Vestas : The best Green Chip stock

Very good perspectives delivered by Vestas at its Capital Market Day. The group is still the best-in-class in the industry, and its strong backlog provides visibility for the coming years. We confirm our positive view on the stock.

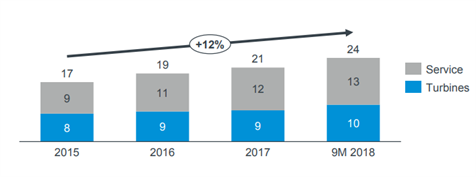

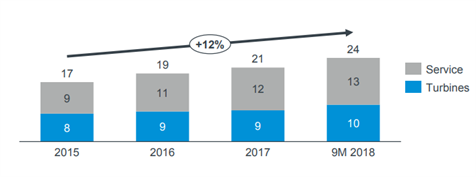

As part of its CMD, Vestas delivered upbeat long-term ambitions, reflecting organic growth and profitability improvements. The group is expecting revenue to grow faster than the market, an EBIT margin at least 10%, FCF >0 every year. Several drivers, such as: i) 6-8% annual growth in onshore volumes towards 2020, ii) new growth centres in EMEA, and notably in Asia Pacific, iii) and a strong service business, will be the main sources of growth in the coming years.

CMD key highlights:

Strong market outlook

Global investments in renewable energy are expected to skyrocket in the coming years. With more than $3tn expected to be invested by 2030, renewable energy should surpass coal and fossils in 2035 and will be able to respond to the strong demand for electricity (EVs, population growth, emerging markets, IoT and data centres,…) which is projected to grow >40% until 2035.

- Renewable energy investments growth will be driven by strong electricity demand (>40% until 2035) and governments’ investments.

- Strong order backlog provides visibility, while increasing the profit share in service improves profitability

- All segments (Onshore, Offshore, Service) will contribute to growth

- become #1 in the US market

- increase market share in LatAm

- have a leading position in EMEA

- be the largest (non-Chinese) player in China

Moreover, governments are still supporting renewable energy investments:

Source: Vestas Company

All in all, Vestas should continue to perform as long as renewable energy targets remain positively oriented. New growth centres such as EMEA and, notably, Asia Pacific (Australia: Kennedy Project), which should offset the potential drop in the US post 2020 (gradual end of the PTC), as well as the 6-8% annual growth expected in onshore volumes towards 2020, and a strong service business, are among the key drivers that will support revenue growth in the coming years.

On the other hand, the continuous reduction of LCOE is expected to impact negatively the Average Selling Price (ASP) and thus profitability.

Best-in-class

At the bottom line, Vestas is guiding to at least a 10% EBIT margin, which is in line with our estimates of 10% for the next three years. We realise we are quite conservative in this aspect but, considering the end of the feed-in-tariffs and the replacement by the introduction of auctions, at this stage, it would appear preferable to not be over-optimistic on profitability.

Nevertheless, it is worth nothing that Vestas, with a 10% EBIT margin, is still the best-in-class in terms of profitability (7.6% for SGRE in FY 18). Furthermore, Vestas has confirmed that cost discipline will be a key priority in the coming years (SG&A at 6.7% of sales in 9M 18 vs. 7.4% in FY 17) and will be supported by increased activity in low cost countries. On the other hand, Vestas will continue to increase its R&D spending, which is very good news as only large companies can afford these investments, thus securing their leading position.

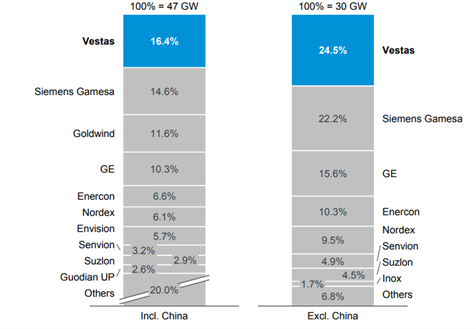

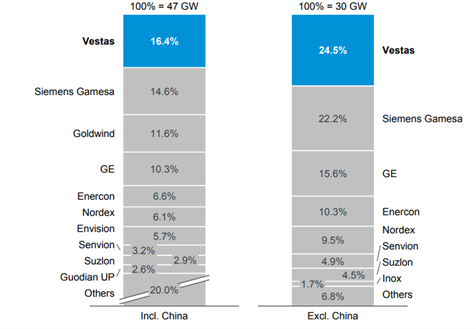

Market share installations in 2017 (in %)

Source: Vestas Company

All in all, Vestas should continue to perform as long as renewable energy targets remain positively oriented. New growth centres such as EMEA and, notably, Asia Pacific (Australia: Kennedy Project), which should offset the potential drop in the US post 2020 (gradual end of the PTC), as well as the 6-8% annual growth expected in onshore volumes towards 2020, and a strong service business, are among the key drivers that will support revenue growth in the coming years.

On the other hand, the continuous reduction of LCOE is expected to impact negatively the Average Selling Price (ASP) and thus profitability.

Best-in-class

At the bottom line, Vestas is guiding to at least a 10% EBIT margin, which is in line with our estimates of 10% for the next three years. We realise we are quite conservative in this aspect but, considering the end of the feed-in-tariffs and the replacement by the introduction of auctions, at this stage, it would appear preferable to not be over-optimistic on profitability.

