractive over the mid-term, but not too sexy yet.

For sure, the group can’t afford another downturn in its markets. Investors are probably waiting a bit longer (Q1 or H1 19) before giving credit again to the group on the commercial front at the same as the prospect for another issue will hopefully have further decreased by then. The fear of being fooled again certainly plays a role. This is our current view: it is not such a big issue to miss the beginning of the recovery in the share price, despite the nice current upside.

The dire showing is obviously the consequence of the collapse in the oil price (-75% for the Brent between early 2014 and 2016, with a rebound that still leaves it 40% behind), and the following cut in capex by oil majors, which has roughly halved since FY14 to c.US$400bn. The impact has been brutal with the French group losing a third of its revenues between FY14 and FY18. Its once decent EBITDA margin (15%) was divided in four (4% last year).

The group’s ROCE, which hasn't exceeded its WACC anyway since FY10 (this is a capital-intensive business), is nowhere close to doing so in a foreseeable future (4.9% in…FY20, or hardly half of its 9.2% WACC). Long-term targets set in early 2016 look out of reach (EBITDA €1.2-1.4bn, ROCE above WACC and a FCF over €600m by 2020 on FY14 volumes (the amount reached again in FY18)). The good point though is that even gullible analysts have for long held promises for what they are: a fairy tale.

FY19? Probably “less bad”

After a long period of denial, management reacted very late not only to restructure but quite simply to survive. The “transformation plan” is made of old recipes: reduce capacity, restructure the industrial tool, cut staff, move production out of Europe. This had broadly been done (no less than 3-4 years after oil prices started to fall!): the share of Europe in Vallourec’s capacities is about 25% (vs 45% previously), staff has been reduced by c.20% to c.19,000 in four years (despite the 1,000 extra workers in China and before some more lay-offs in Germany), Brazilian operations have been reshaped and Chinese Tianda has been fully acquired to lower the cost basis.

Altogether, management claims costs have gone down by €445m (2016-18), with a target of €650m by 2020. Fair enough. Not enough though: despite these efforts (and the rebound in the US/Canadian shale oil&gas markets in FY18), profitability, albeit improving, was still miserable last year. Q4 18 has shown some light (EBITDA 8%) but that has to prove sustainable. Vallourec’s biggest hope lies in the fact it is more exposed to EAMEA than to the US.

This explains at the same time why the rebound in its results has not been very spectacular in FY18 and could be more substantial going forward. This part of the world accounts for c.50% of Vallourec’s revenues with the corresponding operational leverage. Fingers crossed but, at least, our oil analyst and experts do confirm this view that the investment cycle has turned positive, in both oil and gas, in this region.

(un)Funded?

After a 40% rebound (from admittedly ultra-low prices) on the FY18 results and the Q4 positive FCF, why are investors not jumping in and short massively closing positons? We see four reasons:

First, management has lost credibility since FY15. Denying a capital increase only weeks before announcing one was not a proper way to build confidence and raised the question of the decision-making process at Vallourec. The market is probably discounting this mishap in the group’s communication, as well as the fact it issued too optimistic outlooks/forecasts when the crisis began.

The second reason is that the cost-savings initiatives are still hardly readable in the P&L. The increase in material costs in FY17-18 and the appalling situation of the group “pre-savings” definitely make it hard to post positive margins, even after restructuring.

Thirdly, the group has indicated that H1 19 could suffer from pressure on the US side, after some weakness seen in Q4, in line with the views of Tenaris.

Last but not least, will there be a capital issue? No! shouts management. We acknowledge the likelihood of a capital increase (prompted by the 100% gearing covenant tested each year-end) has gone down. The positive Q4 18 free cash flow gives hopes, despite the fact that the cash needs are highly seasonal and bearing in mind that €153m was burnt in Q3 alone.

It is happy that the covenant calculation “neutralises” foreign currency translation reserves (i.e. it is computed on a higher apparent equity) so that it allows for a maximum net debt of c.€2.9bn at year-end 2018 (about the same number in FY19 on our estimates) vs a €2.2bn net debt. In other words, there is a c.€700m cushion, even if management would of course have to react before numbers force them to. One should also not forget the €1bn issue of FY16 has been entirely burnt in two years.

Our opinion remains one of caution about the issue of a refinancing as our forecasts still include a €600m capital increase in FY19, to be on the safe side. We have not yet reached the degree of confidence that could lead us to trust fully management’s forecasts, as mentioned above. Anyway this still leaves a nice 28% upside potential to the share price.

Valuation €3 or €4.2?

To be complete, we must say that without a capital increase in FY19, our target price would even be… €4.20. A massive c.70% upside. It is no surprise that the valuation be supported by DCF, the only “dynamic” metric while the current picture is far less appealing. This is exactly what the market is currently saying: the investment proposal probably looks attractive over the mid-term, but not too sexy yet.

For sure, the group can’t afford another downturn in its markets. Investors are probably waiting a bit longer (Q1 or H1 19) before giving credit again to the group on the commercial front at the same as the prospect for another issue will hopefully have further decreased by then. The fear of being fooled again certainly plays a role. This is our current view: it is not such a big issue to miss the beginning of the recovery in the share price, despite the nice current upside.

Subscribe to our blog

We never expected our list of European stocks sold on AI fears to go down this fast. It seems to rhy...

If those bashed businesses keep to their growth convictions in their 2026 outlook, maybe the pressu...