Back to Black for bp

bp's recent strategic tweak, focusing on resilient hydrocarbons, was welcomed by investors, both ESG-friendly and non-ESG-focused alike! The updated guidance provides for a 25% reduction in hydrocarbon output by 2030 vs 2019, instead of the 40% announced in 2020. The hydrocarbon business will remain resilient for longer due to high-margin projects that will contribute 200k boed by 2025. However, price risks could jeopardize yield and balance sheet strength, and declining oil and gas prices will create pressure on BP owing to its gearing which, at 26.5%, is higher than Shell’s or TotalEnergies’.

At the annual results/strategy presentation in early February, the audience of investors and analysts heard the bp management sing “Back to Black.” This was clearly not intended to be a tribute to late singer Amy Winehouse. Instead, its was a moment to cherish the company’s heritage business “resilient hydrocarbons.”

The strategic tweak CEO Bernard Looney described as “leaning in” was welcomed by investors, both ESG-friendly and non-ESG-focused alike. The updated guidance provides for a 25% reduction in hydrocarbon output by 2030 vs 2019, instead of the 40% announced back in 2020. Bp will now produce 2 million barrels of oil equivalent per day by 2030 as opposed to 1.6 mboed.

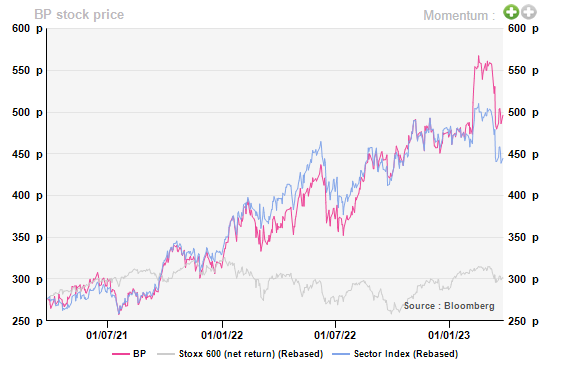

The market heralded bp’s pivot as the updated hydrocarbon strategy ensures strong operating cash flow and returns for longer. Until financial stability woes blindsided equities on March 10, 2023 (and since then), bp’s shares had soared 14% ytd while Shell had risen by 7% and TotalEnergies remained flat. In February bp’s top 3 investors, BlackRock, Vanguard and Norges Bank, increased their shareholding in the company by 3%, 38% and 16%, respectively, compared to the previous month.

BP's share price performance

bp’s popularity after the strategic tweak whetted the appetites of peers and encouraged a discursive change in Shell, whose brand-new CEO passionately advocated for continued oil and gas investments to lure investors, particularly in the US.

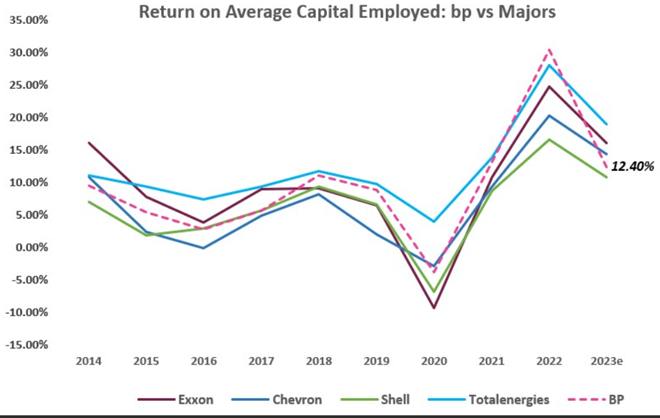

bp’s lack of allure among investors since 2020 had been a testimony to its less attractive FCF compared to peers during 2020 and 2021. The 2022 oil and gas price rally however finally turned the tables, bolstering the balance sheet and fattening returns. With a ROACE of above 30%, the company finally delivered a figure superior to competitors. However, 2023 could send bp back to below its peers according to our estimate of a $17bn adjusted profit at an oil price of $85/bbl. In short, bp’s allure is contingent upon a healthy price environment as the low carbon business is still not profitable.

Source: Company reports, AlphaValue

High-margin projects to keep hydrocarbons resilient

While declining production increases the capex needs (an additional $1bn until 2030), bp will be able to maintain the hydrocarbon business resilient for longer and secure the longevity of cash flows.

Hydrocarbon production from 2023 to 2025 will remain flat at 2.3 mboed against the backdrop of a 3%-5% annual decline rate. bp will achieve stable production thanks to the start up of 9 high-margin projects that will contribute 200k boed by 2025. The development costs however are a pickle. In 2022, bp spent $10bn in upstream, excluding the acquisition of Archaea Energy. The figure pointed to c.$12/boe for development costs – 20% higher than bp’s goal to reach $10/boe. With production at 2 mboed by 2025 and the guided upstream capex in the range of $9-11bn, achieving the development cost target does not seem probable today.

…but price risks could jeopardize yield and balance sheet strength

As much as the market liked the muse of a three-digit Brent price in 2023, the probability is almost zero. Concerns over financial stability and high-, weighing heavily down on bp’s profitability. Price swings could impact bp more than Shell and TotalEnergies. A $1 change in Brent has 36% more impact on bp’s pre-tax adjusted operating profit than that of its French competitor.

Having rinsed investors with cash in FY22 thanks to price-driven profits, oil and gas companies will remain under pressure to maintain healthy returns in the medium term after a decade of high expenditure. The race to high returns will create pressure on bp amidst declining oil and gas prices.

