Willian Demant's dream run over

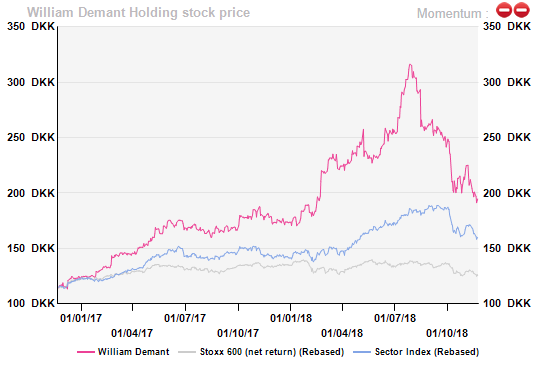

As we always say, a hearing aids stock is as good as the next product and William Demant Holding’s/WDH share price has clearly mirrored this. The launch of the ‘novel’ 2.4GHz dual technology product, Oticon Opn in mid-2016, placed the world’s second largest hearing aids manufacturer on the higher growth pedestal, enabling it to outpace competitors – the wholesale business (>50% of sales) snowballed 11% organically in FY17, beating GN (+6.4%) and Sonova (+4.7%). Applauded by the markets, the scrip zoomed c.150% during January 2017-July 2018.

The dream run came to an end with negative unit growth in H1 18. The entry of Bose in the $5bn hearing aids wholesale space, which disrupted the decades-long oligopoly, worsened the situation further.

Sustained volume pressure in Q3 18 and the resulting step-up in R&D were another nail in the coffin. Ergo, the stock has been bashed c.35% from its peak in the last four months, coinciding with the weakness in the broader MedTech universe (down c.12%).

With traditional rivals now out with their ‘unique’ offerings, the two-year long Oticon Opn dominance would come to an end and thereby lower WDH’s ability to outgrow the industry.

As markets have digested most of this, the stock appears fairly-valued at current levels and thus we prefer to steer clear of WDH for now (no upside according to our estimates).

Oticon Opn to lose its sheen

Strong traction for premium product ‘Oticon Opn’ bolstered ASPs, translating into a sustained market share gain (in value terms) for WDH in 9M 18. But, volumes were in the red, impacted by lower demand in the NHS channel/UK, loss of sales to AudioNova (following its acquisition by Sonova) and reduced tender wins.

Given the industry’s shortening product lifecycle and considering that opponents have added ‘innovative’ devices to their portfolio recently – Sonova’s upgraded 2.4GHz product, GN’s premium-plus offering and Starkey’s AI-empowered wearable – the growth prospects of Opn now appear eclipsed.

Though the newly-launched line extensions of existing products would cushion volumes in the near term, WDH has decided to ramp-up its R&D investments to identify the next-gen platform and thus contest in the most fiercely competitive environment in the last two years.

US OTC regulation an overhang

After years of lobbying, audio technology firm ‘Bose’ has finally entered the hearing aids arena, with a first of a kind ‘self-fitted’ device, thus paving the way for the US OTC regulations for hearing aids (effective 2020).

Considering that the upcoming regulations, for mild to moderate patients, would do away with the ‘costly’ support services (like testing, adjustments and follow-ups), the new devices would be priced at a fraction of the cost of the currently available versions, indicating further ASP pressure within the industry.

Also, cannibalisation in the moderate category (c.28% of the hearing loss patients) is inevitable, though the launch of no-frill versions of existing devices would allow the traditional developers to enter and thus compete in the mild category (c.66% of patients).

Retail segment to also face the heat

Given that support services are largely provided at the retail end, which accounts for c.70% of the hearing aids value chain (vs. c.25% for wholesale), manufacturers with a high presence in retail would be adversely impacted in the OTC era.

WDH’s margin-dilutive retail business (>33% of sales), which is still in the process of streamlining the operations of the acquired entities in the US, should see further margin pressure in the forecast years. In our view, it’s time that management reconsiders its forward-integration strategy.

Margin expansion to slow-down

After half a decade of contraction, profitability reached an inflection point in FY17, all thanks to Opn. However, with volumes under pressure and R&D investments on the rise, the margin expansion story would slow down in our view (80bp operating margin improvement anticipated in FY18 vs. 150bp in FY17).

