Insights From Q1 2023

Over Q1 2023 the Stoxx600 gained 8.4%. It was a hectic quarter, culminating with a heart-stopping near-banking crisis.

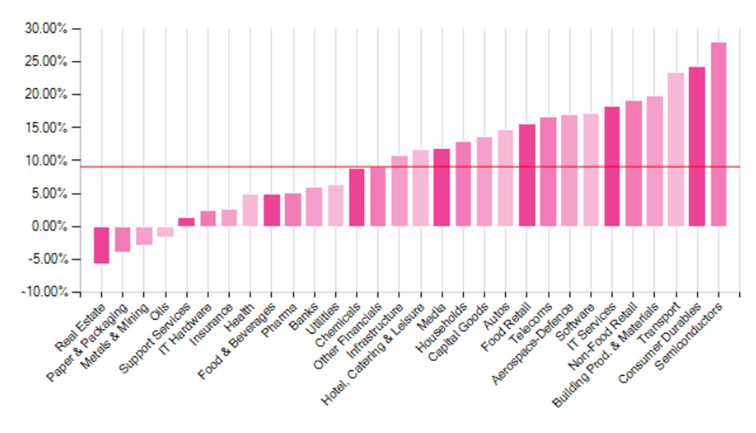

The sector performance over the quarter confirmed that risk takers were back in business with exposure to a recovering China in the background pulling up Semi Conductors, Consumer Durables and Transport in contrast to lagging Oils and Metals. It now appears that this Chinese reversion to normal life is not as quick as had been expected but the call remains a powerful one.

One of the quarter's big surprises was the lack of fear about the Autos sector. This is inconsistent with the ultra-competitive conditions in the Chinese domestic market, ongoing price cuts worldwide and absurd capex to be ‘there’ in the EV battle for the sake of market share. This is certain to end badly and to be depressive for Europe as the wider sector is so important for the EU.

On Financials, it took ages to prick the illusion that the Real Estate sector could navigate the funding scarcity unscathed. But it did finally happen, all of a sudden, 3 months (!) after the BREIT $125bn property fund was first gated. The underperformance of Insurers was also slow in coming but is pretty clear now that they are in the middle of a regime change whereby savers will want higher and guaranteed returns before they can be had by shifting investment assets to match that demand. Insurers should avoid the sort of mismatch that eventually plagued the banks even though the latter were printing gold by raising lending rates well before suffering from tighter funding.

26/30 sectors up over the Q1: call it a surprisingly positive outcome

Earnings trends still too good to be true?

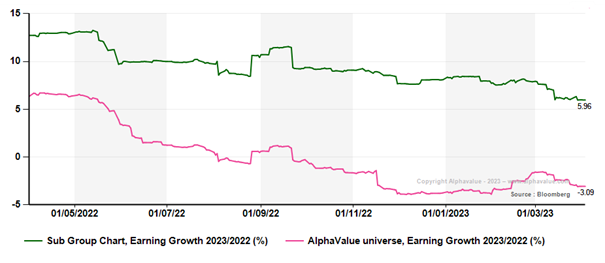

Looking at earnings growth and earnings growth revisions, the trend is south. This should not be a surprise as the 2022 base makes for unfavourable comparisons as earnings for 2022 have been relentlessly upgraded. The following chart tracks both the whole coverage (in pink) and ex Banks and ex Deep Cyclicals (in green). The absolute number for 2023 eps growth ex Banks and Deep Cyclicals of 6% is both highly respectable and completely at odds with the earlier expectations of a slowdown. This is a good surprise even though it is bound to erode as issuers discover that they cannot push through additional price hikes to offset their own rising costs.

As mentioned yesterday, the paradox is that Banks and Deep Cyclicals currently weigh on global earnings growth but may well be experiencing upgrades looking forward.

Trends for 2023 earnings growth (total universe in pink, ex Banks and Deep Cyclicals in green)

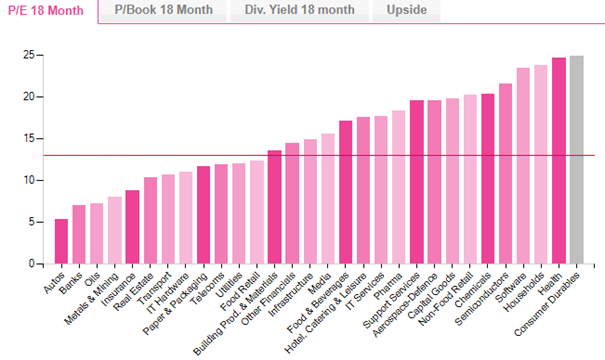

That will be 16x, thank you

To close this short review, below are the going prices by sector. The pecking order shouldn't be a surprise but it is worth pointing out that 2 sectors are trading at nigh on 25x or more: Health and Consumer Durables. Such stretched valuations had disappeared from sight back in 2022. The PEs below are computed on a rolling 18-month forward looking earnings so that they already encapsulate the better part of 2024. In our view this is still way too expensive. Ex Banks and Deep Cyclicals, the current 2023 PE is 16.1x.

The sector performance over the quarter confirmed that risk takers were back in business with exposure to a recovering China in the background pulling up Semi Conductors, Consumer Durables and Transport in contrast to lagging Oils and Metals. It now appears that this Chinese reversion to normal life is not as quick as had been expected but the call remains a powerful one.

One of the quarter's big surprises was the lack of fear about the Autos sector. This is inconsistent with the ultra-competitive conditions in the Chinese domestic market, ongoing price cuts worldwide and absurd capex to be ‘there’ in the EV battle for the sake of market share. This is certain to end badly and to be depressive for Europe as the wider sector is so important for the EU.

On Financials, it took ages to prick the illusion that the Real Estate sector could navigate the funding scarcity unscathed. But it did finally happen, all of a sudden, 3 months (!) after the BREIT $125bn property fund was first gated. The underperformance of Insurers was also slow in coming but is pretty clear now that they are in the middle of a regime change whereby savers will want higher and guaranteed returns before they can be had by shifting investment assets to match that demand. Insurers should avoid the sort of mismatch that eventually plagued the banks even though the latter were printing gold by raising lending rates well before suffering from tighter funding.

26/30 sectors up over the Q1: call it a surprisingly positive outcome

Earnings trends still too good to be true?

Looking at earnings growth and earnings growth revisions, the trend is south. This should not be a surprise as the 2022 base makes for unfavourable comparisons as earnings for 2022 have been relentlessly upgraded. The following chart tracks both the whole coverage (in pink) and ex Banks and ex Deep Cyclicals (in green). The absolute number for 2023 eps growth ex Banks and Deep Cyclicals of 6% is both highly respectable and completely at odds with the earlier expectations of a slowdown. This is a good surprise even though it is bound to erode as issuers discover that they cannot push through additional price hikes to offset their own rising costs.

As mentioned yesterday, the paradox is that Banks and Deep Cyclicals currently weigh on global earnings growth but may well be experiencing upgrades looking forward.

Trends for 2023 earnings growth (total universe in pink, ex Banks and Deep Cyclicals in green)

That will be 16x, thank you

To close this short review, below are the going prices by sector. The pecking order shouldn't be a surprise but it is worth pointing out that 2 sectors are trading at nigh on 25x or more: Health and Consumer Durables. Such stretched valuations had disappeared from sight back in 2022. The PEs below are computed on a rolling 18-month forward looking earnings so that they already encapsulate the better part of 2024. In our view this is still way too expensive. Ex Banks and Deep Cyclicals, the current 2023 PE is 16.1x.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...