Luxury Spending in China: Optimistic or Cautious?

Our luxury analyst, Jie ZHANG, recently returned from a trip to China, which has led us to adopt a more cautious outlook on Chinese luxury consumption. Here are some key insights from her trip:

Recovery in outbound travel in China

Three years of closed borders and lingering COVID-related restrictions have led to an unprecedented surge in Chinese enthusiasm for travel.

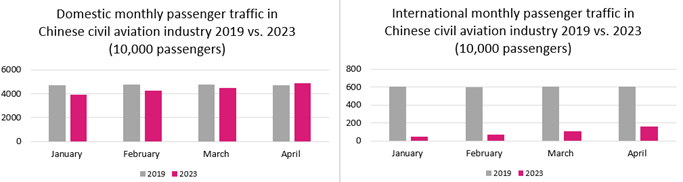

As the graph below shows, domestic traffic has exceeded the level for the same period in 2019 since April, according to the Civil Aviation Administration of China. China's Ministry of Culture and Tourism expects the total number of domestic tourists during the Labor Day holiday to reach 274 million, recovering to 119.1% of the same period in 2019.

Bookings for outbound travel from China are also picking up strongly. However, the recovery in outbound travel remains constrained by limited airline capacity, soaring flight prices and the visa issuance process. As the graph above shows, the number of outbound trips in April this year reached 27% of the same period in 2019. According to China's National Immigration Administration, during the Labor Day holiday, the number of people entering and leaving the country reached 6.3 million, with a daily average of 1.3 million (2.2x the 2022 level), reaching 59.2% of the same period in 2019.

Interestingly, according to the latest data released by Alipay, the number of transactions per traveler for outbound travel over the Labor Day holiday jumped by 40% compared to the same period in 2019. Japan and Thailand continue to be the most popular with Chinese shoppers, followed by Korea, Singapore and France. France continues to be the most attractive European country for Chinese travelers, with waiting lists for French visas currently extending into late summer.

As airline capacity and visa issuance continue to normalize, we expect outbound travel by Chinese tourists to be the main driver of luxury spending from the second half of the year.

Greater gap between bigger and smaller cities

Most importantly, after visiting several different cities, we found that the pandemic has increased the gap between China’s tier-1 cities and those that are small and medium sized. Lingering COVID-related restrictions and several waves of lockdowns have caused slower growth of household income and ongoing weakness in the labor market.

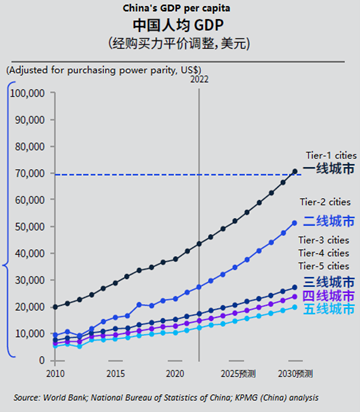

Tier-1 cities have benefited from greater attention from international investors, better resources, government support and economic stimulus after the pandemic, which has helped to limit the impact of the pandemic and speed up the recovery. Many businesses in small and medium-sized cities, particularly in the service sector, were hit hard by the pandemic and uncertain macroeconomic conditions, resulting in closures, bankruptcies and layoffs, losing engines of growth (the graph below shows the widening gap between the GDP per capita of China's Tier 1 cities and that of small and medium-sized cities from 2022 onwards) and a more difficult labor market than that of Tier-1 cities.

The pandemic has had a serious impact on the wealth and purchasing power of consumers in small and medium-sized towns. According to a recent report by Oliver Wyman, 75% of Chinese consumers reduced or postponed their spending on clothing and footwear during the pandemic. While higher-income groups showed a willingness to spend on high-quality products again, 60% of low- and middle-income consumers said they would only spend on essential items.

Although the incomes in China's Tier-1 cities are clearly higher than those in small and medium-sized cities, Tier-1 cities have higher property prices, a high cost of living thus limited growth in disposable income, whereas small and medium-sized cities have a low cost of living, higher disposable income, and many residents of small and medium-sized cities have much greater purchasing power for luxury goods than those living in Tier-1 cities. In recent years, after a strong presence in China's Tier-1 cities, luxury brands have begun to explore small and medium-sized cities. The first Hermès boutique in Zhengzhou achieved sales of RMB120m on its first day of opening, customers queued for four hours and many product categories, including handbags, were almost sold out. Luxury brands such as Chanel, Louis Vuitton and Hermès have started a war of speed by opening shops in China's small and medium-sized cities.