Nevertheless, it is worth nothing that Vestas, with a 10% EBIT margin, is still the best-in-class in terms of profitability (7.6% for SGRE in FY 18). Furthermore, Vestas has confirmed that cost discipline will be a key priority in the coming years (SG&A at 6.7% of sales in 9M 18 vs. 7.4% in FY 17) and will be supported by increased activity in low cost countries. On the other hand, Vestas will continue to increase its R&D spending, which is very good news as only large companies can afford these investments, thus securing their leading position.

Market share installations in 2017 (in %)

Source: Bloomberg New Energy Finance

All in all, we remain confident about the capability of Vestas to maintain this threshold of 10% at least, as increased activity ahead, combined with a growing profit share in servicing, new products and technology, will be the key drivers to sustain the profitability. Conversely, the increasing competition from Chinese players (e.g Goldwind), and, last but not least, the cost inflation from tariffs should be a drag to exceeding the 10% EBIT margin threshold.

The full research study is available on AlphaValue research platform : click here.

Source: Bloomberg New Energy Finance

All in all, we remain confident about the capability of Vestas to maintain this threshold of 10% at least, as increased activity ahead, combined with a growing profit share in servicing, new products and technology, will be the key drivers to sustain the profitability. Conversely, the increasing competition from Chinese players (e.g Goldwind), and, last but not least, the cost inflation from tariffs should be a drag to exceeding the 10% EBIT margin threshold.

The full research study is available on AlphaValue research platform : click here.

- EU 2030 target for renewable energy increased from 27% to 32%;

- EU nations committing to even bolder targets (Denmark> 50% by 2030, Sweden 100% by 2040);

- Indian government target for wind and solar increased to 227GW by 2022 (+28%).

Source: Vestas Company

All in all, Vestas should continue to perform as long as renewable energy targets remain positively oriented. New growth centres such as EMEA and, notably, Asia Pacific (Australia: Kennedy Project), which should offset the potential drop in the US post 2020 (gradual end of the PTC), as well as the 6-8% annual growth expected in onshore volumes towards 2020, and a strong service business, are among the key drivers that will support revenue growth in the coming years.

On the other hand, the continuous reduction of LCOE is expected to impact negatively the Average Selling Price (ASP) and thus profitability.

Best-in-class

At the bottom line, Vestas is guiding to at least a 10% EBIT margin, which is in line with our estimates of 10% for the next three years. We realise we are quite conservative in this aspect but, considering the end of the feed-in-tariffs and the replacement by the introduction of auctions, at this stage, it would appear preferable to not be over-optimistic on profitability.

Nevertheless, it is worth nothing that Vestas, with a 10% EBIT margin, is still the best-in-class in terms of profitability (7.6% for SGRE in FY 18). Furthermore, Vestas has confirmed that cost discipline will be a key priority in the coming years (SG&A at 6.7% of sales in 9M 18 vs. 7.4% in FY 17) and will be supported by increased activity in low cost countries. On the other hand, Vestas will continue to increase its R&D spending, which is very good news as only large companies can afford these investments, thus securing their leading position.

Market share installations in 2017 (in %)

Source: Vestas Company

All in all, Vestas should continue to perform as long as renewable energy targets remain positively oriented. New growth centres such as EMEA and, notably, Asia Pacific (Australia: Kennedy Project), which should offset the potential drop in the US post 2020 (gradual end of the PTC), as well as the 6-8% annual growth expected in onshore volumes towards 2020, and a strong service business, are among the key drivers that will support revenue growth in the coming years.

On the other hand, the continuous reduction of LCOE is expected to impact negatively the Average Selling Price (ASP) and thus profitability.

Best-in-class

At the bottom line, Vestas is guiding to at least a 10% EBIT margin, which is in line with our estimates of 10% for the next three years. We realise we are quite conservative in this aspect but, considering the end of the feed-in-tariffs and the replacement by the introduction of auctions, at this stage, it would appear preferable to not be over-optimistic on profitability.

Nevertheless, it is worth nothing that Vestas, with a 10% EBIT margin, is still the best-in-class in terms of profitability (7.6% for SGRE in FY 18). Furthermore, Vestas has confirmed that cost discipline will be a key priority in the coming years (SG&A at 6.7% of sales in 9M 18 vs. 7.4% in FY 17) and will be supported by increased activity in low cost countries. On the other hand, Vestas will continue to increase its R&D spending, which is very good news as only large companies can afford these investments, thus securing their leading position.

Market share installations in 2017 (in %)

Source: Bloomberg New Energy Finance

All in all, we remain confident about the capability of Vestas to maintain this threshold of 10% at least, as increased activity ahead, combined with a growing profit share in servicing, new products and technology, will be the key drivers to sustain the profitability. Conversely, the increasing competition from Chinese players (e.g Goldwind), and, last but not least, the cost inflation from tariffs should be a drag to exceeding the 10% EBIT margin threshold.

The full research study is available on AlphaValue research platform : click here.

Source: Bloomberg New Energy Finance

All in all, we remain confident about the capability of Vestas to maintain this threshold of 10% at least, as increased activity ahead, combined with a growing profit share in servicing, new products and technology, will be the key drivers to sustain the profitability. Conversely, the increasing competition from Chinese players (e.g Goldwind), and, last but not least, the cost inflation from tariffs should be a drag to exceeding the 10% EBIT margin threshold.

The full research study is available on AlphaValue research platform : click here.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...