Eiffage Chasing Vinci?

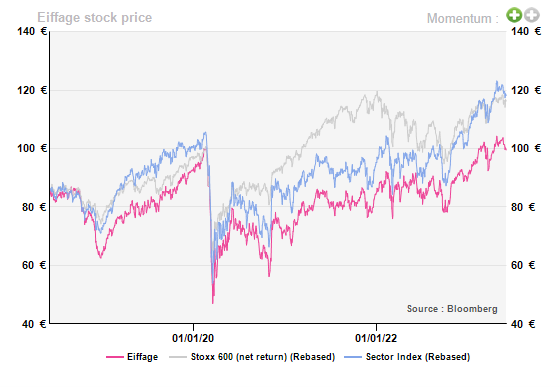

After suffering a severe blow on COVID-19 fears (-53% in a week), with both its construction and concession segments heavily impacted, Eiffage has staged a remarkable recovery. This has stemmed from a slow but gradual revival in traffic and the resilience exhibited by its construction division. The shares are now trading above their pre-pandemic levels, despite the adverse effects of a sharp rise in interest rates, which inherently affects the valuation of concession assets. Eiffage is currently trading at a discount to its peers, while still offering significant growth potential. Effective management of these growth drivers could allow Eiffage to capitalize on its most profitable segments, namely Energy system and Concession, and capture further growth. Eiffage has been a component of AlphaValue's Active stocks list since January 2022.

Source: AlphaValue

Focus on energy transition

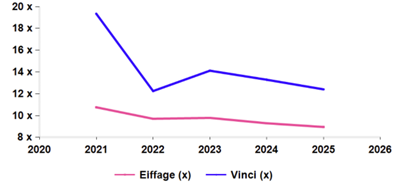

Vinci's growth opportunities sit in the energy transition. Its acquisition of Cobra IS from ACS has enabled the company to expand its market share globally, particularly in emerging markets such as Brazil. On the other hand, Eiffage remains primarily focused on the European market, which accounts for 96% of its total revenue. This lack of geographical diversification, coupled with the delayed investment in the energy transition, may partially explain the disparity in PE ratios between the two companies.

Eiffage PE (pink) vs Vinci PE (blue)

Source: AlphaValue

However, Eiffage is now aiming to capitalize on green energy production, energy storage, energy efficiency, and digitalization. The first quarter of 2023 was particularly dynamic for Eiffage's energy branch, which posted a 17.5% increase in revenue. This segment accounts for 30% of the contracting backlog, which currently stands at €19.9 billion, with significant new projects in the fields of energy transition and sustainable mobility. In terms of geographical distribution, France represents two-thirds of the segment's revenue, while the rest comes from Europe. While the lack of geographic diversification could be seen as a risk, it is important to note that the market in which the group operates offers numerous business opportunities, both in the public and private sectors. Examples include capital spending in the healthcare sector, with Eiffage's estimated backlog reaching approximately €250 million, as well as the rapidly growing data center market (8 to 10% annual growth). Additionally, Eiffage has secured a substantial €1.7 billion contract for a large section of the Paris region metro extension, specifically Lot 1 of line 16, the largest lot of the Grand Paris Express and is actively involved in preparations for the 2024 Paris Summer Olympics. Furthermore, the green hydrogen sector would be a growth vector as it requires a lot of deployment capex.

Considering the group's operational capability and the available liquidity of €4.7 billion, our forecast for the next five years is a CAGR of 7%. We also anticipate a margin improvement of 10 bps per year and an EV/EBIT multiple of 9.5x.

Debates surrounding concession profitability

The concession segment, primarily driven by APRR, is the most profitable and valuable, contributing 40% to group EBIT and accounting for 65% of the group's NAV. APRR operates a significant motorways network spanning over 2,300 km, connecting Paris to Lyon. Despite challenges, the traffic levels in 2022 surpassed those of 2019 by 2%, demonstrating the resilience of these assets. To account for inflationary pressures, Eiffage implemented a tariff increase of 4.7% in February 2023.

The debate on the profitability of motorway concessions in France has resurfaced due to the steady increase in tariffs. An investigation conducted by the Government General Inspection found that the shareholders’ Internal Rate of Return (IRR) for the APRR-Area is 12.49%, significantly higher than the estimated cost of equity at 7.67% contemplated during the privatization in 2006. However, there are two methods for evaluating profitability: project IRR and shareholder IRR. The shareholder IRR depends heavily on financing strategies, particularly the level of debt, which may put concessionaires at a disadvantage as interest rates rise. Nonetheless, the project IRR provides a more accurate assessment of concession profitability and is considered by the Regulatory Authority for Rail and Road (ART) in their evaluations.

It is estimated at 7.8% for historical concession holders and 6.3% for recent ones and aligns closely with the cost of equity. However, it should be noted that there is a gap between the projected and realized IRR due to risks associated with traffic and construction. While this debate has been ongoing since 2006, its impact on future negotiations is expected to be limited.

A way to diversify concession assets

APRR accounts for 66% of Eiffage's concession assets, calling for Eiffage to diversify its concession assets to reduce operational risk. In comparison, Vinci has 20% of its net asset value (NAV) derived from airports, whereas Eiffage's exposure to airports is less than 5%. Eiffage chose instead to invest in Getlink, the Eurotunnel concession holder, becoming its largest shareholder by acquiring an additional 13.71% stake for €1.2 billion, bringing its total ownership to 18.8%. Eiffage intends to be a long-term investor in Getlink and may further increase its stake based on market conditions, with a potential maximum ownership of 29%. This increase in ownership could cost approximately €900m at the current price.