Higher sales for low margin value‐added accessories would also limit profitability growth and partly offset the benefits of the soon to be concluded cost-cutting programme in the forecast years.

Fully-priced

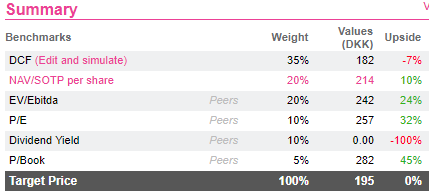

After factoring in decelerating sales growth and a slow-down in margin progression, the DCF trades in the red. Nonetheless, the shortfall is made up by a green light in the NAV. With 2018 P/E multiple now in line with the historical average (23.9x vs FY16-17: 23.3x), the scrip appears fairly-valued in our view. Thus, the family-controlled business, with no dividend yield to cushion, is best left untouched at current levels.

Instead, why not consider Sonova which boosts of a ‘best in class’ product portfolio amongst the three listed hearing aids manufacturers currently – the introduction of the new 2.4GHz Made-for-All device (in November 2018) has the potential to swing the pendulum in its favour.

Oticon Opn to lose its sheen

Strong traction for premium product ‘Oticon Opn’ bolstered ASPs, translating into a sustained market share gain (in value terms) for WDH in 9M 18. But, volumes were in the red, impacted by lower demand in the NHS channel/UK, loss of sales to AudioNova (following its acquisition by Sonova) and reduced tender wins.

Given the industry’s shortening product lifecycle and considering that opponents have added ‘innovative’ devices to their portfolio recently – Sonova’s upgraded 2.4GHz product, GN’s premium-plus offering and Starkey’s AI-empowered wearable – the growth prospects of Opn now appear eclipsed.

Though the newly-launched line extensions of existing products would cushion volumes in the near term, WDH has decided to ramp-up its R&D investments to identify the next-gen platform and thus contest in the most fiercely competitive environment in the last two years.

US OTC regulation an overhang

After years of lobbying, audio technology firm ‘Bose’ has finally entered the hearing aids arena, with a first of a kind ‘self-fitted’ device, thus paving the way for the US OTC regulations for hearing aids (effective 2020).

Considering that the upcoming regulations, for mild to moderate patients, would do away with the ‘costly’ support services (like testing, adjustments and follow-ups), the new devices would be priced at a fraction of the cost of the currently available versions, indicating further ASP pressure within the industry.

Also, cannibalisation in the moderate category (c.28% of the hearing loss patients) is inevitable, though the launch of no-frill versions of existing devices would allow the traditional developers to enter and thus compete in the mild category (c.66% of patients).

Retail segment to also face the heat

Given that support services are largely provided at the retail end, which accounts for c.70% of the hearing aids value chain (vs. c.25% for wholesale), manufacturers with a high presence in retail would be adversely impacted in the OTC era.

WDH’s margin-dilutive retail business (>33% of sales), which is still in the process of streamlining the operations of the acquired entities in the US, should see further margin pressure in the forecast years. In our view, it’s time that management reconsiders its forward-integration strategy.

Margin expansion to slow-down

After half a decade of contraction, profitability reached an inflection point in FY17, all thanks to Opn. However, with volumes under pressure and R&D investments on the rise, the margin expansion story would slow down in our view (80bp operating margin improvement anticipated in FY18 vs. 150bp in FY17).

Higher sales for low margin value‐added accessories would also limit profitability growth and partly offset the benefits of the soon to be concluded cost-cutting programme in the forecast years.

Fully-priced

After factoring in decelerating sales growth and a slow-down in margin progression, the DCF trades in the red. Nonetheless, the shortfall is made up by a green light in the NAV. With 2018 P/E multiple now in line with the historical average (23.9x vs FY16-17: 23.3x), the scrip appears fairly-valued in our view. Thus, the family-controlled business, with no dividend yield to cushion, is best left untouched at current levels.

Instead, why not consider Sonova which boosts of a ‘best in class’ product portfolio amongst the three listed hearing aids manufacturers currently – the introduction of the new 2.4GHz Made-for-All device (in November 2018) has the potential to swing the pendulum in its favour.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...