The Chinese government will proceed with policies to boost consumption and accelerate economic growth and this, along with a sharp rebound in outbound tourism, will continue to drive the growth of luxury consumption in the coming months. However, following the post-pandemic polarization, we believe that the shrinking wallets of consumers in small and medium sized cities will affect the sustained firepower of the Chinese luxury market. The feedback from China makes us more cautious on the luxury sector and we will adjust our valuations accordingly.

Recovery in outbound travel in China

Three years of closed borders and lingering COVID-related restrictions have led to an unprecedented surge in Chinese enthusiasm for travel.

As the graph below shows, domestic traffic has exceeded the level for the same period in 2019 since April, according to the Civil Aviation Administration of China. China's Ministry of Culture and Tourism expects the total number of domestic tourists during the Labor Day holiday to reach 274 million, recovering to 119.1% of the same period in 2019.

Bookings for outbound travel from China are also picking up strongly. However, the recovery in outbound travel remains constrained by limited airline capacity, soaring flight prices and the visa issuance process. As the graph above shows, the number of outbound trips in April this year reached 27% of the same period in 2019. According to China's National Immigration Administration, during the Labor Day holiday, the number of people entering and leaving the country reached 6.3 million, with a daily average of 1.3 million (2.2x the 2022 level), reaching 59.2% of the same period in 2019.

Interestingly, according to the latest data released by Alipay, the number of transactions per traveler for outbound travel over the Labor Day holiday jumped by 40% compared to the same period in 2019. Japan and Thailand continue to be the most popular with Chinese shoppers, followed by Korea, Singapore and France. France continues to be the most attractive European country for Chinese travelers, with waiting lists for French visas currently extending into late summer.

As airline capacity and visa issuance continue to normalize, we expect outbound travel by Chinese tourists to be the main driver of luxury spending from the second half of the year.

Greater gap between bigger and smaller cities

Most importantly, after visiting several different cities, we found that the pandemic has increased the gap between China’s tier-1 cities and those that are small and medium sized. Lingering COVID-related restrictions and several waves of lockdowns have caused slower growth of household income and ongoing weakness in the labor market.

Tier-1 cities have benefited from greater attention from international investors, better resources, government support and economic stimulus after the pandemic, which has helped to limit the impact of the pandemic and speed up the recovery. Many businesses in small and medium-sized cities, particularly in the service sector, were hit hard by the pandemic and uncertain macroeconomic conditions, resulting in closures, bankruptcies and layoffs, losing engines of growth (the graph below shows the widening gap between the GDP per capita of China's Tier 1 cities and that of small and medium-sized cities from 2022 onwards) and a more difficult labor market than that of Tier-1 cities.

The pandemic has had a serious impact on the wealth and purchasing power of consumers in small and medium-sized towns. According to a recent report by Oliver Wyman, 75% of Chinese consumers reduced or postponed their spending on clothing and footwear during the pandemic. While higher-income groups showed a willingness to spend on high-quality products again, 60% of low- and middle-income consumers said they would only spend on essential items.

Although the incomes in China's Tier-1 cities are clearly higher than those in small and medium-sized cities, Tier-1 cities have higher property prices, a high cost of living thus limited growth in disposable income, whereas small and medium-sized cities have a low cost of living, higher disposable income, and many residents of small and medium-sized cities have much greater purchasing power for luxury goods than those living in Tier-1 cities. In recent years, after a strong presence in China's Tier-1 cities, luxury brands have begun to explore small and medium-sized cities. The first Hermès boutique in Zhengzhou achieved sales of RMB120m on its first day of opening, customers queued for four hours and many product categories, including handbags, were almost sold out. Luxury brands such as Chanel, Louis Vuitton and Hermès have started a war of speed by opening shops in China's small and medium-sized cities.

The Chinese government will proceed with policies to boost consumption and accelerate economic growth and this, along with a sharp rebound in outbound tourism, will continue to drive the growth of luxury consumption in the coming months. However, following the post-pandemic polarization, we believe that the shrinking wallets of consumers in small and medium sized cities will affect the sustained firepower of the Chinese luxury market. The feedback from China makes us more cautious on the luxury sector and we will adjust our valuations accordingly.

Subscribe to our blog

If one is not inclined to cut a bit of each A&D holding, and is intent on retaining all-weather Airb...

2026 starts as your typical financial year with high eps growth ambitions (+11%), most likely to be tri...