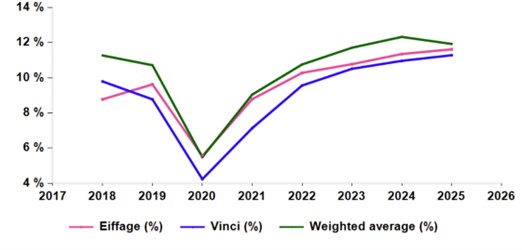

Eiffage's plan to diversify its portfolio may initially lower its ROCE, which is already below average, but the strong margins on the concession assets will contribute to a rapid recovery. For instance, Vinci's past acquisitions initially affected its ROCE, but this has since shown improvement and is catching up with Eiffage.

Eiffage ROCE (pink) vs. Vinci ROCE (blue) vs. sector (green)

Source: AlphaValue

Source: AlphaValue

Focus on energy transition

Vinci's growth opportunities sit in the energy transition. Its acquisition of Cobra IS from ACS has enabled the company to expand its market share globally, particularly in emerging markets such as Brazil. On the other hand, Eiffage remains primarily focused on the European market, which accounts for 96% of its total revenue. This lack of geographical diversification, coupled with the delayed investment in the energy transition, may partially explain the disparity in PE ratios between the two companies.

Eiffage PE (pink) vs Vinci PE (blue)

Source: AlphaValue

However, Eiffage is now aiming to capitalize on green energy production, energy storage, energy efficiency, and digitalization. The first quarter of 2023 was particularly dynamic for Eiffage's energy branch, which posted a 17.5% increase in revenue. This segment accounts for 30% of the contracting backlog, which currently stands at €19.9 billion, with significant new projects in the fields of energy transition and sustainable mobility. In terms of geographical distribution, France represents two-thirds of the segment's revenue, while the rest comes from Europe. While the lack of geographic diversification could be seen as a risk, it is important to note that the market in which the group operates offers numerous business opportunities, both in the public and private sectors. Examples include capital spending in the healthcare sector, with Eiffage's estimated backlog reaching approximately €250 million, as well as the rapidly growing data center market (8 to 10% annual growth). Additionally, Eiffage has secured a substantial €1.7 billion contract for a large section of the Paris region metro extension, specifically Lot 1 of line 16, the largest lot of the Grand Paris Express and is actively involved in preparations for the 2024 Paris Summer Olympics. Furthermore, the green hydrogen sector would be a growth vector as it requires a lot of deployment capex.

Considering the group's operational capability and the available liquidity of €4.7 billion, our forecast for the next five years is a CAGR of 7%. We also anticipate a margin improvement of 10 bps per year and an EV/EBIT multiple of 9.5x.

Debates surrounding concession profitability

The concession segment, primarily driven by APRR, is the most profitable and valuable, contributing 40% to group EBIT and accounting for 65% of the group's NAV. APRR operates a significant motorways network spanning over 2,300 km, connecting Paris to Lyon. Despite challenges, the traffic levels in 2022 surpassed those of 2019 by 2%, demonstrating the resilience of these assets. To account for inflationary pressures, Eiffage implemented a tariff increase of 4.7% in February 2023.

The debate on the profitability of motorway concessions in France has resurfaced due to the steady increase in tariffs. An investigation conducted by the Government General Inspection found that the shareholders’ Internal Rate of Return (IRR) for the APRR-Area is 12.49%, significantly higher than the estimated cost of equity at 7.67% contemplated during the privatization in 2006. However, there are two methods for evaluating profitability: project IRR and shareholder IRR. The shareholder IRR depends heavily on financing strategies, particularly the level of debt, which may put concessionaires at a disadvantage as interest rates rise. Nonetheless, the project IRR provides a more accurate assessment of concession profitability and is considered by the Regulatory Authority for Rail and Road (ART) in their evaluations.

It is estimated at 7.8% for historical concession holders and 6.3% for recent ones and aligns closely with the cost of equity. However, it should be noted that there is a gap between the projected and realized IRR due to risks associated with traffic and construction. While this debate has been ongoing since 2006, its impact on future negotiations is expected to be limited.

A way to diversify concession assets

APRR accounts for 66% of Eiffage's concession assets, calling for Eiffage to diversify its concession assets to reduce operational risk. In comparison, Vinci has 20% of its net asset value (NAV) derived from airports, whereas Eiffage's exposure to airports is less than 5%. Eiffage chose instead to invest in Getlink, the Eurotunnel concession holder, becoming its largest shareholder by acquiring an additional 13.71% stake for €1.2 billion, bringing its total ownership to 18.8%. Eiffage intends to be a long-term investor in Getlink and may further increase its stake based on market conditions, with a potential maximum ownership of 29%. This increase in ownership could cost approximately €900m at the current price.

Eiffage's plan to diversify its portfolio may initially lower its ROCE, which is already below average, but the strong margins on the concession assets will contribute to a rapid recovery. For instance, Vinci's past acquisitions initially affected its ROCE, but this has since shown improvement and is catching up with Eiffage.

Eiffage ROCE (pink) vs. Vinci ROCE (blue) vs. sector (green)

Source: AlphaValue

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...