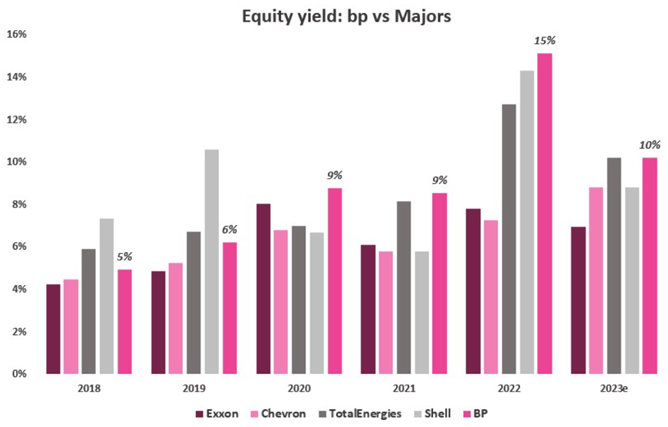

A retrospective look at the past 5 years’ equity yield (dividends + buyback), computed on the back of the annual average share price, shows that bp did not fare worse than peers. On the contrary, in FY20 and FY21, it was the best performer and FY22 was crowned with an impressive figure of 15%. The yield performance certainly benefitted from the lower stock price. However, we would like to caution against an underlying obfuscator trend.

Source: Company reports, AlphaValue

A defensive play in 2023?

Oil and gas remained a wannabe defensive player in FY23 with healthy returns, especially for the European players as the above graph suggests. When it comes to bp, the name remains less attractive compared to Shell and Total due to the uncertainties we observe in its cash flow and return generation in the face of an increasing capex need and a less robust balance sheet. The only upside comes from the DCF, which will remain relatively strong thanks to the positive adjustment in the hydrocarbon strategy. Overall, bp's strategic update aims to ensure strong returns for investors, making it an attractive option for those looking for a long-term investment in the energy sector. Subscribe to our blog to keep up with the latest updates from bp and other companies in the energy sector.

The strategic tweak CEO Bernard Looney described as “leaning in” was welcomed by investors, both ESG-friendly and non-ESG-focused alike. The updated guidance provides for a 25% reduction in hydrocarbon output by 2030 vs 2019, instead of the 40% announced back in 2020. Bp will now produce 2 million barrels of oil equivalent per day by 2030 as opposed to 1.6 mboed.

The market heralded bp’s pivot as the updated hydrocarbon strategy ensures strong operating cash flow and returns for longer. Until financial stability woes blindsided equities on March 10, 2023 (and since then), bp’s shares had soared 14% ytd while Shell had risen by 7% and TotalEnergies remained flat. In February bp’s top 3 investors, BlackRock, Vanguard and Norges Bank, increased their shareholding in the company by 3%, 38% and 16%, respectively, compared to the previous month.

BP's share price performance

bp’s popularity after the strategic tweak whetted the appetites of peers and encouraged a discursive change in Shell, whose brand-new CEO passionately advocated for continued oil and gas investments to lure investors, particularly in the US.

bp’s lack of allure among investors since 2020 had been a testimony to its less attractive FCF compared to peers during 2020 and 2021. The 2022 oil and gas price rally however finally turned the tables, bolstering the balance sheet and fattening returns. With a ROACE of above 30%, the company finally delivered a figure superior to competitors. However, 2023 could send bp back to below its peers according to our estimate of a $17bn adjusted profit at an oil price of $85/bbl. In short, bp’s allure is contingent upon a healthy price environment as the low carbon business is still not profitable.

Source: Company reports, AlphaValue

High-margin projects to keep hydrocarbons resilient

While declining production increases the capex needs (an additional $1bn until 2030), bp will be able to maintain the hydrocarbon business resilient for longer and secure the longevity of cash flows.

Hydrocarbon production from 2023 to 2025 will remain flat at 2.3 mboed against the backdrop of a 3%-5% annual decline rate. bp will achieve stable production thanks to the start up of 9 high-margin projects that will contribute 200k boed by 2025. The development costs however are a pickle. In 2022, bp spent $10bn in upstream, excluding the acquisition of Archaea Energy. The figure pointed to c.$12/boe for development costs – 20% higher than bp’s goal to reach $10/boe. With production at 2 mboed by 2025 and the guided upstream capex in the range of $9-11bn, achieving the development cost target does not seem probable today.

…but price risks could jeopardize yield and balance sheet strength

As much as the market liked the muse of a three-digit Brent price in 2023, the probability is almost zero. Concerns over financial stability and high-, weighing heavily down on bp’s profitability. Price swings could impact bp more than Shell and TotalEnergies. A $1 change in Brent has 36% more impact on bp’s pre-tax adjusted operating profit than that of its French competitor.

Having rinsed investors with cash in FY22 thanks to price-driven profits, oil and gas companies will remain under pressure to maintain healthy returns in the medium term after a decade of high expenditure. The race to high returns will create pressure on bp amidst declining oil and gas prices.

A retrospective look at the past 5 years’ equity yield (dividends + buyback), computed on the back of the annual average share price, shows that bp did not fare worse than peers. On the contrary, in FY20 and FY21, it was the best performer and FY22 was crowned with an impressive figure of 15%. The yield performance certainly benefitted from the lower stock price. However, we would like to caution against an underlying obfuscator trend.

Source: Company reports, AlphaValue

A defensive play in 2023?

Oil and gas remained a wannabe defensive player in FY23 with healthy returns, especially for the European players as the above graph suggests. When it comes to bp, the name remains less attractive compared to Shell and Total due to the uncertainties we observe in its cash flow and return generation in the face of an increasing capex need and a less robust balance sheet. The only upside comes from the DCF, which will remain relatively strong thanks to the positive adjustment in the hydrocarbon strategy. Overall, bp's strategic update aims to ensure strong returns for investors, making it an attractive option for those looking for a long-term investment in the energy sector. Subscribe to our blog to keep up with the latest updates from bp and other companies in the energy sector.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...