VALUATION WISE: Utilities down the drain

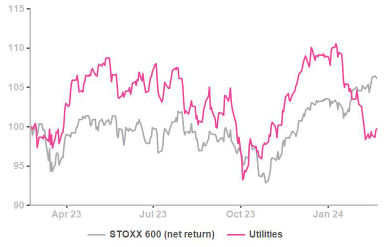

Utilities, like all sectors dependent on rates, enjoyed a strong rally late in 2023 on rate cut hopes. Since the close of 2023 they have lost 9% or so. This is a lot in a market up 3% and it is not linked to changes in the interest rates mood music.

Utilities reversal of fortune

The driving force behind this sudden change of mind is the collapse in energy prices in Europe. This cannot be captured through international prices such as Brent and is hard to gauge on the wild swings of TTF gas or the German baseload.

As a reminder: TTF Gas

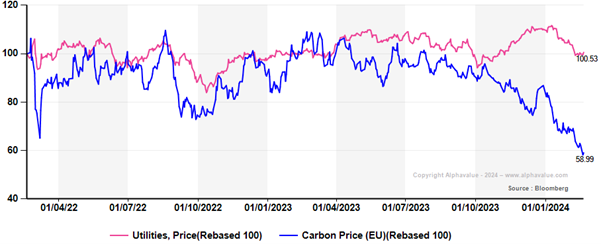

Falling energy prices can be tracked though, through the proxy of carbon prices which tend to match those of fossil fuels. The following chart signals a clear dash for the exit since October for holders of fossil commodities with the Utilities sector only paying attention from early 2024 as rates may not be cut as quickly as expected.

What Carbon rights say about energy prices was not heard by Utilities until early 2024

Another reason for the delayed reaction is that, whilst Utilities reliant on energy trading and high spot prices took a bath, those going for green-only projects experienced some sort of an epiphany after being bashed last summer for their unhinged business models. The trigger to that recovery for green power was better news coming from wind turbine suppliers.

The provocative next question is whether lower energy prices are here to stay.

Our answer?: quite possibly. Fossil energy is scarce (default market reading before greenhouse gases became a concern to financial markets) but the demand for fossil may be falling pretty rapidly as the benefits of electrification are pretty obvious including in developing countries. Less primary fossil fuel replaced by more flexible primary electrical power seems unavoidable. As power prices themselves increasingly rely on green energy whose marginal cost is zero, the true question is whether wind/solar farms will ever contemplate shutting down to keep prices high … for others. The answer is a clear no. In addition the idea that the reference price is that of the costly gas plant needed to offset green supply drops is increasingly irrelevant too as grid stability improves (HVDC and heavy duty IGBTs help reduce synchronisation shocks) and green generation assets are self balancing when everyone and his dog Tesla eventually connect back and forth to the grid.

What is more, individual units of energy consumption may even contract rapidly, simply because technology progress is so phenomenal: same light, LED bulb 5x more efficient for instance.

So over the long run a scenario of eroding energy prices is not absurd. This reading is for now largely held back by the drive of the energy players to project themselves according to levelized costs that allow for expensive capex over the life expectancy of a producing unit.

That is a self-serving angle though as, here again, (Chinese) technology is helping to bring down capital costs rapidly. It takes a government-owned EDF to continue to invest in absurdly expensive new nuke and thereby twist the economics of power by forcing enormous capital costs on the taxpayer. Mega projects à la EDF do not add up but provide an umbrella to alternative energies to claim that capital costs are up and need to see a return. Without that umbrella, power prices are more likely to fall than to rise as power is ultimately a derivative of technological progress. This is for the very long run obviously.

Utilities reversal of fortune

The driving force behind this sudden change of mind is the collapse in energy prices in Europe. This cannot be captured through international prices such as Brent and is hard to gauge on the wild swings of TTF gas or the German baseload.

As a reminder: TTF Gas

Falling energy prices can be tracked though, through the proxy of carbon prices which tend to match those of fossil fuels. The following chart signals a clear dash for the exit since October for holders of fossil commodities with the Utilities sector only paying attention from early 2024 as rates may not be cut as quickly as expected.

What Carbon rights say about energy prices was not heard by Utilities until early 2024

Another reason for the delayed reaction is that, whilst Utilities reliant on energy trading and high spot prices took a bath, those going for green-only projects experienced some sort of an epiphany after being bashed last summer for their unhinged business models. The trigger to that recovery for green power was better news coming from wind turbine suppliers.

The provocative next question is whether lower energy prices are here to stay.

Our answer?: quite possibly. Fossil energy is scarce (default market reading before greenhouse gases became a concern to financial markets) but the demand for fossil may be falling pretty rapidly as the benefits of electrification are pretty obvious including in developing countries. Less primary fossil fuel replaced by more flexible primary electrical power seems unavoidable. As power prices themselves increasingly rely on green energy whose marginal cost is zero, the true question is whether wind/solar farms will ever contemplate shutting down to keep prices high … for others. The answer is a clear no. In addition the idea that the reference price is that of the costly gas plant needed to offset green supply drops is increasingly irrelevant too as grid stability improves (HVDC and heavy duty IGBTs help reduce synchronisation shocks) and green generation assets are self balancing when everyone and his dog Tesla eventually connect back and forth to the grid.

What is more, individual units of energy consumption may even contract rapidly, simply because technology progress is so phenomenal: same light, LED bulb 5x more efficient for instance.

So over the long run a scenario of eroding energy prices is not absurd. This reading is for now largely held back by the drive of the energy players to project themselves according to levelized costs that allow for expensive capex over the life expectancy of a producing unit.

That is a self-serving angle though as, here again, (Chinese) technology is helping to bring down capital costs rapidly. It takes a government-owned EDF to continue to invest in absurdly expensive new nuke and thereby twist the economics of power by forcing enormous capital costs on the taxpayer. Mega projects à la EDF do not add up but provide an umbrella to alternative energies to claim that capital costs are up and need to see a return. Without that umbrella, power prices are more likely to fall than to rise as power is ultimately a derivative of technological progress. This is for the very long run obviously.

Subscribe to our blog

This is a train that AlphaValue boarded timely: metals at large have been on fire, courtesy of …

Obviously such speculative question marks are not Stellantis specific.